- Bitwise has applied for 11 new U.S. spot altcoin ETFs ahead of 2026.

- Strong ETF inflows into assets like XRP and SOL have not boosted prices.

- Analysts warn the crypto ETF market may face overcrowding and shakeouts.

Digital asset manager Bitwise is gearing up for a much bigger push into altcoin ETFs as 2026 approaches. According to a recent SEC filing, the firm has applied for approval to launch 11 new U.S. spot crypto ETFs, expanding well beyond Bitcoin and Ethereum. The move signals growing confidence that traditional investors still want exposure to crypto, even as price action across many assets remains muted.

Under Bitwise’s proposed structure, roughly 60% of each ETF would be directly invested in the underlying token, with the remaining 40% allocated to derivatives and other exchange-traded products. It’s a setup designed to balance spot exposure with flexibility, especially in a volatile market.

Which Altcoins Are in Focus

The list of targeted assets spans a wide range of crypto sectors. Bitwise’s filings reference potential ETFs tied to Aave, Zcash, Uniswap, Hyperliquid, Sui, Starknet, Near Protocol, Bitensor, Ethena, Canton, and TRON. Together, the lineup reflects how diversified the altcoin landscape has become, covering DeFi, privacy, Layer 1s, AI-linked tokens, and emerging infrastructure plays.

The timing also matters. In 2025, regulators approved a wave of altcoin ETFs, including products tied to Solana, XRP, Hedera, Litecoin, Chainlink, and even a Dogecoin ETF. According to analyst Chad Steingraber, this momentum could accelerate, calling 2026 “the year of the crypto ETF.”

Strong ETF Demand, Weak Price Response

Despite growing institutional interest, ETF inflows haven’t translated into strong price performance for most altcoins. Bitcoin and Ethereum were the exception earlier in 2025, as ETF-driven demand helped BTC climb above $126,000 and pushed ETH close to $5,000 before the late-year market correction erased gains.

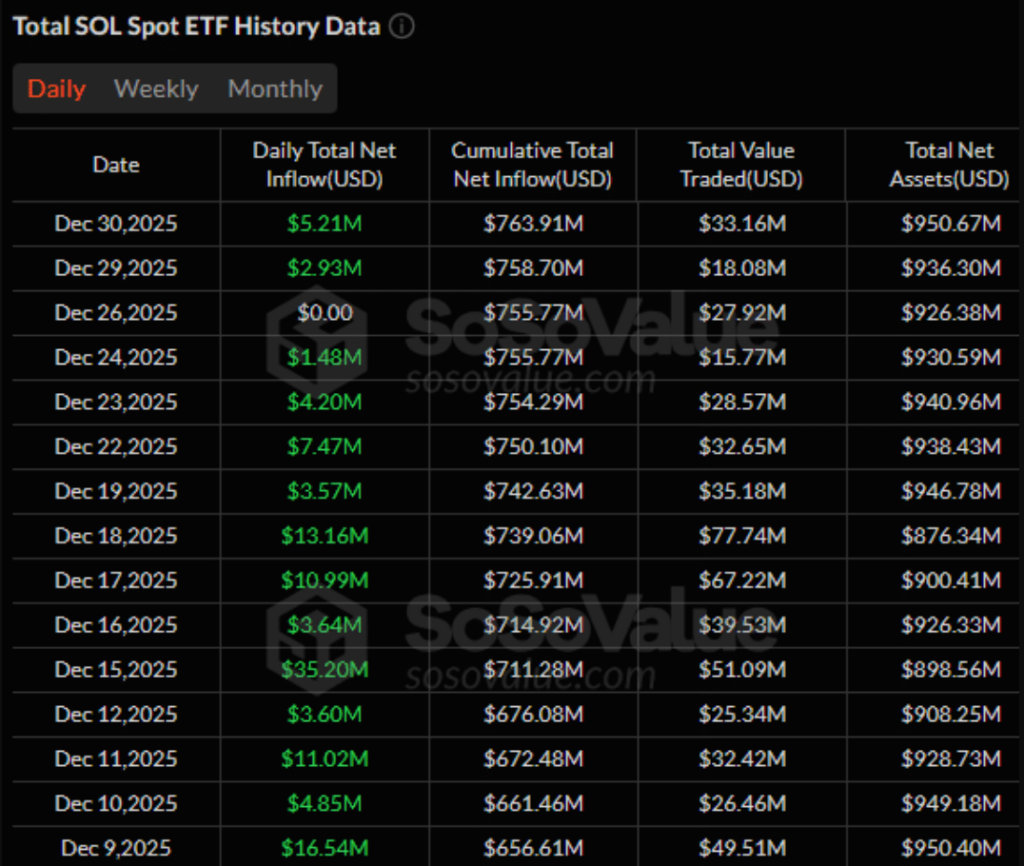

Altcoins have told a different story. XRP ETFs have attracted more than $1.16 billion in cumulative inflows as of late December, yet XRP’s price remains stuck below $2. U.S. spot Solana ETFs have seen roughly $763 million in inflows and almost $1 billion in total assets, even as SOL fell from $195 to around $124 over the same period.

LINK, LTC, and HBAR ETFs have followed a similar pattern, showing steady demand but limited price response. Dogecoin stands out as the lone exception, having failed to attract meaningful ETF inflows so far.

What Comes Next for Altcoins

The disconnect between ETF demand and token prices suggests that institutional exposure alone may no longer be enough to drive rallies. OTC buying, hedging strategies, and broader macro pressure are all muting spot market reactions. Bloomberg ETF analyst James Seyffart has also warned that the crypto ETF space is becoming crowded, raising the risk of consolidation or outright failures among smaller products.

For prices to respond, broader market sentiment may need to improve. Until then, ETFs appear to be laying structural groundwork rather than acting as immediate price catalysts.