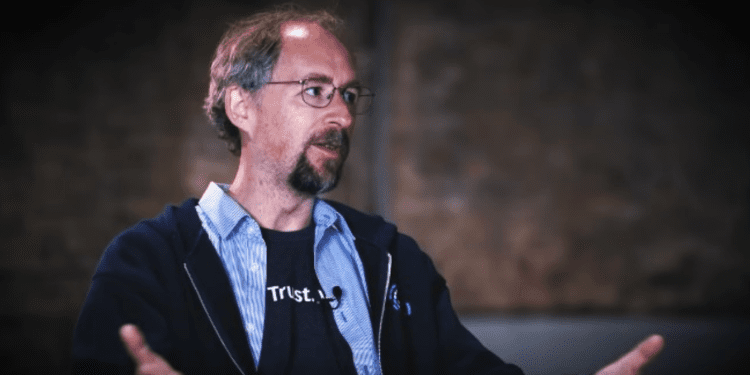

- Blockstream CEO Adam Back says BTC may reach $10 million before the halving in 2032

- He believes that if Bitcoin’s Layer 2 technology and wallet infrastructure improve, the price will go to the moon

- The CEO noticed that the price of BTC continues to double annually since 2013 and might continue the trend

Predictions continue in the crypto community, with each to their own opinions about the price of Bitcoin (BTC) in the long term. For Blockstream CEO Adam Back, he says it will reach $10 million – if and only if the overall infrastructure of the cryptocurrency improves.

According to Back, BTC’s year-on-year price average always doubled in value. If the bullish annual trend continues, it can reach $10 million on or before 2032 – the year that BTC will hit its sixth halving event.

He referred to crypto mogul Hal Finney’s price prediction, who also said $10 million is achievable.

“It checks the decade Jan 2013 – Dec 2022 bitcoin went up 2.036x/year (1200x in a decade),” he tweeted to his community of more than 500,000 followers.

Although $10 million sounds impressive, BTC will need to overcome its obstacles, mainly its infrastructure.

While Bitcoin still reigns supreme in the crypto market, it suffers from outdated technology. With high gas fees and layer problems, BTC will need more than just being labeled as “people’s money.”

Back also mentioned that more “sidechains” are needed to support Bitcoin. Fiat money comes with the assistance of financial institutions. However, BTC has nothing else except developers and the people who deem it valuable.

Still a Long Way to Go

Growing BTC as an established asset for transactions is a continuously complicated process, especially since many companies still need to be convinced about its use case. After all, the world is used to fiat money, and “restarting” the way transactions are made will take a lot of time.

The Blockstream CEO said only 1 to 2% of the global population uses BTC for payments. If blockchain developers can persuade the general audience and trusted corporations about Bitcoin’s integrity and firm foundations, mass adoption will boost the price up into orbit.

Yet, the goal of mass adoption is possible. Adam Back said the cryptocurrency must “displace” a part of it to provide value in portfolios besides stock, gold, bond, and real estate.

He was also transparent about the possibility of mass adoption if the fiat continues to deteriorate. He said he was uncertain, although if it does happen, society will go crazy.

“Adoption could have hyperbitcoinization spurts, where rapid viral adoption nukes a weak currency in a hyper-inflationary frenzy, and domino crash 20 bottom-tier currencies. People get pragmatic, adapt fast if they see fiat melting, a rush of others protecting savings via #bitcoin.”

However, BTC’s outdated technology and infrastructure are significant obstacles that must be overcome to be considered a viable alternative to fiat money. Back stated that BTC must displace a part of traditional investments to provide value in portfolios and boost mass adoption.