- Bitcoin fell below $90K, triggering over $100M in long liquidations.

- U.S. spot Bitcoin ETFs recorded their largest daily outflows since late November.

- On-chain demand remains muted, keeping upside momentum in check.

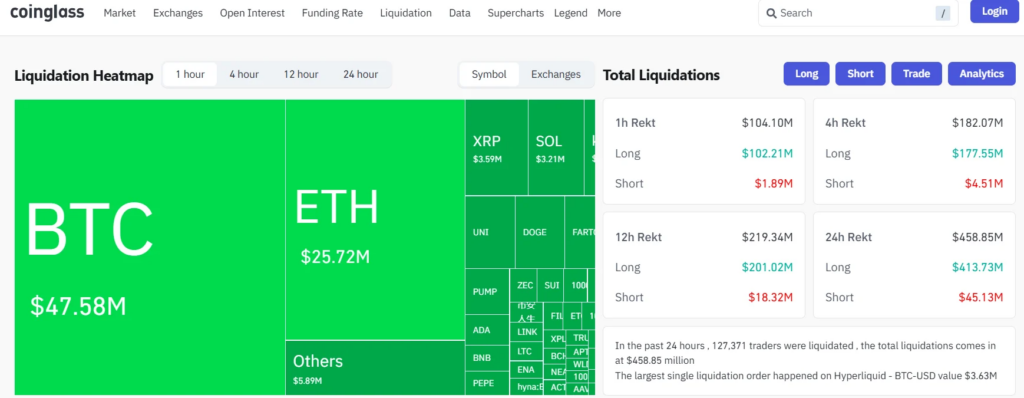

Bitcoin dropped below the $90,000 level in the early hours of Thursday, triggering more than $100 million in long liquidations as leverage was flushed from the system. At the time of writing, BTC was hovering right around $90,000, down roughly 3% over the past 24 hours, according to CoinGecko data. The move caught many traders offside, especially after Bitcoin had briefly pushed toward $94,000 earlier in the week.

ETF Outflows Are Driving Short-Term Weakness

The pullback lines up closely with a sharp reversal in ETF flows. Data from Farside Investors shows U.S. spot Bitcoin ETFs recorded $486 million in net redemptions on Wednesday, marking the largest single-day outflow since November 20. Flows had already turned negative on Tuesday, with $243 million exiting during that session, erasing much of the strong buying seen at the start of January. Bitcoin’s recent price action has been moving almost lockstep with these flow shifts.

Liquidations Accelerated the Move

As Bitcoin slipped under key levels, leveraged long positions absorbed the bulk of the damage. More than $100 million in longs were liquidated as price momentum flipped, amplifying the downside move. This type of selling pressure tends to be mechanical rather than conviction-driven, but it can still push price lower in the short term while positioning resets.

On-Chain Demand Has Yet to Rebound

Despite ongoing debate about what initially fueled Bitcoin’s rally toward $94,000, some analysts remain cautious. CryptoQuant analyst Cauê Oliveira noted that on-chain demand has not yet recovered in a meaningful way. Current activity levels, while improving slightly, are still viewed as insufficient to sustain a sustained push toward the $100,000 mark without renewed spot demand.

The Bigger Picture Remains Unresolved

Some market participants point to geopolitical developments, particularly around Venezuela and potential impacts on oil prices, as a possible longer-term tailwind. Lower energy costs could ease inflation pressure and reduce mining expenses, creating a more supportive backdrop for Bitcoin over time. For now, however, ETF flows and leverage dynamics appear to be setting the near-term tone.