- Standard Chartered says a brief dip below $100K is likely, but short-lived.

- Prediction markets show traders betting 66% odds on a sub-$100K move.

- Analysts still see Bitcoin hitting $200K by 2025 and $500K by 2028.

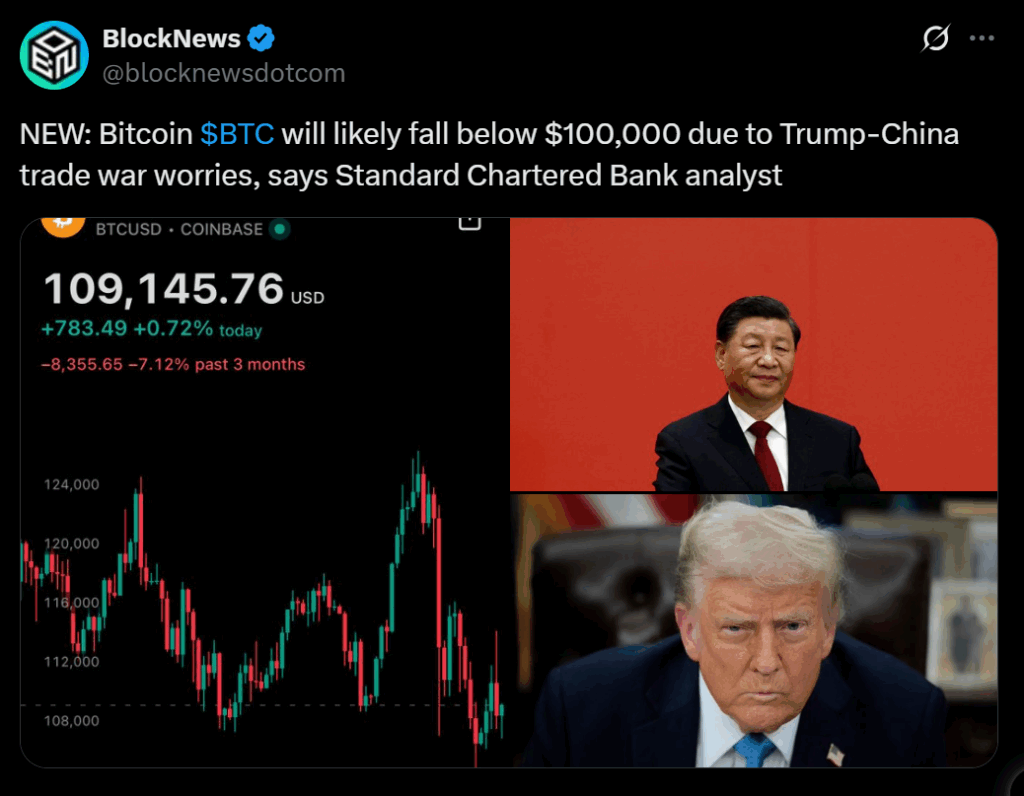

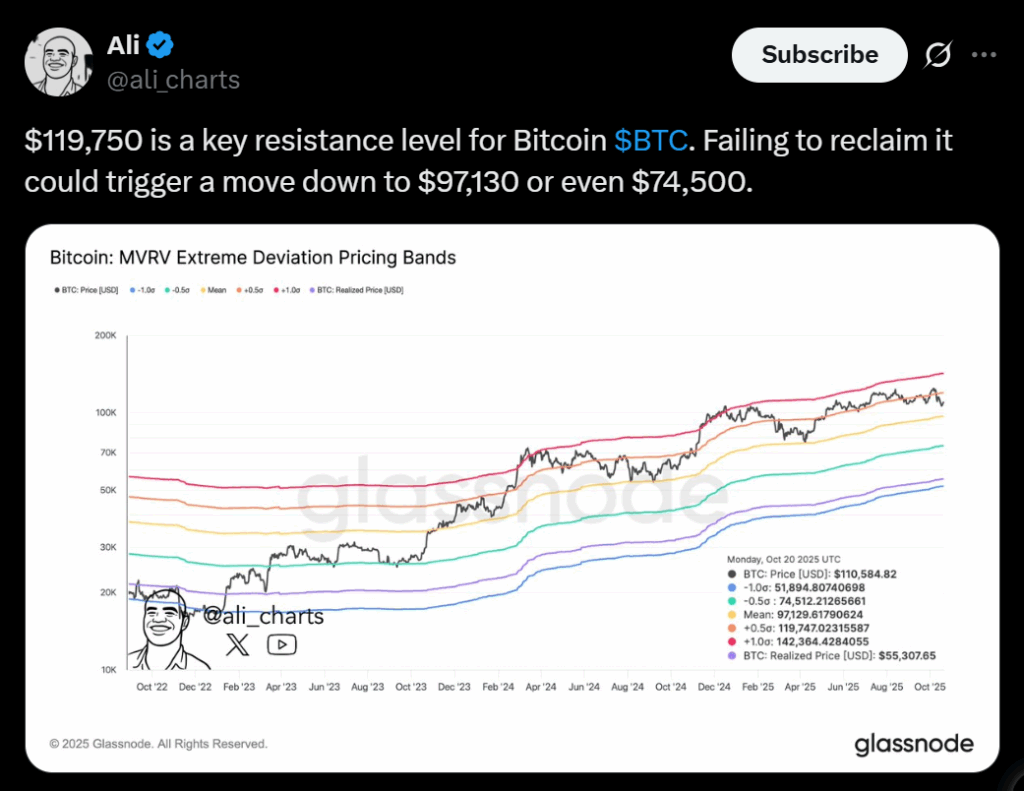

Bitcoin hovered near $108,000 on Wednesday morning, about 14% down from its October 6 all-time high, as Standard Chartered analysts warned that a dip below $100,000 is “inevitable.” Geoff Kendrick, the bank’s global head of digital assets research, said while the correction might shake out short-term traders, it could mark the final major buying chance before Bitcoin enters a new growth cycle.

“Stay nimble and ready to buy the dip below 100k if it comes,” Kendrick wrote. “It may be the last time Bitcoin is ever below that level.” He noted that BTC’s 50-week moving average has held firm since early 2023 — when Bitcoin traded at just $25,000 — suggesting a solid structural base for the next leg higher.

Gold’s Weakness May Help Bitcoin Bounce Back

Kendrick pointed to shifting flows between gold and Bitcoin, observing that the recent gold selloff coincided with an intraday Bitcoin rebound. “Gold has been outperforming Bitcoin a lot recently, but that may be starting to turn,” he said. The strategist also emphasized liquidity conditions and investor rotation as key indicators for when Bitcoin might stabilize after a sub-$100K move.

Traders Bet on a Dip, Analysts Stay Long-Term Bullish

Prediction markets on Robinhood show traders assigning a 66% probability that Bitcoin dips under $100,000 this year, and a 33% chance it falls below $90,000. Despite that bearish near-term view, Kendrick remains extremely bullish, forecasting $200,000 by late 2025 and $500,000 by 2028 as institutional demand grows and ETF flows expand.

Shorts Rise, But the Reversal Could Be Swift

Coin Bureau’s Nic Puckrin noted that funding rates across exchanges have turned negative and open interest is climbing — a setup often seen before short squeezes. “Everyone’s betting against the recovery,” Puckrin said. “That’s usually when the reversal hits hardest.”

With macro catalysts like a potential Fed rate cut and U.S.–China trade easing, the market may be gearing up for another surprise move higher — just when traders least expect it.