- Bitcoin RSI has fallen below key 12-month and 4-year averages

- Past cycles show this often precedes deeper bearish phases

- Capital rotation into gold and silver is pressuring crypto sentiment

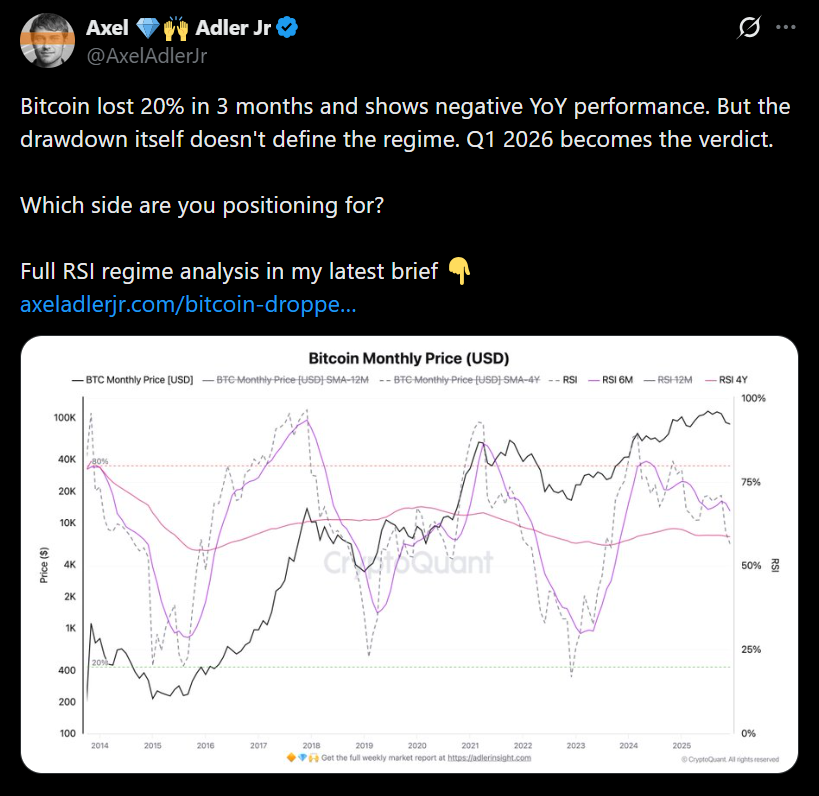

Bitcoin’s recent price action is starting to raise deeper concerns among market watchers. The asset is down roughly 20% over the past three months and about 10% year-over-year, and technical indicators are now flashing early warning signs that the pullback may not be just another routine correction. Momentum has weakened notably as broader macro forces continue to weigh on risk assets.

RSI Breakdown Signals Rising Downside Risk

According to CryptoQuant analyst Axel Adler Jr., Bitcoin’s relative strength index is currently sitting at 56.5. This places it well below the 12-month average of 67.3 and just under the closely watched 4-year average of 58.7. Historically, this level has acted as a dividing line between temporary pullbacks and more persistent bearish phases.

Adler notes that in prior cycles, including 2018 and 2022, Bitcoin slipping below its long-term RSI average often coincided with transitions into deeper downtrends. While this does not guarantee an extended bear market, it does suggest that downside risks are increasing if momentum fails to recover.

Capital Rotation Is Weighing on Bitcoin

Bitcoin’s softer momentum comes as investors continue rotating into hard assets. Gold and silver have dominated 2025, posting some of their strongest rallies in decades. Silver has climbed to around $72 per ounce, marking a gain of roughly 148% and pushing its market capitalization beyond $4 trillion. Gold has surged nearly 70% and is on track for one of its best years on record.

This shift toward traditional inflation hedges appears to be pulling capital away from crypto, leaving Bitcoin struggling to reclaim leadership as a macro hedge. As long as metals remain in favor, Bitcoin may find it difficult to regain upside traction.

What This Means Going Forward

Bitcoin’s long-term structure has not fully broken down, but the RSI data suggests the market is entering a more fragile phase. If momentum continues to weaken and RSI remains below its long-term averages, the probability of a prolonged bearish stretch increases. On the other hand, a recovery in risk appetite or renewed macro catalysts could still stabilize price action.

For now, Bitcoin sits at a crossroads where sentiment, momentum, and macro trends are all working against it.