- Historical data shows October–November average returns near 20%, fueling optimism for a Q4 rally.

- Fed rate cut odds at 96.7% could inject liquidity and reignite crypto risk appetite.

- Institutional inflows and ETF demand hint at growing confidence in Bitcoin’s long-term strength.

October and November have always been kind to Bitcoin — at least historically. The crypto crowd knows it, and this year, despite a few shaky starts, optimism is still running high. These two months are often when traders get bold, take risks, and sometimes walk away with big wins. While, of course, past performance doesn’t guarantee future results, most market watchers seem to agree that the bullish rhythm could carry through the rest of the year.

Looking at data going back to 2019, Bitcoin’s average return for October and November hovers around 20%, with a median gain of roughly 15%. Even with a small 4.3% dip earlier this month, sentiment hasn’t soured much. If anything, it’s setting the stage for what could be a key pivot point in BTC’s broader market path — a calm before the next leg up, maybe.

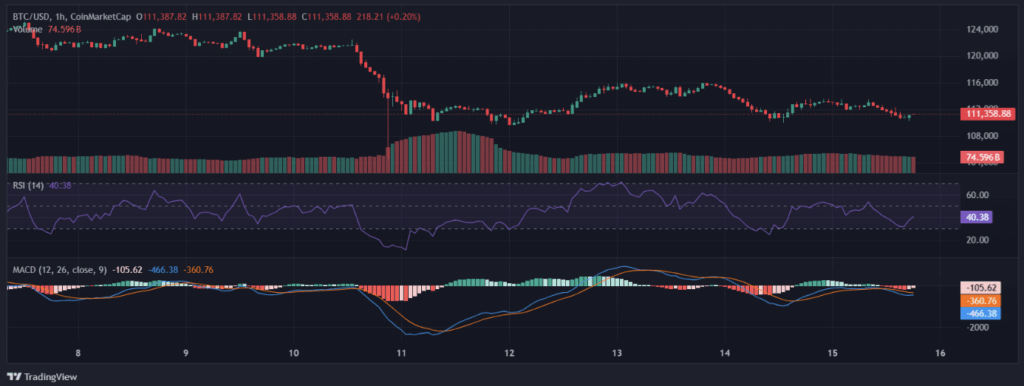

Current BTC Technicals Hint at Uncertainty

At the moment, Bitcoin is trading near $111,358, up by about 0.20% in the last 24 hours. The Relative Strength Index (RSI) sits at 40.38, which isn’t great news for bulls since it’s still below that neutral 50 mark — signaling mild bearish pressure. The MACD, too, is printing negative values, and the histogram doesn’t look too friendly either, pointing to declining momentum.

Trading volume is hovering around $74.59 billion, showing some activity but not enough conviction yet. Overall, the chart gives off mixed vibes — a blend of mild weakness and the possibility of consolidation before any major move. Basically, Bitcoin’s waiting for a cue.

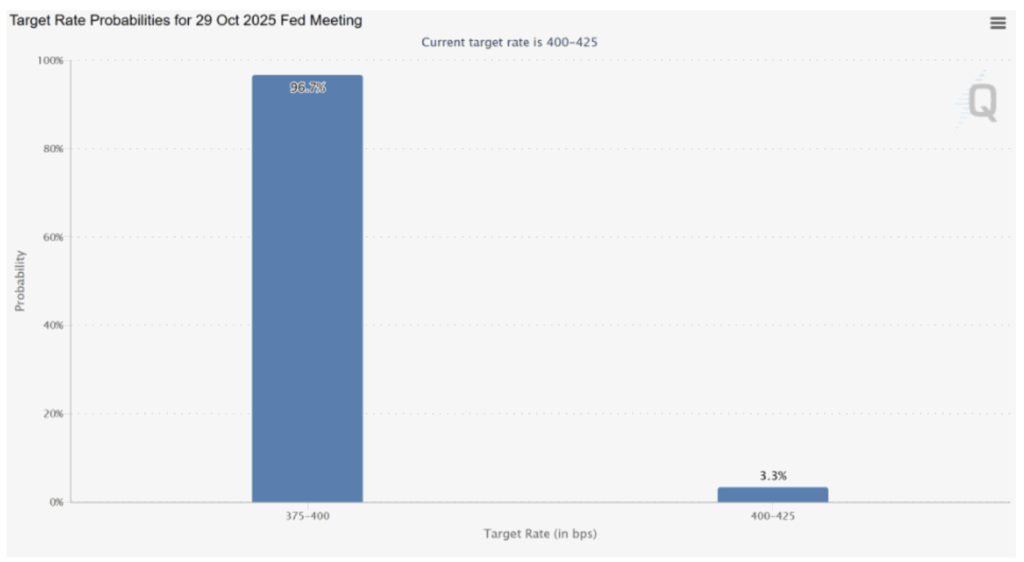

Fed Rate Cut Bets Could Shift the Mood

Here’s where things get interesting: odds for a Federal Reserve rate cut are sky-high. The CME FedWatch tool shows a 96.7% chance of a 25 basis point reduction. If that happens, liquidity could start flowing again, and borrowing might get cheaper — two things risk assets absolutely love.

Crypto, especially Bitcoin, tends to thrive in these easy-money cycles. A cut could light the spark that reignites risk appetite across markets. Investors might not be shouting “bull run” just yet, but the setup looks promising if macro winds turn favorable.

Institutions Keep Loading Up

Institutional players aren’t sitting idle either. Spot Bitcoin ETFs pulled in nearly $5 billion in net inflows just in the first half of October, showing renewed confidence from big money. On top of that, public companies now hold over $117 billion worth of BTC, a 28% jump from last quarter.

More than 1 million BTC now sits in corporate treasuries — that’s not retail FOMO, that’s long-term conviction. Whether it’s ETF flows or balance-sheet buys, institutions are making it clear: they’re here for the long game, not the hype cycle.

Stocks, Trade Tensions, and Bitcoin’s Correlation

At the same time, Bitcoin’s correlation with U.S. equities remains tight — about 92% with the Nasdaq, which basically makes it an unofficial tech stock proxy right now. So when global tensions flare up, like the ongoing U.S.-China trade strain, Bitcoin often catches some of the fallout too. That’s what we saw in recent sessions — stocks dip, Bitcoin dips.

Still, that link cuts both ways. If tech stocks bounce back on rate cut optimism, Bitcoin could follow quickly, riding that same wave of renewed investor appetite.

Final Thoughts

The crypto market’s moving fast as ever, and Bitcoin’s at the heart of it. Between potential rate cuts, growing institutional demand, and historically strong seasonal performance, the setup feels… familiar. It’s the kind of backdrop where bold traders start placing their bets and cautious ones quietly accumulate.

October and November could once again live up to their “Uptober” reputation — but this is Bitcoin we’re talking about, so volatility is always part of the ride. Whether it’s a breakout or a fake-out, one thing’s certain: the next few weeks won’t be boring.