- ADA consolidates between 20- and 50-day EMAs after bouncing from 200-day EMA support.

- Price action within an ascending channel targets a move toward $1.00+ if breakout volume comes in.

- Large whales are accumulating as network activity rises, signaling strong long-term confidence.

Cardano’s price action has turned bullish, with ADA trading at $0.7283 and showing signs of building long-term momentum. Trading volume sits near $866.11 million, and technical indicators point toward a healthy consolidation phase that could precede a significant upside move.

EMA Structure Supports Ongoing Accumulation

ADA recently bounced from its 200-day EMA, now trading between its 20-day and 50-day EMAs, signaling a stable support zone. This structure aligns with a 7-month falling wedge breakout in July, followed by a controlled pullback that appears to be a reaccumulation phase before a potential parabolic rally.

Ascending Channel Targets $1 and Beyond

From April onward, ADA has been moving within an ascending channel. July’s surge from the $0.55–$0.60 range to $0.92 was a liquidity grab toward the channel’s upper boundary. The current retracement to the lower boundary could set up a strong rebound, with upside targets including a retest of July’s highs and a possible break above $1.00 if breakout volume materializes.

Whale Accumulation Strengthens the Bullish Case

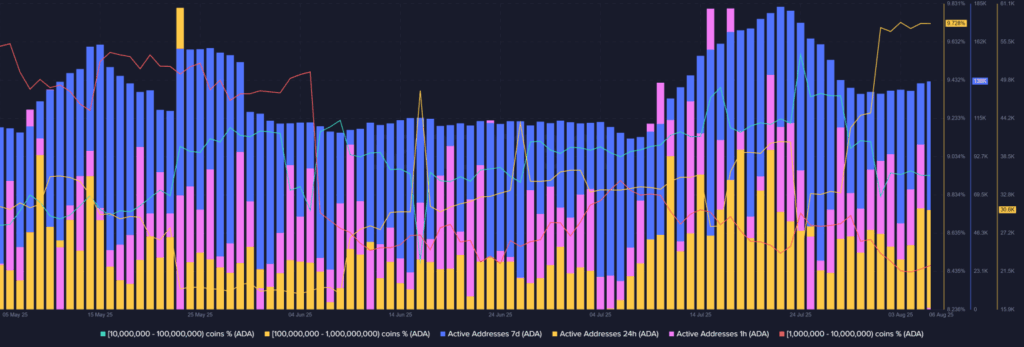

On-chain data from Santiment reveals that large whale addresses (100M–1B ADA) have been quietly absorbing supply as smaller whale cohorts reduce holdings.

This accumulation trend, coupled with increased activity across 1-hour, 24-hour, and 7-day active address metrics, points to both growing retail engagement and strategic positioning by institutional-sized players.