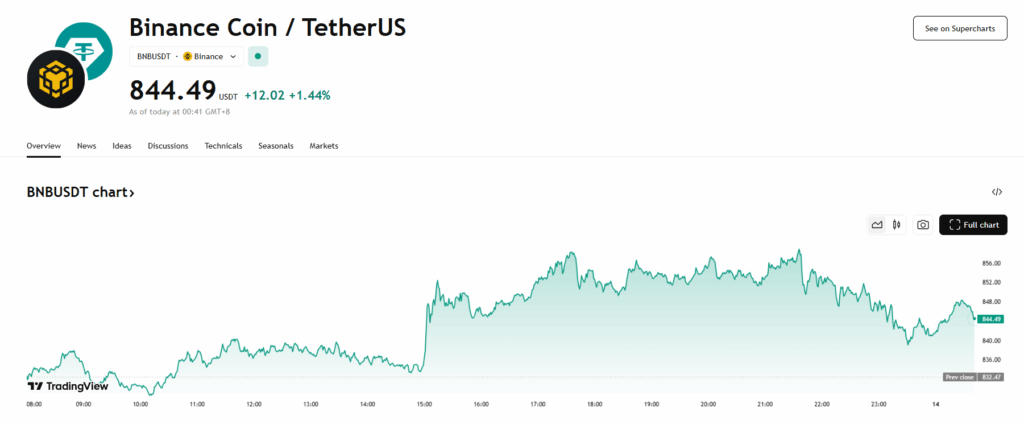

- BNB surged 4% to trade above $850, nearing its record $860 high, fueled by a market rally and CEA Industries’ 200,000 BNB purchase.

- Volume spiked to triple the daily average, but profit-taking near $855 suggests possible short-term consolidation.

- Strong support is holding near $834.40, with resistance at $855 as BNB maintains dominance in the exchange token sector.

BNB jumped more than 4% in the last 24 hours, slicing through multiple resistance levels to trade just shy of its all-time high at $860. The surge came as the broader crypto market rallied and was supercharged by a heavyweight buy — CEA Industries scooping up 200,000 BNB, instantly making it the largest corporate holder of the token.

The rally kicked off from $813.90, gathering steam as BNB broke past $839.57 and $853.67. Momentum, however, began to fade as the price approached the $855 zone, where sellers emerged and trimmed gains. Even so, the token managed to hold above $850 for much of the session, a sign that buyers weren’t backing off entirely.

Corporate Demand Fuels Momentum

CEA’s $160+ million BNB purchase isn’t just a headline grabber — it’s another marker of how corporate treasuries are increasingly diversifying into altcoins beyond Bitcoin and Ethereum. Trading volume spiked to nearly triple its daily average during the rally, pointing to deep-pocketed participation rather than just retail hype.

Still, as prices pushed toward $855, sell orders stacked up, signaling profit-taking and setting the stage for short-term consolidation. While momentum cooled toward the close, the presence of strong bid zones suggests this might be more of a pause than a reversal.

Technical Setup: Support Holding, Resistance Testing

Market data shows solid support forming near $834.40, a level defended through heavy trading during the climb. BNB’s breakout above $839.57 and $853.67 remains intact, but the $855 ceiling will need a decisive breach for a shot at reclaiming its record.

The broader market added to the bullish backdrop, with the CoinDesk 20 index gaining 5.3% in the same 24-hour stretch. Within the exchange token category, BNB continues to dominate, commanding over 81% of the sector’s market cap. Now less than 1% off its all-time high, the next move could determine whether BNB sets a new record or cools off in a consolidation range.