Bitcoin (BTC) has been sealed within a tight range, with the Thanksgiving season failing to bring the volatility required to give it the direction of movement. Instead, the flagship cryptocurrency turned bearish over the weekend, trading in red on Saturday and Sunday, giving rise to bearish targets that may extend toward the $8,500 level.

Although the Bitcoin price prediction is biased to the downside, the overly bearish positioning of the derivatives market and Bitcoin’s contrasting on-chain activity could mean a short-term reversion for the big crypto.

Troubles Derivatives Markets Weight Down Bitcoin’s Price

Fear continues to wreck the crypto market as distrust of institutions and rumors of insolvencies fill the space following the FTX fiasco. Early last week, fears of financial troubles at the Digital Currency Group (DCG) exerted overhead pressure on the prices of its subsidiary’s Grayscale BTC (GBTC) derivatives products.

According to capital market insights from the blockchain analytics firm IntoTheBlock, GBTC presented a discount that implied a Bitcoin value of $8,500 after it hit a record discount of more than 45% relative to the pioneer cryptocurrency.

GBTC’s discount later narrowed to 42% after a Tuesday letter from the DGC founder CEO Barry Silbert was sent out to restore investor confidence. The letter partially eased tensions regarding the financial health of DCG’s subsidiaries Genesis, Grayscale Investments, and mining company Foundry.

Note that futures contracts for December have been priced lower than the currency Bitcoin spot price, a condition referred to as backwardation. This does not usually happen for Bitcoin and is typically an indication that a lot of selling has occurred in the last few weeks.

According to IntoTheBlock, future backwardation also offers an arbitrate opportunity that investors can take advantage of by “buying the contract, selling spot and profiting from the difference as they converge by the time of expiration.”

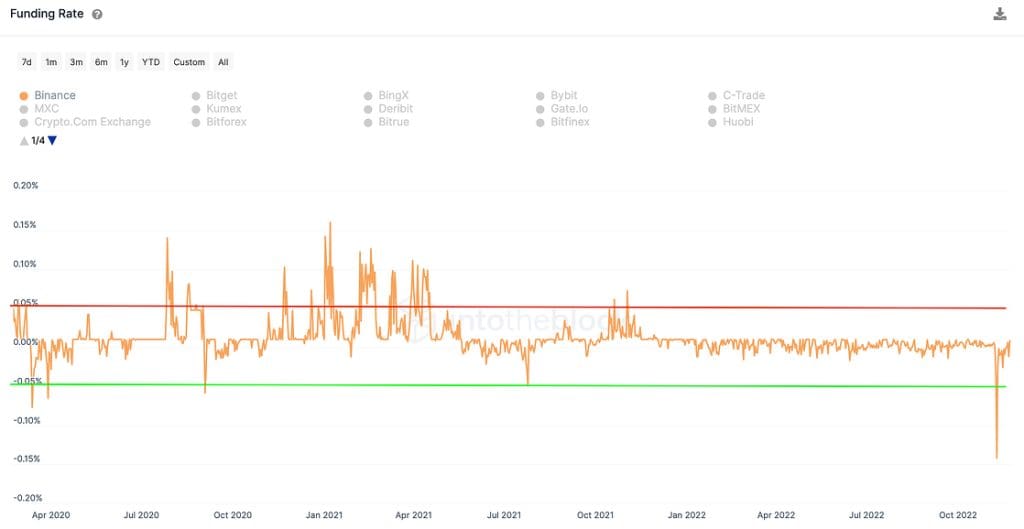

March 2020 and May 2021 are historical periods where futures were backward and aligned with BTC bottoms. If history repeats, similar trends could be observed with highly negative funding rates.

Funding rates below -0.05% and above 0.05% suggest traders are accumulating to push the price in one direction. For those who need more clarification about the market’s demand, the funding rate is charged to long holders when it is positive, and the perpetual swaps price is above the spot price.

A funding rate of 0.05% translates to an annualized cost of 54% of the position’s value. Funding rates on Binance dropped to -0.14% in the aftermath of the FTX collapse. This was the lowest in the platform’s history, indicating that there were more short positions than long ones in the market.

Meanwhile, Bitcoin is trading in its fourth consecutive bearish session, as shown on the daily chart below. BTC price has been oscillating within the $15,707 and $16,922 price range for the last few days. The appearance of a bullish divergence from the Relative Strength Index (RSI) suggests that the sell-off could soon run out of steam.

Recovery attempts may be stifled by supplier congestion between the $16,922 level and the intermediate resistance at $17,592. Rejection from this zone could push the price back into the range above, where BTC could stay for some time.

However, if bulls succeed in propelling the prize above the said resistance zone, it could signal that the downtrend has ended. The following line of resistance could emerge from the 50-day simple moving average (SMA) at $18,525 or the 100-day SMA at around $19,200, and if breached, the upward traction may reach the $20,000 psychological level.

Besides the derivative’s data, Bitcoin’s optimistic outlook is supported by an increasing number of addresses holding 1-10 BTC. The number of unique addresses having this amount of Bitcoins reached a record high in November at 800,000. This suggests that the holders of the largest cryptocurrency by market capitalization are taking advantage of the discounted prices to accumulate and increase their holdings to at least 1 BTC.

Conversely, the RSI is still positioned in the negative region at 40. This implies that BTC sellers are still more than buyers. Therefore, the price could turn down from the current price to break below the $15,707 support line, signaling the continuation of the downtrend. Further lower, the BTC price may drop toward the $13,500 demand zone.

Generally, the market remains murky following the SBF/FTX/Alameda debacle and its contagion effects. This has undoubtedly, led to bearish signals appearing in the derivatives market. Despite this, many Bitcoin holders see this as an opportunity to increase their BTC reserves, which is a bullish sign.