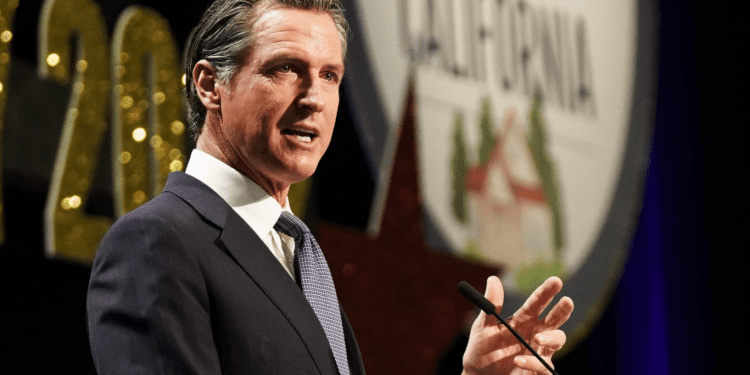

- Governor Gavin Newsom of California hid his personal connections to Silicon Valley Bank from the general public as he advocated for the bank’s rescue with the White House and Treasury.

- Newsom is associated with the bank through three wineries, his wife’s charity, and even personal accounts.

- The failure to disclose this information puts him in violation of state law.

Gavin Newsom, Governor of California, reportedly failed to mention his substantial ties with Silicon Valley Bank as he lobbied the Treasury and White House concerning the pending bailout of the bank.

According to reports by The Intercept, SVB lists Newsom’s three wineries, CADE, Odette, and PlumpJack, as clients. In addition, Newsom also maintained personal accounts at SVB for years, as informed by a longtime former employee of Newsom who used to manage his money. However, it is yet to be determined whether or not these personal accounts were still open at the time when SVB closed.

Furthermore, Newsom should have disclosed that his wife, Jennifer Siebel, also had professional ties with the bank and that SVB had donated $100,000 to the California Partners Project, a nonprofit organization formed by Siebel, in 2021 upon Newsom’s request. Additionally, the founder of the California Partners Project’s board of directors is the president of SVB Capital, John China.

According to a statement issued by Newsom’s office on Saturday, the Governor had “been in touch with the highest levels of leadership at the White House and Treasury” to stabilize the entire innovation ecosystem, which has supported the country’s economy whole.

In the following statement, the Governor praised the government for its intervention saying, “The Biden Administration has acted swiftly and decisively to protect the American economy and strengthen public confidence in our banking system,” adding that “small businesses that can now make payroll, workers who will get their paychecks,” and “nonprofits that can keep their doors open tomorrow.”

While it is unclear whether Newsom disclosed his ties with SVB to the White House or the Treasury, he did not tell them to the public. Newsom stood to benefit from the federal intervention since most of his companies potentially hold more than $250,000 in deposits.

As such, he has violated California State law which states that:

” A public official at any level of state or local government shall not make, participate in making, or in any way attempt to use the public official’s official position to influence a governmental decision in which the official knows or has reason to know the official has a financial interest.”

The Federal Intervention

On Sunday, Banking regulators devised a strategy to protect depositors’ funds at Silicon Valley Bank and New York-based Signature Bank. As a result of the approvals made by the officials, the depositors were given full access to their funds by Monday.

In addition, the Treasury Department identified both SVB and Signature as systemic risks, granting it the power to dissolve both companies in a manner that “fully protects all depositors,” as stated by the Treasury Department.

Furthermore, due to the $250,000 limit on guaranteed deposits, many depositors were left uninsured hence the FDIC’s deposit insurance fund was approved to be used as compensation for affected depositors.