- Bitcoin dropped to $92,000 amid Trump’s tariff announcements but rebounded to $99,000 after a temporary pause on some tariffs.

- Analysts expect Bitcoin’s price to peak between $180,000 and $250,000 as demand from long-term holders remains strong.

- Technical indicators suggest Bitcoin’s market top may occur around September–October 2025.

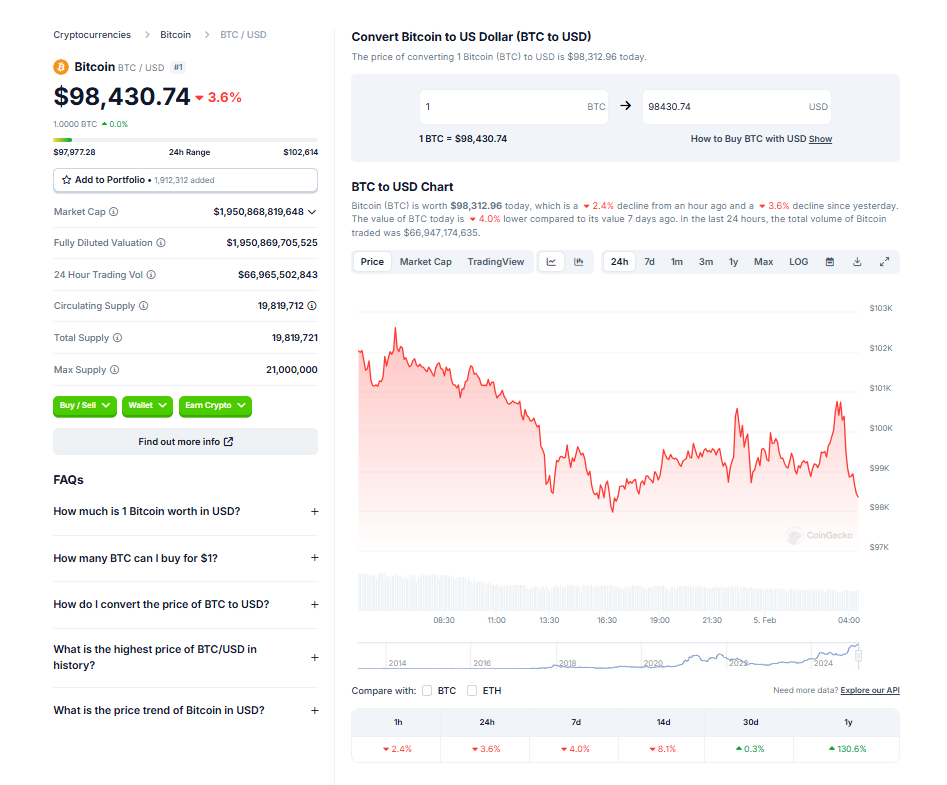

Bitcoin’s sharp decline to $92,000 on Feb. 3 rattled the market, triggering $2.1 billion in liquidations. Investors initially panicked due to U.S. President Donald Trump‘s tariff announcements but calmed somewhat after the pause on tariffs for Mexico and Canada, with Bitcoin rebounding to $99,000 by Monday. Still, questions linger—has the bull market peaked, or is there more upside ahead?

Market Sentiment and Fear vs. Greed

The Fear & Greed Index plunged to 44 (indicating fear) during the sell-off but rapidly recovered to 72 (greed) after news of Trump’s Crypto Czar David Sacks’ upcoming address. However, with retaliatory tariffs from China and ongoing macroeconomic uncertainty, some fear that traders may be walking into a bull trap.

Bitcoin demand remains resilient. Historical data shows that previous bull markets saw sharp corrections of around 25% before entering a euphoric final phase. Analysts suggest that if this pattern repeats, Bitcoin could see further gains.

Supply Metrics and Price Predictions

Glassnode data indicates that long-term holders have not yet sold off significantly, implying confidence in future price growth. Since November 2024, over 1 million BTC have been transferred to new buyers, but long-term investors still retain a large share of supply. Analysts like VanEck’s Matthew Sigel and Bitwise expect Bitcoin to peak between $180,000 and $200,000, with some predicting up to $250,000.

Timing the Market Top

Technical indicators such as the RSI and the Pi Cycle Top model offer insight into the potential timeline for Bitcoin’s peak. CryptoCon’s analysis suggests the top may occur between September and October 2025, while the Pi Cycle Top predicts a peak around Sept. 26, 2025. While no metric is foolproof, strong demand and market resilience point to the possibility that the true top has yet to arrive.