- Bitcoin drops to $101,645 amid $700M in crypto liquidations, with longs losing $484.85M.

- Ethereum slips to $2,432, contributing $45.49M to the liquidation tally.

- Bybit records the largest single liquidation – an $11M loss on the BTC/USD pair.

Bitcoin’s having a rough day – slipping to $101,645, down 2.79% in the last 24 hours. Ethereum’s not faring much better, dropping 2.9% to $2,432. The slide comes as a wave of liquidations hits the crypto derivatives market, wiping out $699.71 million in leveraged positions. Long traders got hit hardest, losing $484.85 million, while shorts accounted for $214.86 million.

Bitcoin and Ethereum Traders Take the Biggest Hits

Bitcoin traders took the brunt of the blow, with $80.02 million in liquidations, followed by Ethereum traders, who saw $45.49 million evaporate. The biggest single liquidation happened on Bybit’s BTC/USD pair, a staggering $11 million loss. And it wasn’t just Bitcoin and Ethereum – other tokens added $31.53 million to the liquidation tally.

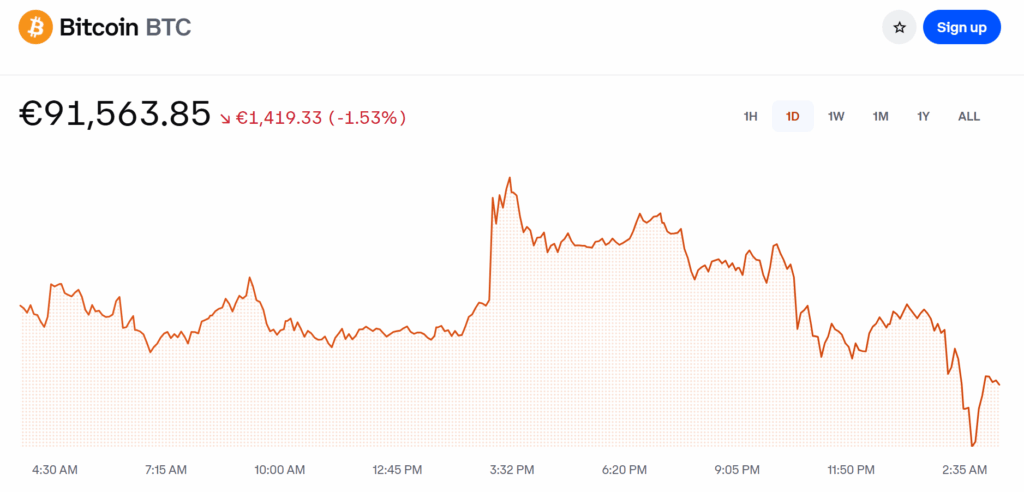

Price Action: BTC Struggles Near $105K Resistance

Looking at the charts, Bitcoin nosedived from a local high of $105,706 to a low of $100,764 before clawing back some ground.

The hourly candlestick chart shows heavy selling pressure, with red volume bars stacking up. That $105,000 resistance level? Yeah, it’s proving tough to crack.