- Memecoin market cap rebounded sharply in early January as capital rotated back into risk-on assets

- Solana-based memecoins led the recovery, signaling renewed speculative appetite

- Large-cap memecoins showed conviction-backed gains, while smaller tokens saw higher volatility

After weeks of drifting sideways, memecoins are starting to wake up again. Capital is slowly but clearly rotating back in, and the shift has been building over the past month. It hasn’t been loud or sudden, but the change in momentum is getting harder to ignore.

Through mid-December, the sector looked tired. Total market cap slid from above $42 billion to just over $36 billion, bleeding steadily as risk appetite cooled. Then early January flipped the script. Capital rushed back, pushing memecoin market cap from around $38 billion to a peak near $48 billion, before settling closer to $44.69 billion. Not perfect, but a meaningful rebound.

Volume tells the same story. Trading activity jumped roughly 17.4% to $4.75 billion, confirming that this wasn’t just a thin bounce. Traders showed up, and they stayed.

Solana Memecoins Lead the Risk-On Shift

One detail stands out in this rebound. Much of the early momentum came from Solana-based memecoins, which often act as a proxy for broader risk appetite. When capital is willing to rotate into high-beta assets on Solana, it usually says something about sentiment.

That rotation has been helped by a supportive macro backdrop. Bitcoin holding above $90,000 has given traders confidence to move further out on the risk curve. Together, these conditions are lifting confidence across crypto markets, with memecoins behaving less like isolated hype and more like early risk-on indicators.

Big Memecoins Move First, and With Conviction

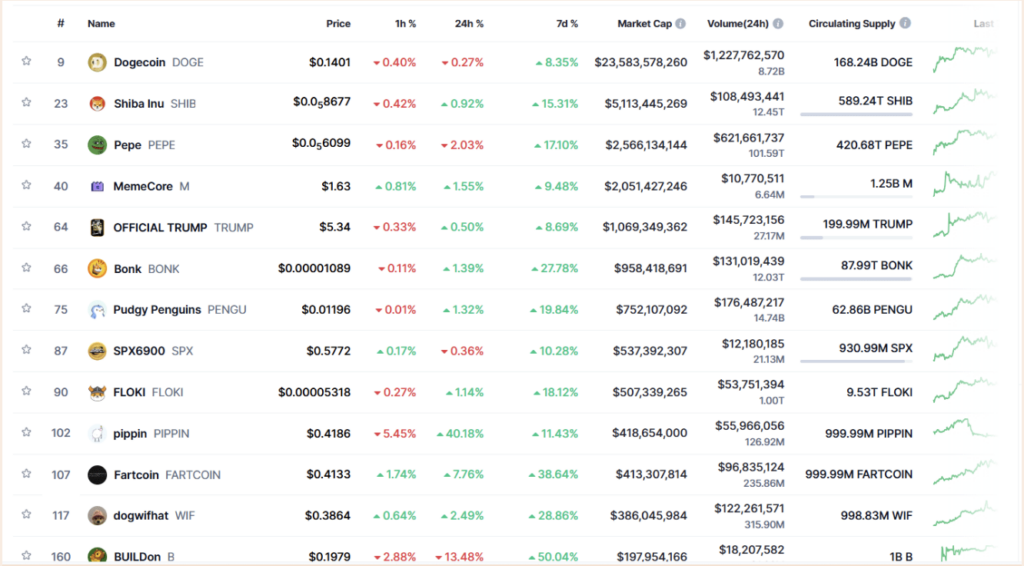

Data from CoinMarketCap shows that gains have been led by the largest memecoins, which tends to matter. Bonk has been out in front, jumping nearly 28% over the past seven days while posting about $131 million in daily volume. That pairing, price and volume, points to conviction rather than a low-liquidity pump.

Shiba Inu followed with a 15.3% gain over the same period. With a market cap north of $5 billion, SHIB’s move carried more weight than most. Capital rotated in steadily, suggesting accumulation rather than fast-money speculation.

Pepe also joined the party, climbing about 17.1% and backed by a hefty $621 million in daily volume. That level of activity signals real trader engagement, not just passive price drift.

Smaller Tokens Chase Momentum, With More Volatility

As usually happens, momentum spilled into smaller names too. Dogwifhat surged nearly 29%, Fartcoin ripped higher by close to 39%, and Pudgy Penguins added just under 20%. These moves were fueled by the same broader rebound, helped along by Solana’s low fees and fast execution.

Retail participation has clearly picked up after a rough 2025. Post-holiday optimism, tax-related positioning, social media hype, and easier on-chain access are all feeding into the renewed interest. That said, smaller market caps come with sharper swings. Volatility cuts both ways.

In simple terms, the difference is showing. Top memecoins are displaying strength backed by volume and capital rotation. Mid-tier and smaller tokens, meanwhile, are seeing faster, more fragile moves driven by momentum chasing. The sector is heating up again, but not all rallies are built the same.