- BONK has gained over 100% in two weeks, outperforming a weakening crypto market.

- Its rally is largely driven by hype around a planned 1 trillion token burn once it hits 1 million holders.

- Profit-taking and Bitcoin’s correction could trigger a major BONK pullback in the short term.

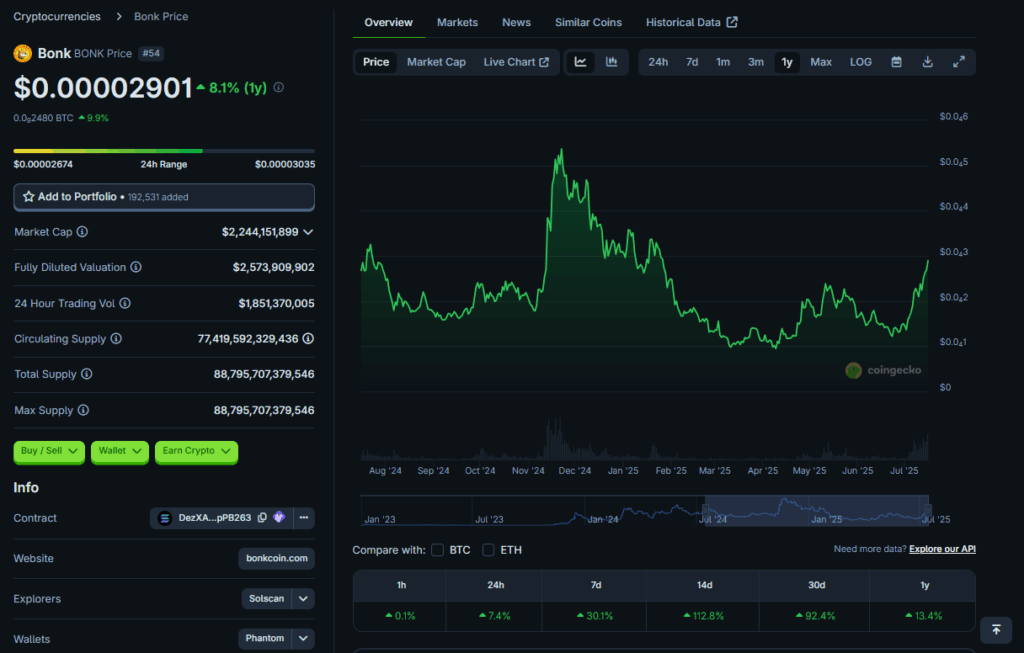

The broader crypto rally is showing signs of fatigue. After reaching an all-time high of $122,838 on July 14, Bitcoin (BTC) has slipped to $117,000. Other cryptocurrencies have mirrored this pullback, retracing gains across daily charts. However, Solana-based memecoin Bonk (BONK) remains a surprising exception. BONK has climbed 10.4% in the past day, 26.9% in the past week, and over 100% in the last 14 days. Its month-long surge of 96.9% signals that its momentum hasn’t yet faded with the rest of the market.

BONK has also seen a 20.5% increase since July 2024, showcasing strength while flagship tokens cool off. This kind of divergence is rare in a market so tightly coupled to Bitcoin’s movements. So, what’s fueling BONK’s green streak in a sea of red?

The 1 Trillion Token Burn Is Feeding the Frenzy

A large part of BONK’s recent success is tied to a promised 1 trillion token burn, which the team says will take place when the coin hits 1 million holders. The announcement triggered a spike in social chatter and trading activity, reigniting speculation-driven interest. The idea of slashing supply—even marginally—is helping fuel price optimism, even though BONK still has around 77 trillion tokens circulating.

Burns often serve as psychological catalysts more than mechanical ones. In this case, the planned burn has stirred up investor FOMO, prompting many to speculate on short-term price hikes. The token’s memecoin nature makes it especially susceptible to such moves, as its performance hinges largely on viral attention rather than fundamentals.

Risk of Sell-Off Looms as Market Cools

Despite the hype, the road ahead for BONK isn’t without risk. Many investors could be looking to book profits, especially if the token rallies closer to the burn milestone. A rapid wave of exits could trigger a sharp sell-off, pulling BONK back down. Moreover, Bitcoin’s decline may drag sentiment down with it, making it harder for outliers like BONK to sustain their rise.

The crypto market at large appears to be cooling, and BONK might not stay insulated for long. Whether the token can continue to decouple from Bitcoin’s direction remains to be seen in the coming weeks.