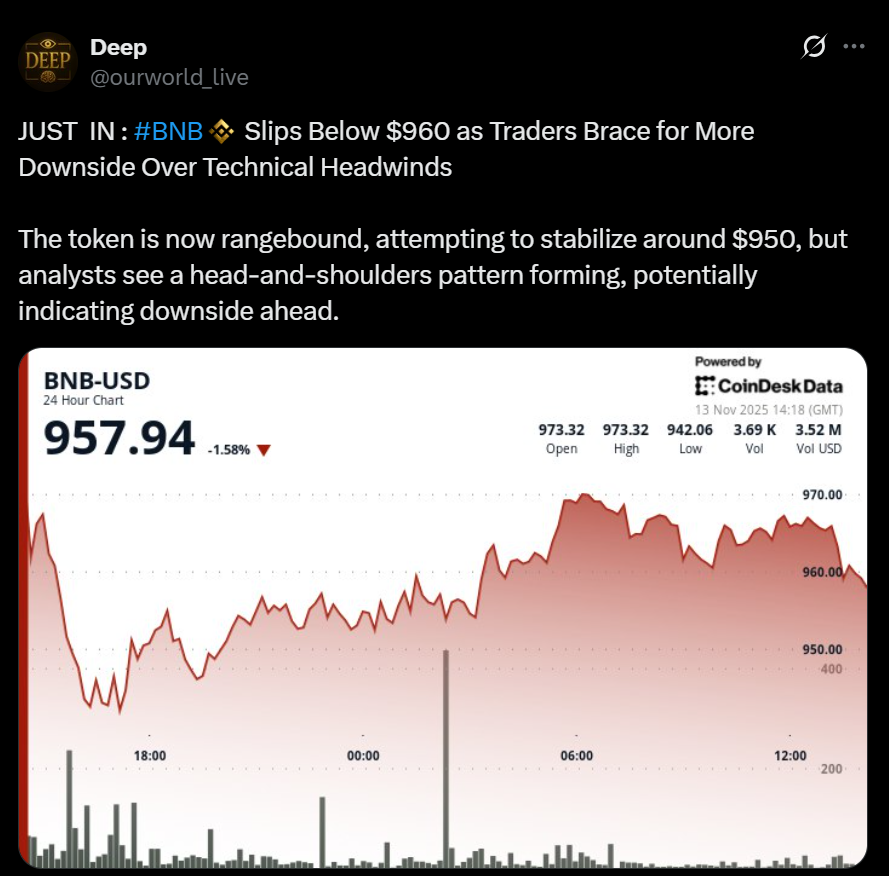

- BNB slipped below $960, rejected from resistance near $970 with a sharp volume spike.

- Traders see a head-and-shoulders pattern, hinting at possible further downside.

- Key levels: reclaiming $970 could help BNB recover, while losing $942 opens a path toward $900.

BNB slid under the $960 mark in the past 24 hours, losing its earlier momentum after running straight into resistance near $970. The brief surge to $970.03 was quickly rejected, and a spike in sell volume signaled that larger orders hit the market, triggering a wave of liquidations. The token briefly fell to $942 before attempting to recover, leaving traders on edge as momentum continues to shift against the bulls.

Rangebound Trading With Bearish Patterns Emerging

BNB is now moving sideways between $950 and $960, with traders showing caution as order flow leans bearish. Analysts note that liquidity pockets are building below $950, which could act as magnets if downward pressure persists. On shorter timeframes, a head-and-shoulders pattern is forming — a classic technical signal that often precedes further downside if support fails to hold.

Key Levels That Will Define BNB’s Next Move

The token is stuck between two crucial zones: resistance near $970 and support around $942. A decisive reclaim above $970 could reset short-term sentiment, but a breakdown could drag BNB toward deeper supports closer to the $900 region. For now, the move mirrors the broader market as the CoinDesk 20 Index dipped 1.6% over the same period, keeping risk assets under pressure.