- Bitcoin bounced from $111K to $115.6K as selling pressure eased.

- Whale accumulation hit high levels, with exchange ratios dropping to 0.43.

- If buying continues, BTC could test $119.6K, but a seller comeback risks a retest of $112K.

Bitcoin’s latest dip seems to have run its course, with selling pressure drying up and whales quietly taking coins off exchanges. After sliding to a local low of $111K, BTC bounced back toward $117,421 before cooling off near $115,600, up around 2.4% on the day. The big question now—can $112K hold if sellers decide to return?

Sellers Back Off, Profit-Taking Slows

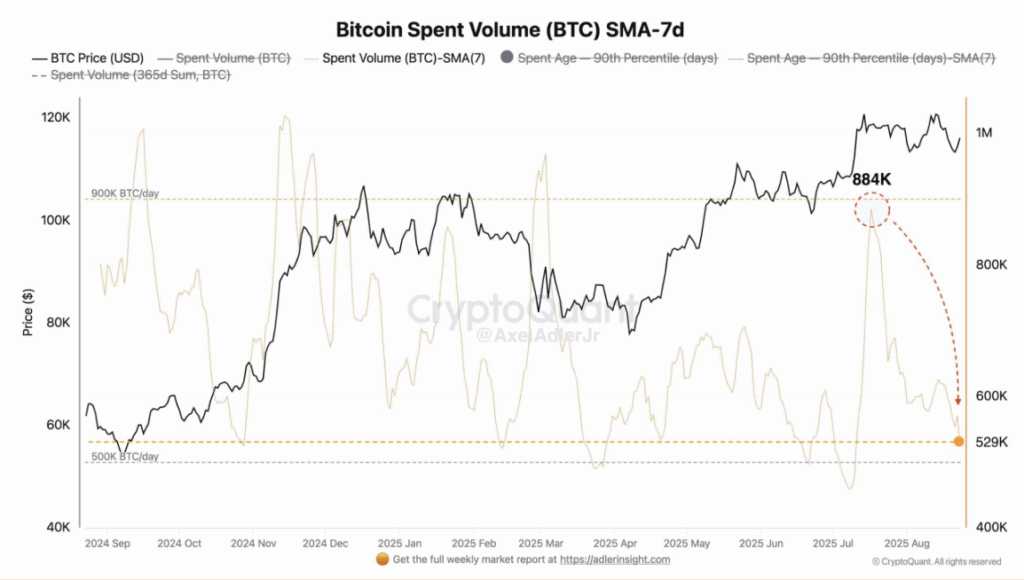

Data from CryptoQuant analyst Axel Adler shows Bitcoin’s Spent Volume (7-day SMA) plunged to 529K BTC per day. That’s a sharp decline, suggesting the big wave of selling has eased. With price action stagnant in recent weeks, the incentive to dump coins has dropped. Even realized profits were muted: long-term holders booked just 7.2K BTC, while short-term traders managed 1.8K BTC. For both groups, the appetite to sell into strength just isn’t there right now.

Whales Pull Coins Off Exchanges

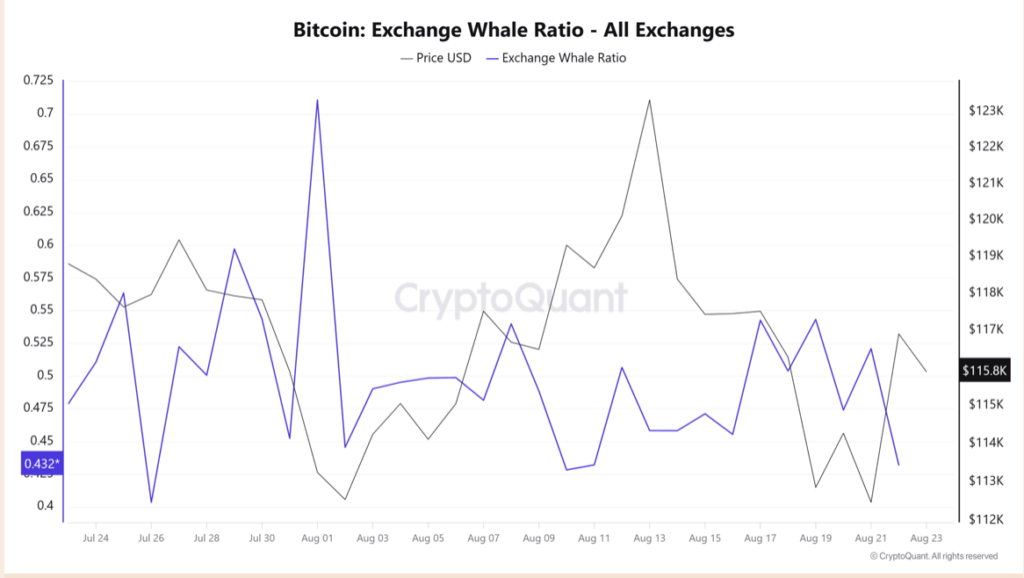

While retail hesitates, whales have been busy stacking. The Exchange Whale Ratio dropped to 0.43, its lowest in nearly two weeks. Lower readings here typically mean whales are moving BTC into private wallets rather than exchanges—less prep to sell, more signs of accumulation. Checkonchain data backs this up: mega holders and exchanges with over 10K BTC saw balances shrink by more than 20,000 coins, showing withdrawals far outweighed deposits.

Historically, this kind of shift—whales pulling coins off exchanges—has preceded stronger upward pressure on price. It doesn’t guarantee a breakout, but it tips the balance toward accumulation rather than distribution.

Can BTC Push Higher?

Netflow data paints the same picture. Bitcoin’s netflow turned negative, dropping to -$128M, another sign of heavy accumulation. If this trend continues, BTC could retest $117K and possibly stretch toward $119,600 in the short term. Still, traders remain cautious. A sudden return of sellers could put pressure back on the $112K support, a level Bitcoin needs to defend to avoid another leg down.

For now, the market looks like it’s leaning bullish—but as always with Bitcoin, one wave of selling could flip the script in an instant.