- Bitcoin Surges Amid Global Uncertainty: BTC surpassed $109K as investors flee traditional assets like U.S. Treasurys due to rising yields and mounting debt concerns. U.S. 30-year bond yields hit 5.15%, revealing cracks in confidence.

- Japan’s Shift Adds Pressure: Japan, the largest foreign holder of U.S. debt, is hiking rates, raising its long-term bond yields and potentially unwinding its U.S. Treasury exposure.

- Bitcoin Gains Dual Appeal: Institutional investors are flocking to Bitcoin ETFs, pushing AUM over $104B. BTC is now seen both as a high-growth asset and a safe haven, signaling a major shift in market behavior.

Bitcoin has climbed above $109,000, catching a tailwind from growing global financial uncertainty. In a twist of irony, the very macro conditions—like rising bond yields and slowing economic growth—that once weighed down Bitcoin are now helping to push it up. The U.S. debt situation, in particular, is rattling investors, with rising Treasury yields putting the country’s $36.8 trillion debt under more pressure than ever.

Surging Yields and a Shaky Bond Market

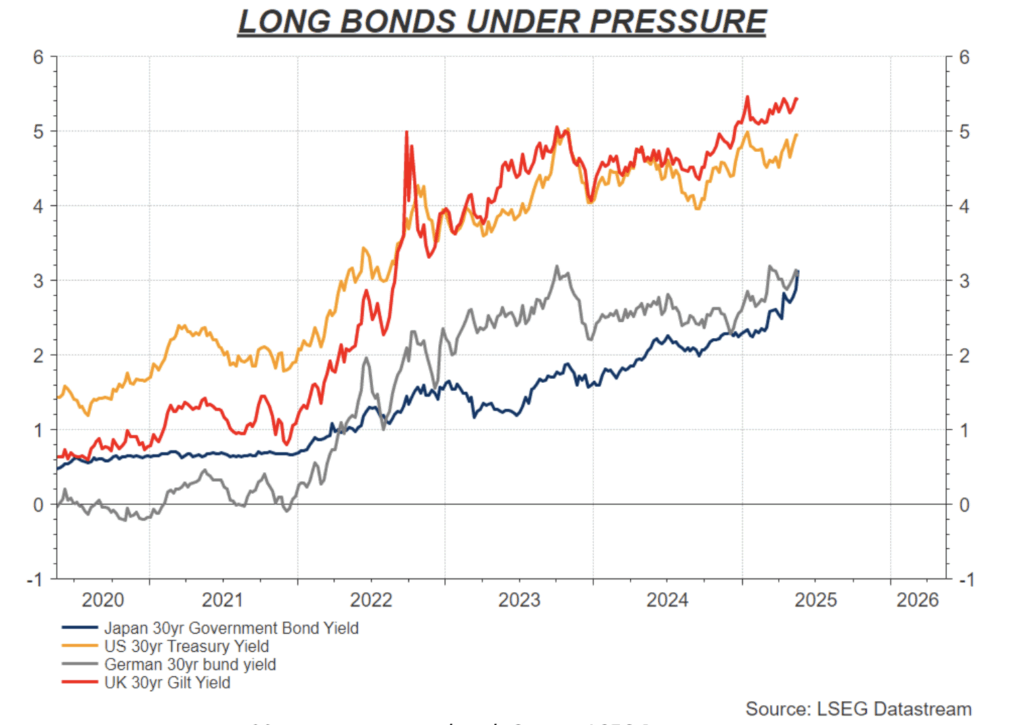

Yields on U.S. bonds are climbing fast. The 30-year hit 5.15%—a level not seen since 2007. The shorter maturities are also climbing but at a slower pace, with the 5-year now at 4% and the 2-year around 3.9%. What’s worrying is that this surge is happening while investor faith in U.S. bonds is eroding, made worse by the recent downgrade of the U.S. government’s credit rating.

Meanwhile in Japan, the largest foreign holder of U.S. Treasurys, things are also shifting. The Bank of Japan has started lifting interest rates, pushing the yield on its 30-year bonds to a record 3.1%. That’s led to fears that Japanese institutions could begin pulling money out of U.S. bonds, adding more stress to an already fragile system.

Bonds Out, Bitcoin In?

In the past, rising bond yields meant bad news for risk assets like Bitcoin. Not anymore. As investors grow increasingly wary of government debt and central bank policies, many are turning to Bitcoin—not just for gains, but for stability. U.S. equities are losing favor, with institutional investors underweight stocks at levels not seen in a year.

Spot Bitcoin ETFs are exploding with inflows, now holding over $104 billion in assets. This signals growing belief in Bitcoin’s role not just as a risk asset, but as a kind of “digital gold” in a world where trust in fiat currency is fading. While its total market cap still lags far behind gold and the base U.S. dollar supply, Bitcoin’s momentum shows it’s no longer a fringe hedge—it’s becoming part of the core strategy.

Bitcoin’s Dual Identity: Safe Haven or Speculative Bet?

What’s fascinating is how Bitcoin is pulling off both roles at once. It’s acting like a high-growth tech stock and a safe haven like gold. That used to be a contradiction, but in today’s upside-down market, it might be the new normal. As the old playbooks lose relevance, Bitcoin’s mix of decentralization, predictability, and growing adoption could make it one of the defining assets of the next financial era.