- Bitcoin briefly reclaimed $97,000 for the first time since November 2025.

- Analysts expect further upside but see $100K more likely in early February.

- Long-term forecasts still point to a new all-time high in 2026.

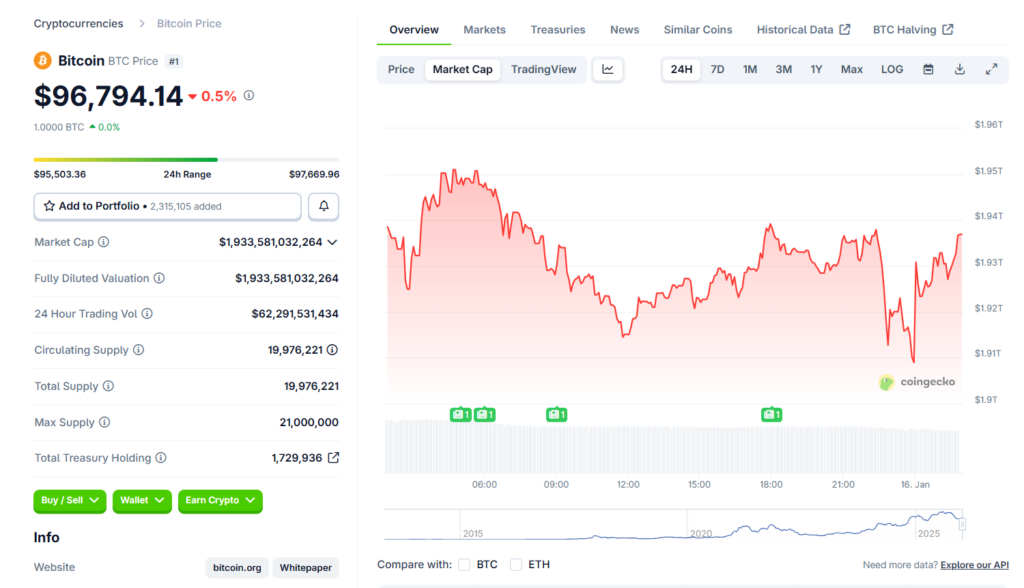

Bitcoin briefly climbed back above the $97,000 level on January 15, marking its first visit to that range since mid-November 2025. The move added fuel to growing speculation that momentum may be rebuilding after months of choppy price action. According to CoinGecko, BTC is up 0.3% over the last 24 hours, 5.5% on the week, more than 9% over the past two weeks, and roughly 11.5% over the last month. With those gains stacking up, attention is now turning to a familiar psychological milestone: can Bitcoin reclaim $100,000 by January 20?

A Recovery Still Fighting Heavy Resistance

Bitcoin’s current position is shaped by its sharp reversal from October 2025, when it printed an all-time high near $126,080 before entering a steep correction. Broader market sentiment turned defensive soon after, driven by macro uncertainty and risk aversion that still lingers today. The $97,000 level has emerged as a key resistance zone, and BTC is now testing whether it can hold above it. A clean break and consolidation above this area would significantly improve the odds of a push toward $100,000.

What Analysts Expect in the Near Term

Short-term forecasts remain cautious. CoinCodex analysts expect Bitcoin to continue grinding higher in the coming days but do not see $100,000 arriving by January 20. Their current model points to a reclaim of the six-figure level closer to February 1, 2026. While the timing may disappoint some traders, a confirmed move above $100,000 would strengthen the broader bullish case and reopen discussions around a new cycle high.

Long-Term Outlook Stays Strong

Zooming out, major institutions remain constructive on Bitcoin’s trajectory. Bernstein and Grayscale both expect 2026 to be a strong year, arguing that Bitcoin is following a five-year cycle rather than the traditional four-year halving pattern. Under that framework, BTC would be positioned to set a new all-time high this year. Bernstein has floated a $150,000 target for 2026 and sees the possibility of Bitcoin pushing beyond $200,000 in 2027 if adoption and macro conditions align.

Caution Still Shapes the Market

Despite the optimistic projections, the market remains fragile. The October 2025 crash left a lasting mark on investor confidence, and many participants are still avoiding high-risk exposure. Fresh volatility tied to macroeconomic developments could challenge Bitcoin’s recovery in the short term. For now, BTC’s ability to defend recent gains and build support above $97,000 will likely determine whether the path to $100,000 accelerates or stalls.