- Self-custody of Bitcoin has declined sharply since ETF approval in Jan 2024, with active addresses falling to levels last seen in 2019.

- Spot ETFs like BlackRock’s IBIT are seeing explosive growth, offering compliance and ease—but at the cost of decentralization.

- Over 250 institutions now hold BTC, signaling mainstream adoption while quietly shifting Bitcoin further from its original ethos.

Ever since the big green light for spot Bitcoin ETFs in January 2024, something’s shifted. Quietly but steadily, self-custody—once a pillar of crypto ideology—has been slipping. Onchain data shows the number of users holding their own BTC is shrinking, and the numbers aren’t subtle.

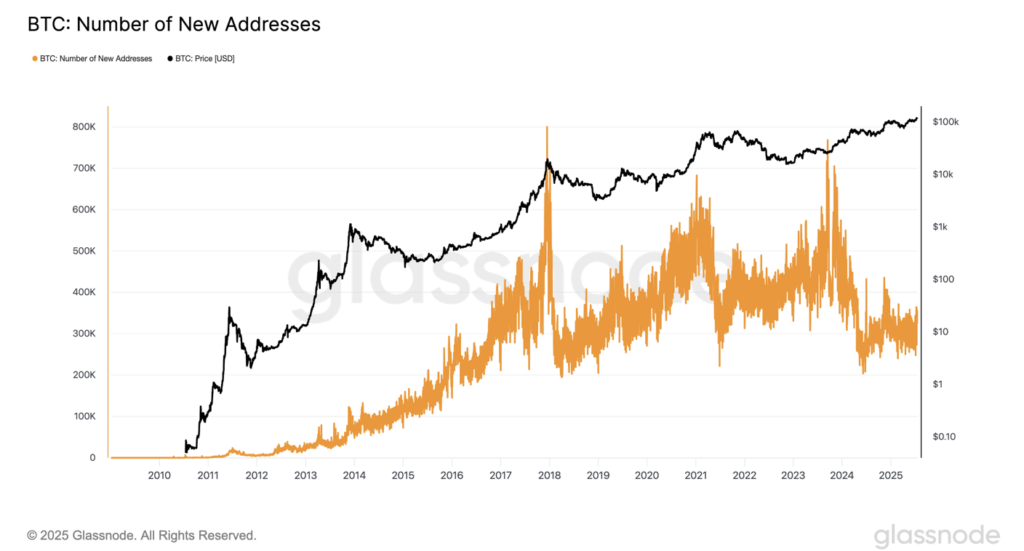

New Bitcoin addresses? Slowing down big time. Active wallets? Dropped from nearly a million at the start of the year to around 650k by late June. That’s territory we haven’t seen since 2019. And it might not be a fluke.

“Since spot ETFs became available the growth rate of self-custody users has been in decline,” analyst Willy Woo said on X. It’s not just one stat—it’s a behavioral shift. Fewer people are using private wallets. More are turning to institutional options. ETFs, mostly.

ETFs: Convenience, Compliance… But at What Cost?

The arrival of ETFs from giants like BlackRock, Fidelity, and Grayscale brought a wave of “mainstream” money into Bitcoin. These funds offer a simple way in—no keys to manage, no exchanges to fuss over, no risk of forgetting your seed phrase.

And people flocked. Really fast.

In just 18 months, net inflows into Bitcoin spot ETFs hit around $50 billion. BlackRock’s IBIT alone exploded to $83 billion AUM by July 18, 2025—after just 200 trading days. It now holds more than 700,000 BTC. That’s wild. For context, that’s nearly 100,000 more than Fidelity’s fund.

Bloomberg’s Eric Balchunas pointed out that IBIT became the fastest ETF ever to reach $80B in assets. The old record? Took Vanguard’s VOO over 1,800 days. Yeah, big difference.

But here’s where it gets a little thorny. Some in the community feel like Bitcoin is, well, losing its roots. Self-custody—“not your keys, not your coins”—has always been core to Satoshi’s idea. With ETFs, you don’t really own the asset. You just kinda have exposure to it.

One user on X put it bluntly: “ETFs didn’t steal users from cold storage… They opened the market to those who were locked behind compliance walls.” True, maybe. But it still feels like a trade-off.

Bitcoin Treasuries Add to the Institutional Avalanche

It’s not just ETFs. Corporate treasuries are jumping on the Bitcoin train too. What started with bold moves from Strategy and Tesla is now more of a movement than a novelty.

By the end of Q2 2025, 125 public companies had Bitcoin on their balance sheets—up 58% from Q1. Altogether, over 250 entities (from ETFs to pension funds) are holding BTC in some form. It’s becoming more normal than niche.

These treasury companies let investors sidestep the whole wallet and private key mess. They offer exposure without the stress. It’s easier, sure, but again—it’s not self-custody.

So while all this growth is bullish on the surface, there’s a deeper question echoing across the crypto world: is Bitcoin becoming just another asset class? Or can it still be something more—something radical, personal, sovereign?