- In the prolonged crypto winter, companies have had to make deep resolutions to survive

- While some companies have already succumbed, others are doing the most to salvage their operations, including selling their infrastructure

- Companies took on large amounts of debt at high-interest rates (10-20 percent) to finance expansion, and now the value of the coins they earn is insufficient to cover the costs of repayments.

The crypto sector has been impacted by the plunging Bitcoin (BTC) prices over the past year, which, coupled with skyrocketing energy costs and an increase in mining difficulty, has worsened the situation for miners.

Notably, the high cost of energy and increasing mining difficulty reflect the amount of computation power that goes to the Bitcoin network, thereby dictating the number of coins miners can achieve.

Many cryptocurrency mining companies have found themselves in the path of a perfect storm, including U.S.-based Marathon Digital Holdings, which is among the largest globally. According to the miner’s CEO Fred Thiel, “It is kind of a last-man-standing situation.”

While profit margins in the mining business surged 90% during the 2021 bull market, they have plunged to unprecedented lows, and if the BTC price fails to explode, miners will have to endure more challenging times. This means that companies that are currently barely surviving will eventually collapse.

A Case Of Who Can Survive Longer

Miners continue to play “a high-stakes game of chicken” as they struggle to reduce costs. The next Bitcoin halving is slated for spring 2024, featuring a mechanism within the Bitcoin system where half the coins awarded are periodically slashed. With every slashing, mining profits are also reduced. For miners, the objective is to ensure their financial position is strong enough to survive the reduced yields for the longest possible time. Eventually, some miners are bound to give in and exit the network, which means the share of coins the remnants win will increase. This makes it a case of who can survive longer. ‘

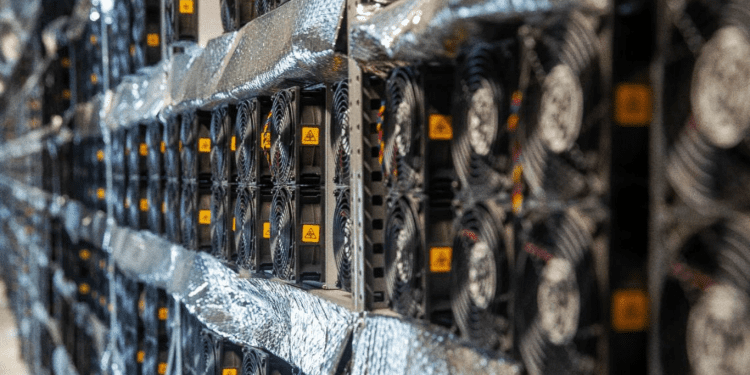

According to Foundry VP of business development Jeff Burkey, “Any miners struggling now will not be able to survive the halving.” Miners will increase their profit margin in every possible way, be it by using better hardware and cooling techniques or leveraging developing software to keep track of machine performance. The struggle to survive may even be so extreme that miners will relocate to regions where power is more affordable or negotiate for better loan terms.

For instance, Geosyn Mining is changing tact to embrace vertical integration. The company’s CEO, Caleb Ward, says he wants to develop his solar farm to power his company’s machines. Such a move would eliminate costs significantly. In Ward’s opinion:

“We need to be more thoughtful about how we protect against risk as an industry. It’s not all about shooting for the moon.”

Miners In Worse Financial Conditions Plating A Dangerous Game Of Waiting

Meanwhile, miners with financial challenges so tough that it prevents them from streamlining their operations are playing a dangerous waiting game as they gamble for an increase in BTC price that may take too long. Citing mining company Bitfarms CFO:

“The beauty of halving cycles is that the industry [is forced] to become more efficient—many weaker players will have to exit the business.”

Mining Companies Already Folding

Several mining companies have already begun to fold, including Compute North, which owned several large-scale mining facilities. The miner filed for bankruptcy in September, three months before publicly traded miner Core Scientific followed suit.

Others, like public company Argo Blockchain, are still trying to navigate the storm by selling off their mining equipment and tier-1 mining center. On the other hand, Stronghold Digital Mining has signed a debt repayment grace period.

In Sabre56’s CEO Phil Harvey’s opinion, however, “immaturity, poor planning, and greed” cause miners’ expected to collapse.” His comment comes after companies took large amounts of debt at interest rates as high as 10-20% to finance their expansion amid the hot market. Ultimately, more than the value of the coins they earn is needed to meet their repayment costs.