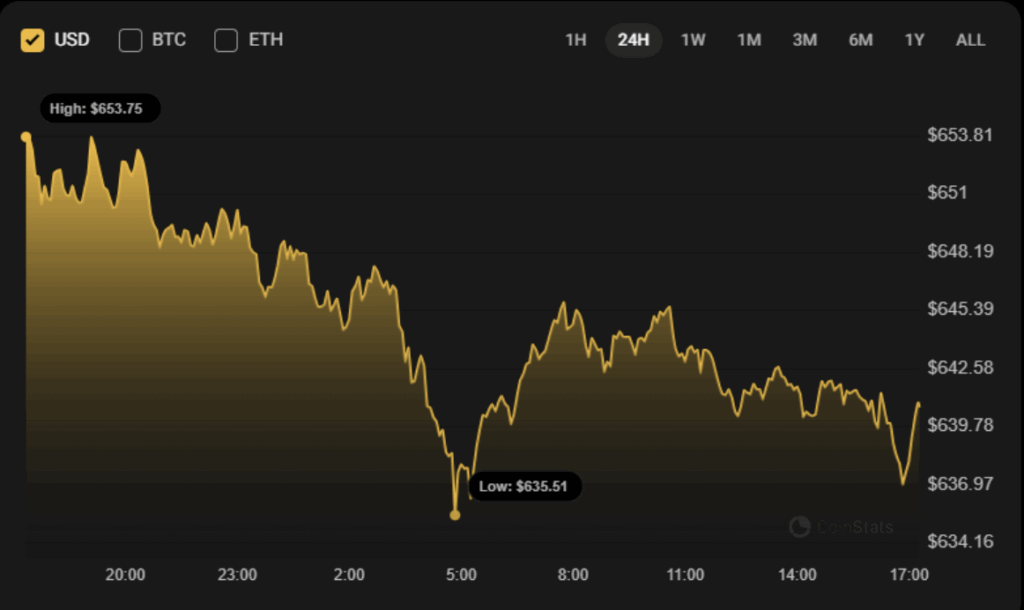

- BNB Struggles as Bears Take Control: Binance Coin (BNB) fell 4.12% over the past 24 hours, dropping to $641.53 as bearish pressure intensified, with bulls struggling to maintain momentum.

- Short-Term Resistance Test Possible: On the hourly chart, BNB is holding within its local channel, and a potential test of the resistance level could occur soon – but only if buyers step in to prevent further downside.

- Midterm Outlook – Bearish Risks Rising: A false breakout at $640.66 suggests a deeper correction could be in play, with $630 emerging as the next key support zone if the current momentum fades further.

BNB is looking shaky to kick off the weekend – bears seem to be calling the shots, at least for now. According to CoinStats, Binance Coin (BNB) dropped 4.12% in the last 24 hours, pulling back to $641.53. And from the looks of it, things could get a bit dicey if the bulls don’t step up soon.

Short-Term Setup – Resistance Test Incoming?

On the hourly chart, BNB is hovering in the middle of its local channel. Not exactly decisive, but if the price can hold steady and gain some momentum, a test of the next resistance level could come as soon as tomorrow. But that’s a big if – considering how choppy the market’s been lately.

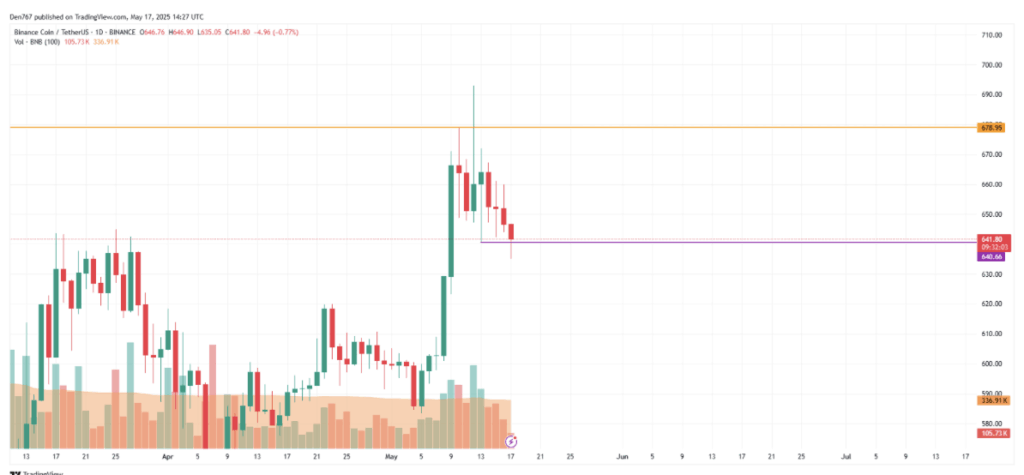

Bigger Time Frame – False Breakout or a Reversal?

Zooming out, the daily chart shows BNB made a false breakout at the $640.66 mark. But here’s the catch – the daily bar close is going to be crucial. If BNB can’t hold that level, traders could be in for a drop toward the $630 zone.

Midterm Outlook – Bulls Fading?

From a midterm perspective, things aren’t looking all that rosy. Bulls couldn’t sustain the previous run, and with momentum fading, a deeper correction could be on the table. If the daily bar closes well below $680, it might set the stage for more downside action.

At press time, BNB is trading at $641.53. The next few days will be key in determining whether the bulls can reclaim control or if the bears push the price lower. Stay tuned – it’s looking like a pivotal moment for BNB.