- Cardano’s Ouroboros Linear Leios upgrade improves scalability without sacrificing security

- Grayscale increased ADA exposure, signaling growing institutional confidence

- A long-term breakout hinges on reclaiming the $1.00–$1.20 resistance zone

For a long stretch, Cardano looked stuck. ADA traded sideways, sometimes drifting lower, even as the ecosystem rolled out upgrades and expanded quietly behind the scenes. That disconnect made the token feel undervalued to many long-term holders, especially while development kept moving forward. Now, with Midnight’s privacy layer already integrated into multiple chains and core protocol upgrades landing, the picture is starting to look more intentional than accidental.

Ouroboros, Cardano’s latest evolution, has also played a role here. The upgrade helped reposition ADA as something institutions could actually take seriously, with Grayscale stepping in as one of the more visible accumulators. Taken together, these moves hint that Cardano’s slow period may have been more about building than stalling.

How Ouroboros Linear Leios Changes Cardano’s Throughput

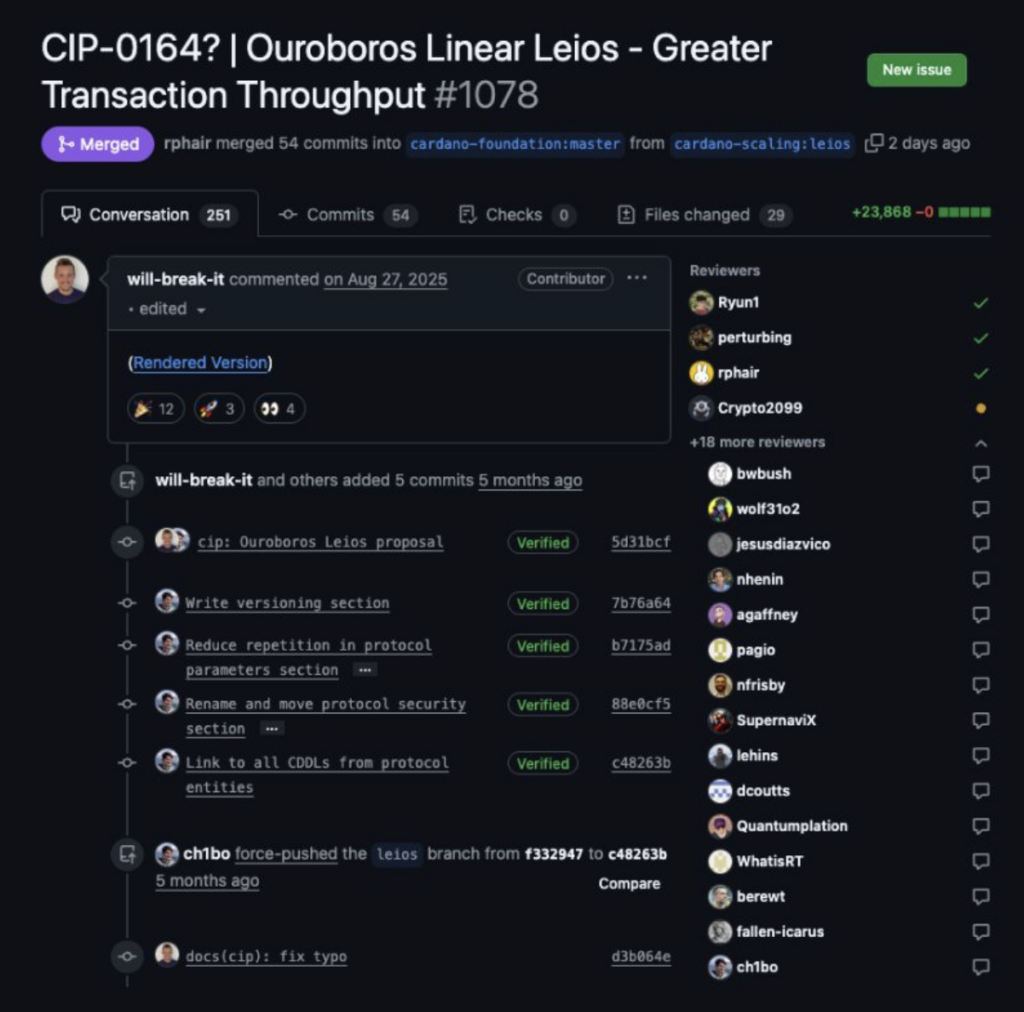

At the protocol level, Cardano merged CIP-0164 with Ouroboros Linear Leios to significantly increase transaction speed and capacity. This upgrade, finalized and merged on January 6, 2025, introduced a two-tier block structure that separates how transactions are handled on the network. It’s a subtle change, but an important one.

Endorser Blocks are designed to process large volumes of non-sensitive transactions in parallel, while Reference Blocks handle operations where order still matters. DeFi trades that need front-running resistance, for example, stay protected in a way that resembles the current Ouroboros Praos model. The idea is to scale without sacrificing security or fairness.

Simulations suggest the upgrade could boost capacity by 30 to 60 times using larger blocks and economic incentives. By routing higher-value transactions through more secure channels, the system also reduces MEV risk. While some community members flagged potential issues around certification and recovery, the successful mainnet deployment confirmed the model works, and gives developers a clearer integration path going forward.

Institutions Start Leaning Into ADA Exposure

On the institutional side, ADA has started showing up more prominently. Grayscale’s Smart Contract Platform Fund went through a quarterly rebalance, and Cardano emerged as a meaningful piece of the allocation. ADA now accounts for 18.55% of the fund, placing it third behind Solana at 29.55% and Ethereum at 29.00%.

That shift signals more than routine rebalancing. It reflects a broader attempt by institutions to increase exposure to scalable proof-of-stake platforms beyond the obvious leaders. Other assets in the fund include Sui, Avalanche, and Hedera, but the growing ADA weight suggests confidence in Cardano’s long-term positioning.

What’s notable is the timing. This accumulation coincides with Cardano improving the efficiency and flexibility of its proof-of-stake design. At the same time, spot market whales appear to be moving in the same direction as institutions, quietly building positions while price remains compressed.

Can ADA Finally Break Through $1

From a technical standpoint, analysts are watching a long-term setup that’s been years in the making. Crypto analyst Crypto Patel points to the two-week ADA/USDT chart, where price has been compressing inside a large symmetrical triangle since the 2021 peak. A descending resistance line formed around the $3 level intersects with a macro ascending support, creating pressure that won’t last forever.

The key accumulation zone sits between $0.28 and $0.38, an area Patel describes as smart money demand. As long as ADA holds above roughly $0.30, the structure remains intact. A breakout above the $1.00–$1.20 resistance zone would be the trigger that changes the conversation, opening the door to higher targets at $2.60, $5.00, and potentially $10 over time.

There is a clear invalidation point, though. A weekly close below $0.28 would weaken the entire bullish thesis and suggest the base has failed. Until then, the setup favors patience. External forces like adoption and regulation will still matter, but structurally, ADA is positioned better than it has been in years.