- BlackRock moved $204M in crypto, sparking speculation about rebalancing, selling, or custody transfers.

- Arkham Intelligence data shows BTC and ETH were sent to Coinbase Prime, fueling market discussions.

- BlackRock has not issued a statement, leaving traders guessing about its next move in the crypto space.

BlackRock is back in the crypto spotlight after on-chain data revealed massive asset transfers—moving around $204 million in digital assets in a short period. The moves have sparked intense speculation across the crypto space.

What’s the play here? No official statement yet, so the guessing game begins.

Rebalancing, Selling, or Just Custody Transfers?

Traders and analysts are scrambling to decode BlackRock’s latest moves, with theories ranging from:

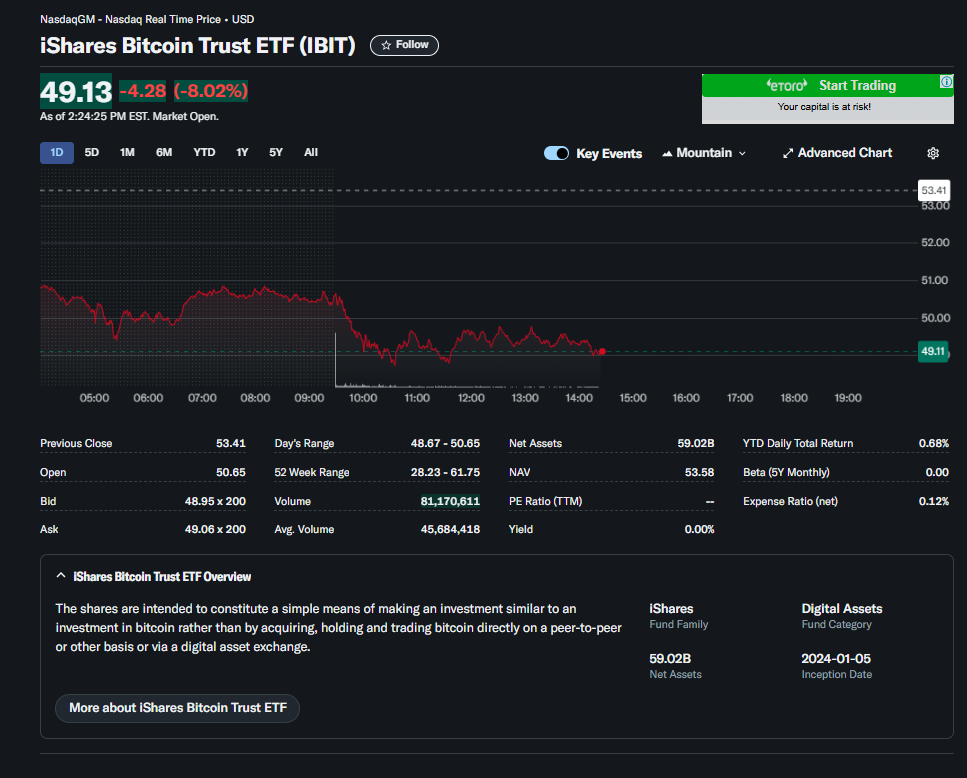

- Routine ETF rebalancing—adjusting holdings in its IBIT (Bitcoin ETF) and ETHA (Ethereum ETF).

- A potential sell-off or profit-taking event before the next market move.

- Simply shifting funds for custody without immediate trading intentions.

With institutional participation growing and macro conditions shifting, BlackRock’s next move could set the tone for crypto markets.

BlackRock’s Transfers Hit Coinbase—Market Reacts

Data from Arkham Intelligence shows that both BTC and ETH from BlackRock’s ETFs were moved to Coinbase Prime—one of the top institutional trading platforms.

- Some traders see this as just portfolio balancing, nothing unusual.

- Others fear it signals a bigger market shift, especially with traditional finance firms ramping up crypto exposure.

- The transfers coincided with a crypto market pullback, fueled by Trump’s tariff threats.

Despite all the speculation, BlackRock isn’t saying a word—and that silence is only adding fuel to the fire. Whether this is just ETF maintenance or a sign of bigger institutional moves, the market is watching very, very closely.