• Bitcoin’s price surpassed $106,000 for the first time, fueled by optimism about its potential role as a U.S. reserve asset.

• President-elect Donald Trump announced plans to create a Bitcoin strategic reserve, similar to the U.S. Strategic Petroleum Reserve.

• Analysts predict Bitcoin could reach $500,000 by 2029 and $1 million by 2033 if it gains formal reserve status and regulated Bitcoin ETFs attract more traditional capital.

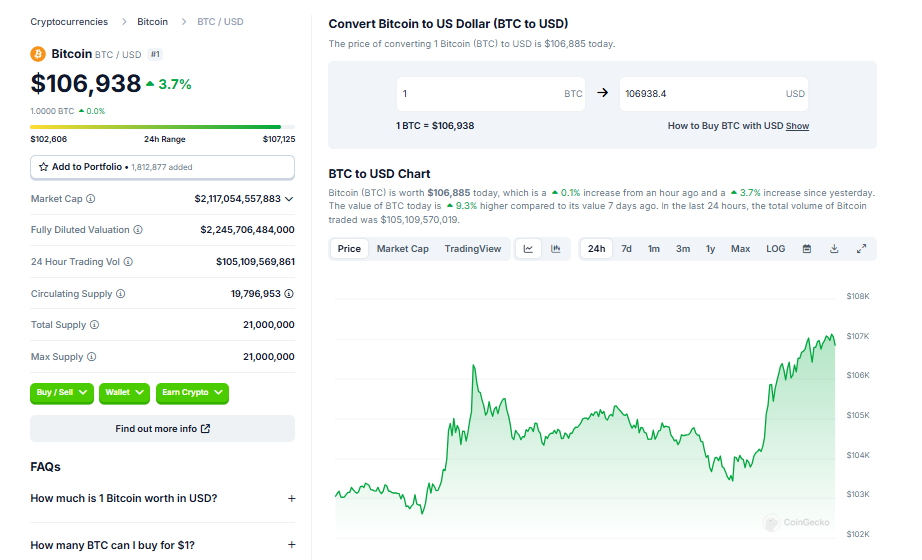

For the first time in history, Bitcoin has broken new ground by exceeding a price of $106,000. This striking achievement has been driven by growing optimism surrounding its potential role as a U.S. reserve asset. The significance of this milestone is further amplified by President-elect Donald Trump‘s recent declaration of creating a strategic reserve for Bitcoin, echoing the U.S. Strategic Petroleum Reserve.

The President’s Commitment to Bitcoin

In a recent interview with CNCB, Trump reiterated his administration’s commitment to setting up such a reserve, stating, “We’re going to do something great with crypto because we don’t want China or anybody else — not just China but others — embracing it ahead of us.” This statement has sparked a surge of enthusiasm around digital assets, extending beyond Bitcoin alone.

Increasing Interest in Crypto Exchange-Traded Products

Crypto exchange-traded products (ETPs) have experienced unprecedented inflows. Data from CoinShares reveals a staggering $3.2 billion flowed into these products last week alone, with Bitcoin accounting for over half of these investments across weekly, monthly, and yearly periods.

Analysts’ Predictions for Bitcoin’s Future

Arthur Hayes, co-founder of BitMEX, has forecasted that Bitcoin could potentially reach “hundreds of thousands of dollars, maybe $1 million” if it gains formal reserve status. Hayes expresses his belief that a reserve-backed Bitcoin system could trigger a surge of institutional and individual investors. In line with Hayes, Bernstein analysts Gautam Chhugani and Mahika Sapra envision Bitcoin hitting $500,000 by 2029 and $1 million by 2033. Their prediction is premised on regulated Bitcoin ETFs attracting more traditional capital to crypto markets.

The Debate Around Bitcoin as a Reserve Asset

However, not everyone is convinced about Bitcoin’s potential as a reserve asset. Critics highlight Bitcoin’s infamous volatility as a significant obstacle for its adoption in this role. They also argue that Bitcoin still lacks the stability traditionally associated with reserves like gold or U.S. Treasury bonds.

Bitcoin’s Mainstream Adoption

Despite these debates, the mainstream adoption of Bitcoin is undeniably accelerating. CoinShares reports that Bitcoin ETFs currently hold over $130 billion in assets globally, with last week’s inflows representing 40% of all Bitcoin inflows for the year.

Conclusion

The record-breaking price of Bitcoin, fueled by speculation of its potential reserve status, is indicative of the cryptocurrency’s growing influence in the financial world. As debates continue and adoption grows, the future of Bitcoin remains an intriguing watch.