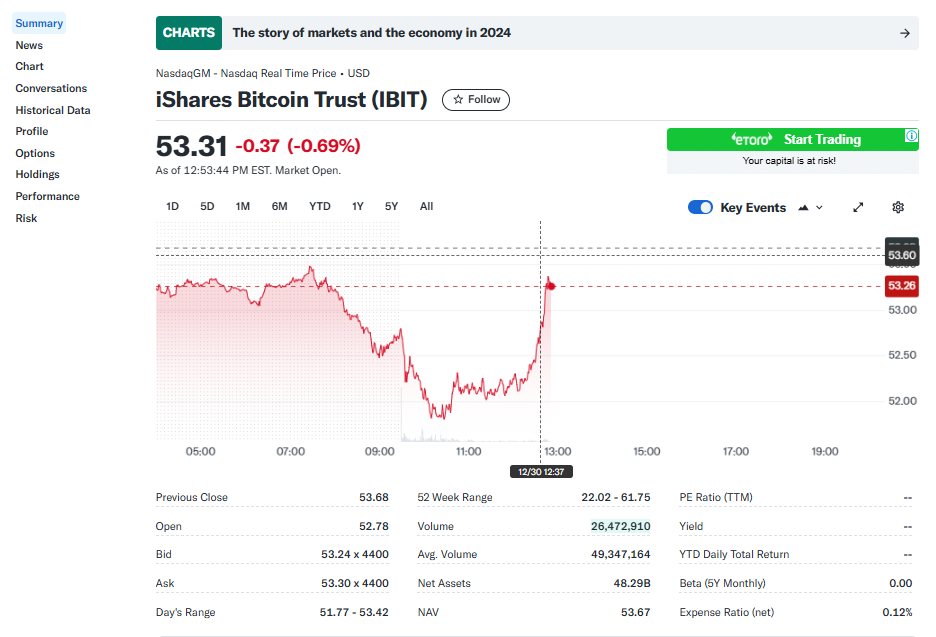

- BlackRock’s iShares Bitcoin Trust (IBIT) ETF smashed industry records in its launch year of 2024, growing to over $50 billion in assets in just 11 months, making it the greatest ETF launch in history.

- IBIT’s success helped drive Bitcoin’s price past $100,000 for the first time, bringing in both institutional and individual investors who were previously skeptical.

- After a long legal battle, the US Securities and Exchange Commission finally approved the launch of spot Bitcoin ETFs in 2024, with BlackRock, Fidelity, VanEck, and Grayscale among the first to launch, collectively holding about $107 billion in assets.

The world of exchange-traded funds (ETFs) witnessed an unrivaled phenomenon with the launch of the iShares Bitcoin Trust (IBIT) by BlackRock Inc.’s iShares unit. Breaking all industry records, it became the most successful debut in ETF history.

Exploring the Unprecedented Success of IBIT

The iShares Bitcoin Trust, known as IBIT, made its debut in 2024 and within just 11 months, it expanded into a colossal entity, accumulating more than $50 billion in assets. This unprecedented growth can be compared to the combined assets under management of over 50 European market-focused ETFs, many of which have been in operation for over two decades. This extraordinary success led Nate Geraci, president of advisory firm The ETF Store, to call it “the greatest launch in ETF history.”

The Impact of IBIT’s Success on the Bitcoin Market:

The triumph of IBIT wasn’t just about achieving significant numbers for BlackRock; it signified a pivotal moment for Bitcoin as well. The support from BlackRock, the world’s largest investment firm with over $11 trillion in assets under management, propelled Bitcoin’s price beyond $100,000 for the first time. This milestone attracted both institutional investors and previously skeptical individuals, amplifying Bitcoin’s credibility and appeal.

The Journey to the Creation of the iShares Bitcoin Trust:

The road to the creation of a Bitcoin ETF in the US was filled with hurdles and setbacks. The first attempt was made by the Winklevoss twins in 2013, but their application faced rejection by the US Securities and Exchange Commission, as did several subsequent applications over the years. Grayscale Investments, a digital-asset firm, was persistent and took the SEC to court, eventually winning a victory in 2023 that paved the way for the conversion of a Bitcoin trust into an ETF.

The entry of BlackRock, a titan in the investment industry, signaled a turning point in the creation of Bitcoin ETFs. Previously, Larry Fink, the firm’s CEO, had criticized Bitcoin, but his perspective shifted, and he began viewing Bitcoin as “digital gold.” BlackRock, known for its impeccable track record of filing and launching ETFs, was viewed as a sign that approval for a Bitcoin ETF was inevitable. Upon receiving the green light in January, BlackRock, along with Fidelity, VanEck, Grayscale and others, successfully launched the first batch of ETFs that invested directly in Bitcoin in the US. Currently, these 12 funds collectively hold about $107 billion in assets.

Conclusion

The launch of the iShares Bitcoin Trust by BlackRock marked a significant milestone in the world of ETFs and the broader financial industry. Its unprecedented success not only demonstrated the growing acceptance and popularity of digital assets but also paved the way for further innovation and development in the field of cryptocurrency investment.