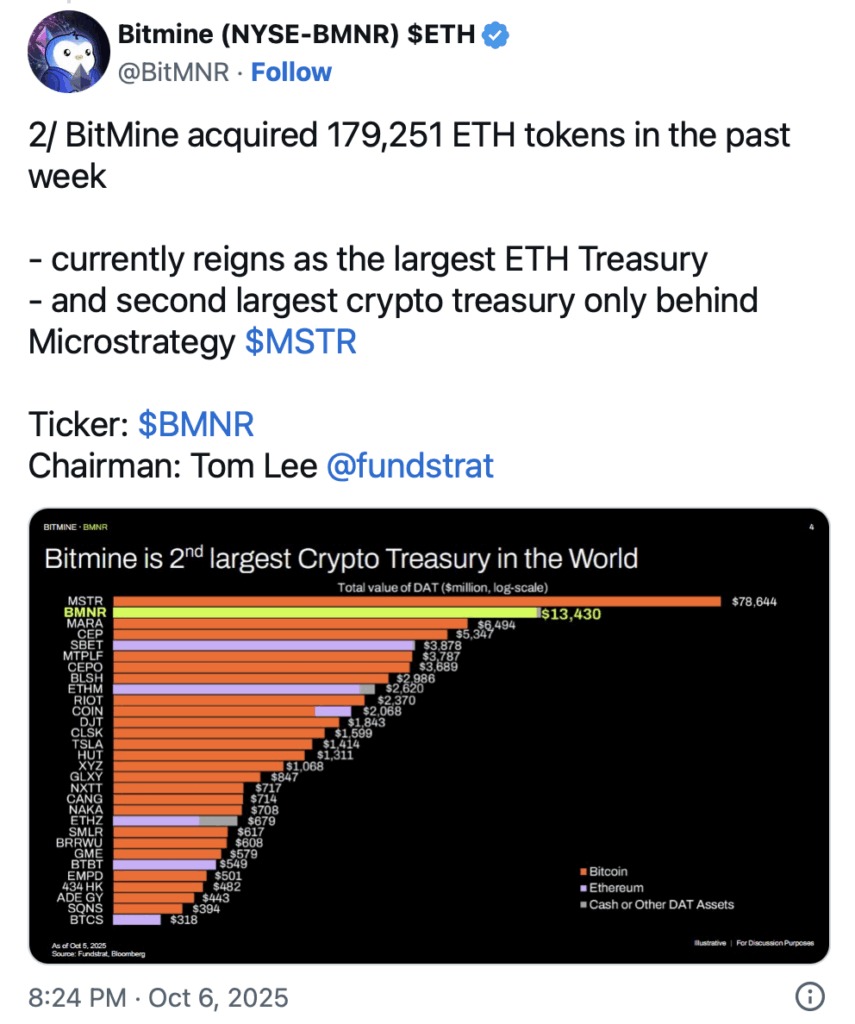

- BitMine expanded its ETH treasury to $13B, one of the largest institutional holdings in the world.

- The move signals rising confidence in Ethereum’s upgrades and its DeFi dominance.

- Analysts expect continued institutional accumulation could push ETH to new highs this year.

Tom Lee’s blockchain investment company, BitMine, has made a bold move—piling heavily into Ethereum (ETH) and pushing its crypto treasury to a record-breaking $13 billion. For analysts, this isn’t just numbers on a balance sheet, it’s a loud vote of confidence in Ethereum’s long-term role as the backbone of decentralized finance and smart contract innovation. The timing couldn’t be sharper, coming right when interest in DeFi is climbing again.

This massive jump in ETH holdings speaks volumes about institutional sentiment. BitMine’s pivot toward Ethereum isn’t just about stacking coins, it could also help spark more mainstream adoption, setting the stage for wider acceptance of blockchain assets beyond speculation.

Why BitMine Is Loading Up on ETH

According to insiders, BitMine began quietly ramping up ETH purchases earlier this year, riding on favorable market waves. Ethereum’s steady upgrades—like the transition to Proof of Stake and the upcoming Proto-Danksharding (EIP-4844) rollout—likely played a big role in shaping their bullish stance.

Their strategy lines up with a wider trend. Global institutions are no longer limiting themselves to Bitcoin alone; the success of Ethereum-based ETFs overseas has made ETH the next logical choice. By pushing its holdings to $13 billion, BitMine now ranks among the largest institutional Ethereum holders worldwide. That kind of accumulation not only strengthens ETH’s standing but could also reduce volatility in the medium term, making the asset more attractive to risk-averse investors.

Market Reactions Paint a Positive Picture

The market didn’t stay quiet. Following the news, Ethereum saw a quick uptick in trading volumes and a noticeable price bump within 24 hours. Of course, crypto still dances to the tune of global macro trends, but traders mostly view BitMine’s move as a bullish spark. Analysts argue that if institutions keep buying at this pace, Ethereum could hit new highs before the year is out.

For BitMine, this is more than a portfolio adjustment—it’s a positioning play. By leaning hard into Ethereum, they could inspire other funds to take a similar route. As investment firms chase exposure to blockchain infrastructure instead of short-term speculation, Ethereum’s role as the go-to smart contract platform looks stronger than ever.

Ethereum’s Bigger Picture

What’s clear is that Ethereum isn’t just riding another hype cycle—it’s proving its staying power. With BitMine’s aggressive strategy adding credibility, the token is increasingly seen as a critical building block for decentralized finance and Web3 growth. If this momentum carries forward, the next wave of adoption could be less about hype and more about real, institutional-scale commitment.