- BlackRock ended 2025 with $14 trillion in assets after record inflows.

- Digital asset AUM reached $78 billion, supported by strong ETF demand.

- Private markets and platform integration are driving growth into 2026.

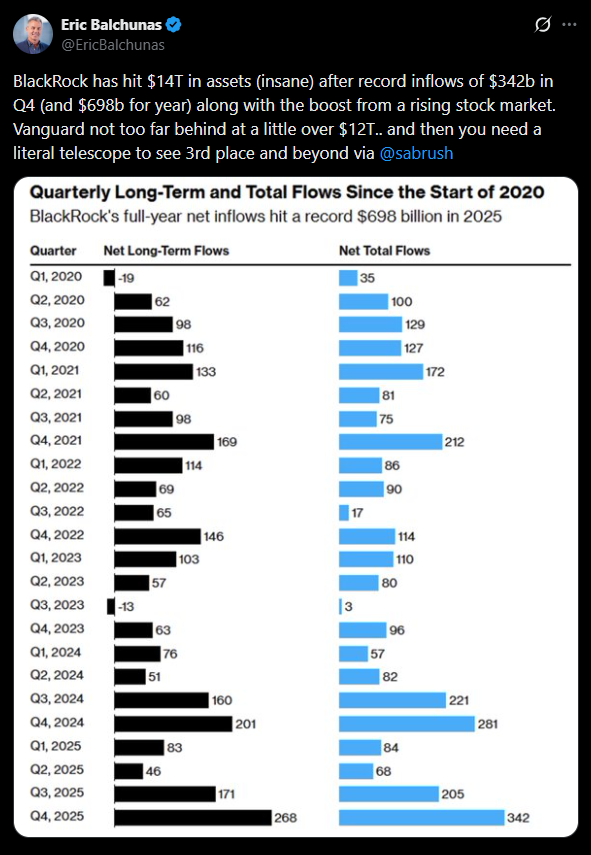

BlackRock closed out 2025 with a major milestone, reporting total assets under management of $14 trillion following a record year for inflows. The asset management giant said annual net inflows reached $698 billion, marking the strongest year and quarter in the firm’s history. Investors reacted quickly to the results, pushing BlackRock shares up roughly 5% after the earnings release.

Digital Assets Quietly Gain Scale

While traditional markets continue to anchor BlackRock’s business, digital assets are becoming a more meaningful contributor. The firm reported about $78 billion in digital asset AUM at year-end, supported by $35 billion in full-year ETF inflows for the category. Though still small relative to the broader platform, the growth signals increasing institutional comfort with crypto-linked products, especially within regulated ETF structures.

Private Markets Expand After HPS Deal

Private markets also played a central role in BlackRock’s expansion. Assets under management in the segment climbed to $323 billion following the acquisition of HPS, strengthening the firm’s presence in private credit and alternative investments. CEO Larry Fink said client activity is expanding across both public and private markets, supported by a growing pipeline and strong fundraising momentum heading into 2026.

A Platform Built for New Growth Channels

Fink emphasized that BlackRock’s unified platform is positioning the firm at the center of multiple long-term growth trends. These include private markets, active ETFs, wealth management, retirement solutions, and emerging areas like digital assets and tokenization. According to Fink, the firm is increasingly able to cross-connect technology, data, and investment products in ways that drive deeper client engagement.

Revenue and Fee Growth Reinforce Momentum

The earnings report also highlighted strong financial performance across the business. Organic base fees grew at a 12% annualized rate in the fourth quarter, reflecting strength in iShares ETFs, systematic active equities, private markets, outsourcing, and cash management. For the full year, BlackRock posted a 19% increase in revenue, driven by favorable markets, organic fee growth, transaction-related income, and higher technology and subscription revenue.