- Diverging Market Sentiment: Binance Coin (BNB) barely moved over the past 24 hours, but spot traders are accumulating while futures traders remain bearish. Spot traders pulled $31.28 million worth of BNB off exchanges this week, indicating long-term confidence.

- Futures Market Weakness: Despite spot accumulation, the Taker Buy/Sell Ratio is at 0.955, showing higher selling pressure. Open Interest has dropped to $789.9 million, signaling reduced conviction among futures traders.

- Development Activity Declines: BNB Smart Chain’s development activity is slowing, with smart contract deployments down 34.77% and verified contracts falling 22.69% in 24 hours, potentially impacting BNB’s price action.

Binance Coin (BNB) barely moved over the past 24 hours, gaining just 0.10%. But while the surface looks calm, the undercurrents tell a more complex story – one of mixed market sentiment and diverging trader behavior.

Spot and Futures Traders Take Opposite Sides

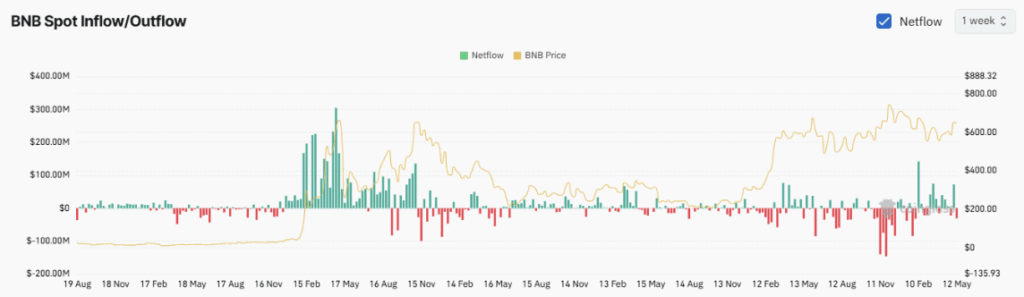

Spot traders have taken a decidedly bullish stance. Over the past day, $8.34 million worth of BNB flowed out of exchanges, adding to a weekly net outflow of $31.28 million. That kind of movement usually means traders are scooping up BNB and moving it to private wallets, a classic sign of long-term confidence.

However, in the futures market, the mood is noticeably different. According to CoinGlass, Binance’s biggest futures traders are actually more bearish than bullish. The Taker Buy/Sell Ratio currently sits at 0.955, suggesting selling pressure is slightly outweighing buying pressure. The broader market ratio is even lower at 0.9139, indicating weak buying interest overall.

Open Interest Falls as Conviction Wanes

Open Interest (OI) – a measure of unsettled contracts in the futures market – has also taken a hit. It’s fallen from $855.2 million in early May to $789.9 million now. That kind of drop points to fading momentum and less trader conviction.

Interestingly, short sellers took heavier losses in the last 24 hours, losing $102,560, compared to $2,140 in losses for longs. That tilt could mean the market is starting to turn against shorts, giving the edge to the bulls – but it’s still too early to call.

Development Activity Slows on BNB Smart Chain

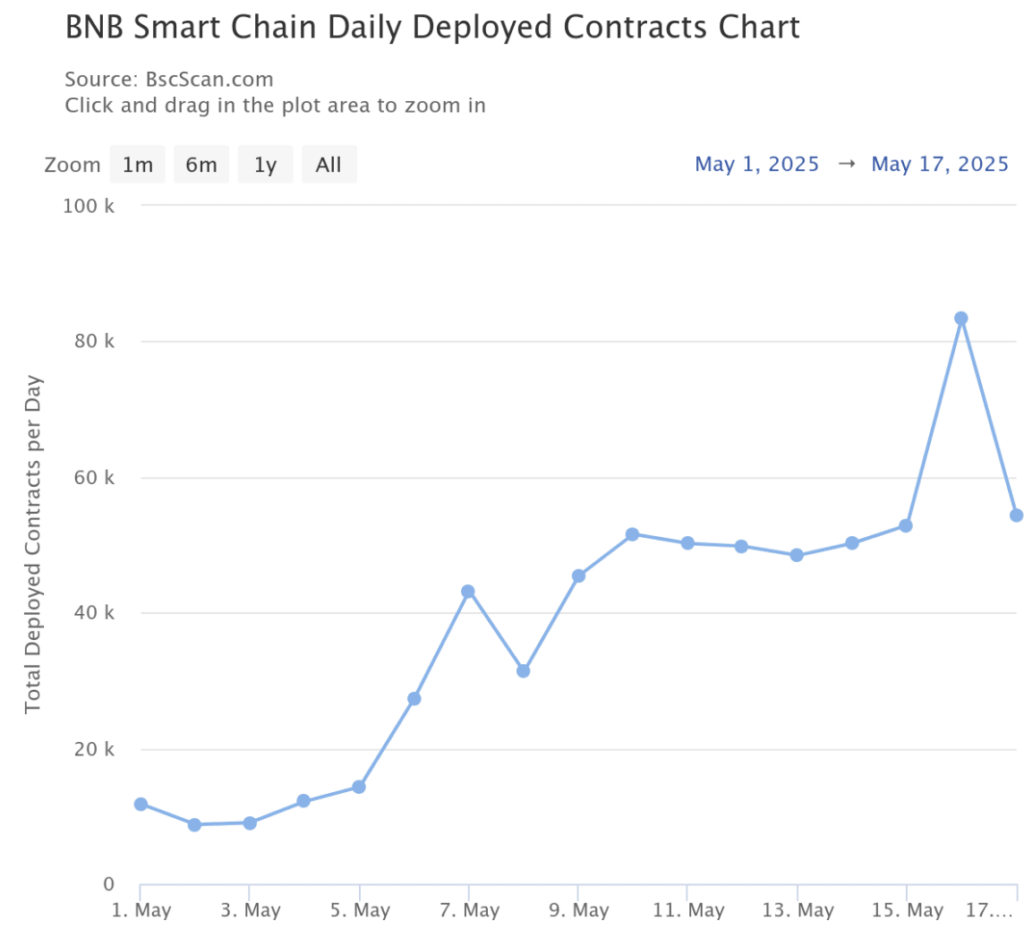

Meanwhile, the BNB Smart Chain is also sending mixed signals. After a solid run of activity earlier this month, smart contract deployment has fallen off a cliff. According to BscScan, daily contract deployments dropped 34.77% in 24 hours, landing at 54,369 contracts.

Verified contracts also slid by 22.69% to 259, suggesting lower network usage and potentially less on-chain demand for BNB.

What’s Next for BNB?

Right now, the BNB market is caught in a push-pull between bullish spot traders and bearish futures players. If development activity continues to decline and negative sentiment around BNB persists, the coin could face further downside. But if on-chain activity picks up and spot traders keep accumulating, a rally might not be off the table just yet.