- $85,800 is shaping up as a key liquidity zone that could spark a breakout or a rejection in Bitcoin’s price.

- A narrowing perpetual-spot gap suggests bearish pressure might be fading slowly.

- Traders are watching volume and macro signals closely as BTC hovers near a major inflection point.

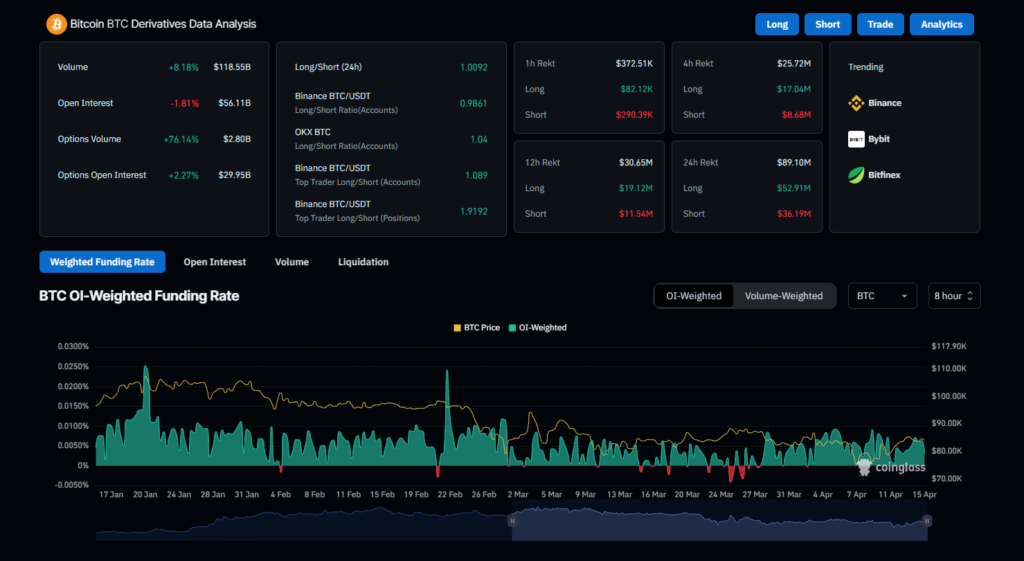

There’s a lot of noise swirling around Bitcoin right now, but one thing’s becoming crystal clear—$85,800 is the level to watch, according to data from CoinGlass.

Why does it matter so much? Well, there’s a big ol’ chunk of liquidity sitting around that price point. That usually means a ton of traders have set stop-losses or limit orders nearby—basically, a hotbed of potential price movement just waiting to get triggered.

So what happens next? It could go one of two ways. If Bitcoin charges through that level with strong volume behind it, we could see a breakout push prices higher. But if bears show up and slap the price back down, we might just get another sharp rejection and a short-term pullback. Either way, it’s a critical zone.

Oh, and CoinGlass also flagged something worth watching—a possible liquidity hunt. That’s when markets intentionally push into these high-liquidity areas to flush out leveraged positions (especially bullish ones). Their BTC Liquidation Heatmap is lighting up with some pretty spicy leverage levels.

What’s Bitcoin Actually Doing Right Now?

At the moment (as of writing), Bitcoin’s sitting at about $84,393, down around 0.48% over the past 24 hours. It dipped as low as $83K on Sunday, and traders seem to be all over the place emotionally—some are cautious, others are eyeing a run-up.

CryptoQuant threw in another piece of the puzzle: their Perpetual-Spot Gap metric. This tracks the difference between the futures price on Binance and the spot market price. Right now, the gap is negative—meaning there’s still selling pressure. But! That gap is starting to close a bit, which might mean the bearish vibes are cooling off.

TL;DR?

All eyes are on $85,800. Cross that line with conviction, and bulls might get the momentum they need. Get smacked down at that level? Expect more chop. As always, though, don’t forget the basics—watch volume, macro trends, and your own risk appetite before making any bold moves.