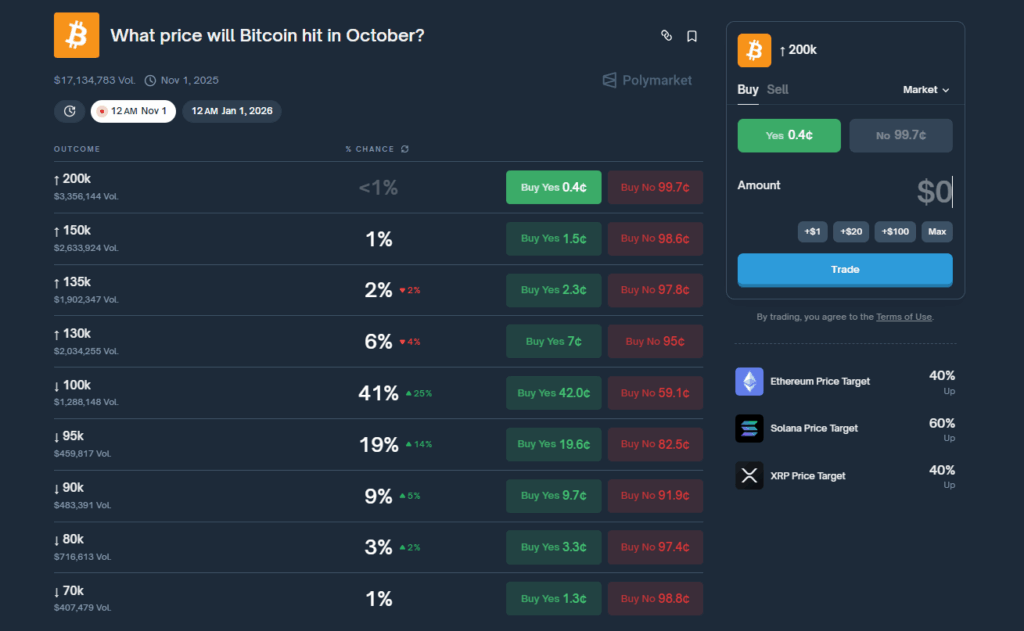

- Polymarket bets now see a 41% chance Bitcoin ends October under $100K.

- Gold hits $4,379, while whales pocket $192M shorting BTC amid $19B in liquidations.

- Analysts remain bullish long-term, but trade tensions and macro pressure cloud the near-term outlook.

Polymarket traders now see a 41% chance that Bitcoin ends October below $100,000, while the odds of it reclaiming above $130,000 sit under 6%. The sentiment shift comes after a chaotic week that saw Bitcoin tumble from $121,000 to $104,000, triggered by President Donald Trump’s 100% tariff threat on Chinese imports.

Bitcoin Breaks $104K as Whales Short Big

The crash aligned with a historic move in gold, which surged past $4,379 to set fresh all-time highs. Over the last month, the precious metal has gained more than 17%, while Bitcoin has dropped 8%, failing to recover from last Friday’s shock.

“Capital is clearly favoring gold right now due to its momentum and lower volatility,” said Sean Farrell, head of digital asset strategy at Fundstrat. He noted that central banks remain consistent gold buyers, giving the metal a “natural backstop” that Bitcoin currently lacks.

Meanwhile, blockchain data revealed that one whale wallet made roughly $192 million shorting Bitcoin ahead of the crash. According to Ed Yardeni, a veteran strategist, “The crypto derivatives ecosystem amplified Bitcoin’s fall. Liquidity vanished fast, triggering over $19 billion in forced liquidations across futures and leveraged positions.”

Analysts Still See Long-Term Upside

Despite the sharp selloff, major banks haven’t given up their bullish calls. JPMorgan still expects Bitcoin to reach $165,000 by year-end, while Citi projects a move to $133,000 this year and $181,000 in 2026. Historically, October has been a strong month for Bitcoin, with gains recorded in 10 of the past 12 years, but this one is shaping up to test that streak.

As of Friday morning, Bitcoin hovered around $108,000, down more than 14% for the week. Analysts warn that the next major support sits near $100,000, with a deeper correction possible if macro conditions worsen before the Federal Reserve’s October 29 meeting.

Gold Steals the Spotlight as Bitcoin Wobbles

Gold’s relentless run has widened its performance gap against crypto. Year-to-date, the metal is up over 50%, more than double Bitcoin’s 20% gain in 2025. Yardeni even dubbed gold the “new bitcoin,” predicting prices could reach $5,000 by 2026 and possibly $10,000 before 2030.

Meanwhile, HSBC raised its gold outlook to $3,355 for 2025 and $3,950 for 2026, citing strong central bank accumulation and rising global uncertainty. With trade tensions between Washington and Beijing intensifying and a potential tariff escalation on November 1, analysts warn that markets may face more turbulence ahead.