- Bitcoin plunged to $98K, triggering nearly $658M in liquidations — with $533M wiped from long positions alone.

- Heavy U.S.-based selling and ETF redemptions pushed BTC below $100K, ending its 189-day streak above the level.

- Prediction markets now give a 66% chance that Bitcoin will hit $95K before the end of November.

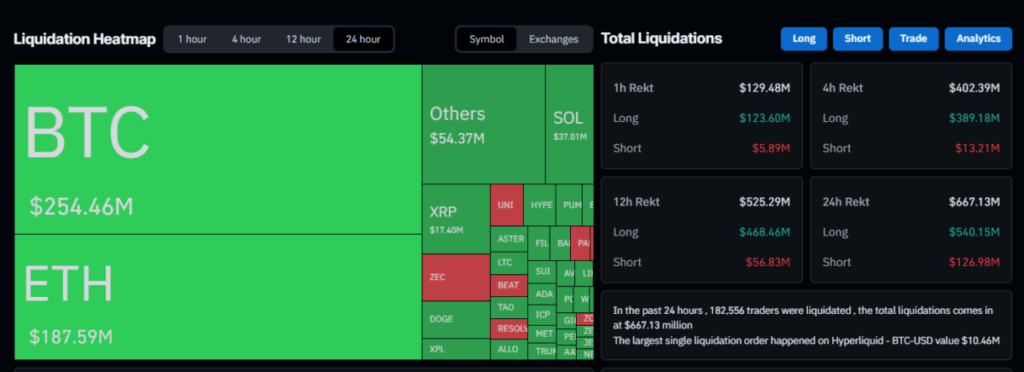

Bitcoin took a sharp dive below the six-figure line again, slipping to around $98,377 on Nov. 13 — and the drop wasn’t gentle at all. The move triggered a massive $657.88 million in crypto liquidations in just 24 hours, with long positions getting hit the hardest. It was one of those market moments where everything happens too fast, and traders barely have time to blink before positions start vanishing.

A Brutal Liquidation Wave

CoinGlass data showed that out of the nearly $658 million washed out, a staggering $533.57 million came from long traders who were positioned for more upside — and got completely blindsided. Shorts only took about $124.31 million in damage, meaning the bulls really ate the bulk of this one. The cascade sped up throughout the day too, jumping from $513 million at the 12-hour mark into full-blown chaos as BTC lost its grip on $100K again.

According to CoinGecko, this was already Bitcoin’s third dip below $100K in November alone, following earlier drops to $99,607 and $99,377. From its peak of $126,080 on Oct. 6, BTC is now down roughly 22%, which is a pretty steep retrace for something that felt unstoppable just weeks ago. Other majors slid too — Ethereum traded near $3,267, Solana around $147.91, and XRP slipped to $2.36.

Why Did Bitcoin Break Below $100K?

Analysts pointed fingers in a few different directions, but one theme kept popping up: U.S. selling pressure. Satoshi Stacker highlighted that the “Coinbase BTC discount” widened again, showing heavy U.S.-based selling dragging prices down.

Trader Maartunn noted that the $100K zone was a huge liquidity pocket — once BTC cracked below it, the market rushed to fill orders lower, ending a 189-day streak of Bitcoin closing above $100K. That streak stretched all the way back to May 8.

And strategist Liz Thomas pointed out something interesting: dollar weakness didn’t help Bitcoin at all — but it did help gold. A kind of weird divergence for a market that usually moves with macro narratives.

Traders Brace for More Downside

Prediction markets aren’t exactly optimistic right now. On Polymarket, traders placed a 66% chance that Bitcoin will touch $95,000 sometime in November. Over on Kalshi, participants gave 37% odds that another S&P 500 company will announce BTC purchases before year-end — a detail that shows some think institutional demand might still show up, even if it’s not here today.

ETF outflows and redemption pressure also played a role in pushing Bitcoin lower, making this the largest liquidation event of Q4 so far. It was one of those classic domino-effect moments: price dips → liquidity cracks → longs flushed → deeper dip → more panic.