- Rising geopolitical tension is pushing investors toward Bitcoin alongside gold and silver.

- 21Shares sees Bitcoin increasingly viewed as a neutral reserve asset.

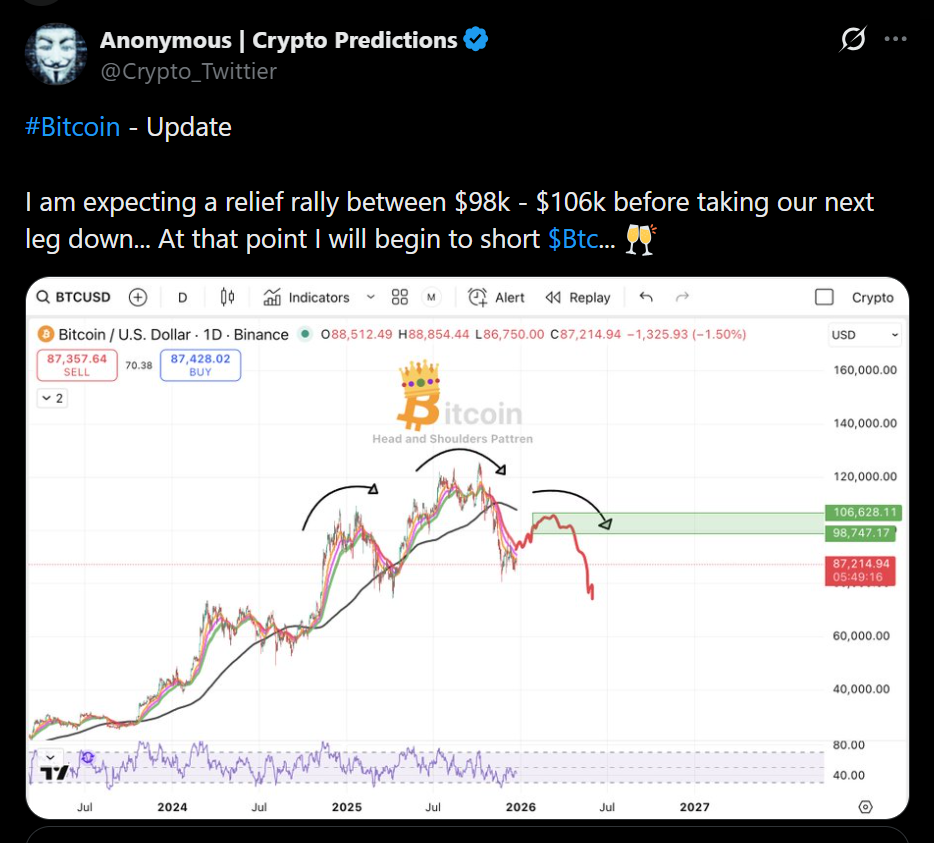

- Technical targets suggest BTC could grind toward the $96K–$106K range over time.

Rising geopolitical uncertainty is beginning to reshape global capital flows, and Bitcoin is increasingly part of that equation. As tensions escalate, dollar-denominated assets often lose appeal, while investors search for alternatives that sit outside traditional political influence. With the recent US–Venezuela conflict adding fuel to macro anxiety, a familiar pattern is reappearing. Capital is rotating into Bitcoin alongside gold and silver, not as a speculative bet, but as a hedge against instability.

Bitcoin Is Being Treated Like a Neutral Asset

That shift has been echoed by 21Shares strategist Matt Mena, who argues that geopolitical stress can actually strengthen assets like Bitcoin. According to Mena, Bitcoin is starting to behave more like a neutral reserve asset, existing in the same category as traditional safe havens. Following reports surrounding the US government’s capture of Venezuela’s president, investors appeared to move quickly into BTC, triggering a sharp rebound that reflected demand for assets untethered from sovereign risk. In moments of geopolitical chaos, neutrality becomes valuable, and Bitcoin is increasingly being priced that way.

Price Action Is Reinforcing the Narrative

Bitcoin’s response has been immediate. After dipping earlier, BTC surged to a seven-week high near $94,725 before consolidating just below $94,000. That kind of rebound, especially under macro stress, reinforces the idea that Bitcoin is no longer reacting purely as a high-risk trade. Historically, Bitcoin has avoided back-to-back annual declines, and after finishing last year down more than 6%, the odds now favor continuation rather than further downside. Price is acting like demand is structural, not emotional.

Near-Term Targets Are Expanding Higher

From a technical standpoint, expectations are also shifting upward. Crypto analyst Anonymous noted that while Bitcoin had been forming a head-and-shoulders pattern late in 2025, the structure now points toward a relief rally rather than immediate downside. His projected range places Bitcoin gradually moving between $96,000 and $106,000 over time. Even conservative interpretations suggest Bitcoin is building strength through consolidation, not exhaustion, as geopolitical uncertainty continues to support demand.

Why This Setup Favors Bitcoin

When risk assets sell off and Bitcoin rallies, that’s a message. It suggests BTC is being repriced as something more durable than a speculative trade. With geopolitical stress pushing investors toward assets that preserve purchasing power and resist political influence, Bitcoin’s role continues to evolve. The combination of macro tension, improving technical structure, and changing investor perception sets the stage for higher prices rather than a return to fear-driven selling.