- Bitcoin ETFs pulled in $442 million on April 24, marking five straight days of inflows with BlackRock’s IBIT leading the charge.

- Ether ETFs rebounded with $63.49 million in net inflows, mostly driven by BlackRock’s ETHA.

- Total crypto ETF assets neared $110 billion, showing strong investor appetite across both Bitcoin and Ethereum.

Money’s still pouring into crypto ETFs like it’s going outta style. On Thursday, April 24, U.S. spot bitcoin ETFs snagged $442 million in net inflows, keeping the hot streak alive for the fifth day in a row.

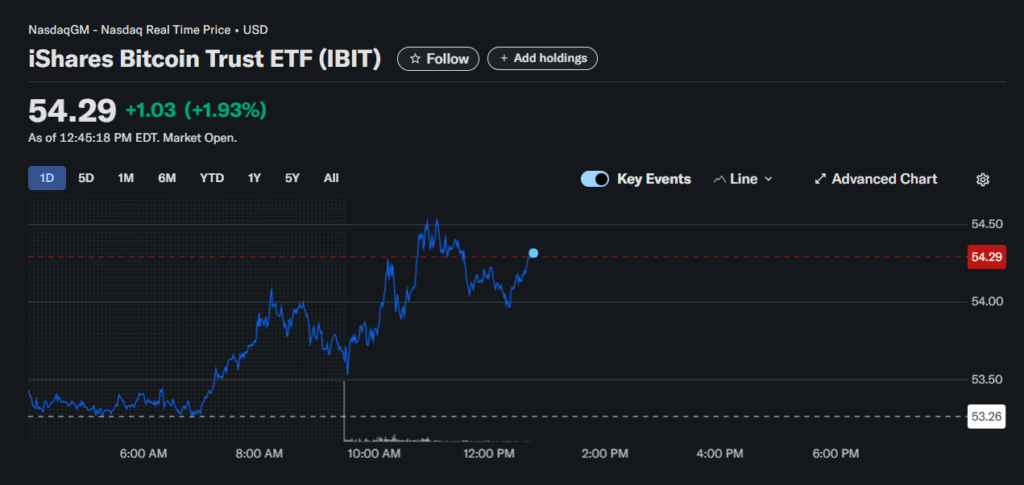

Once again, BlackRock’s IBIT gobbled up most of the action—$327.32 million worth. Ark’s ARKB wasn’t far behind with $97.02 million. Bitwise’s BITB and Invesco’s BTCO also got a slice, pulling in $10.18 million and $7.48 million each. Not a single bitcoin ETF saw an outflow—yeah, zero.

Total trading hit $2.03 billion, with net assets creeping up to $106.97 billion. That $110B milestone? It’s knocking on the door now.

Ether ETFs Are Back in the Game Too

Ether funds also bounced back after a bit of a dip the day before, scoring $63.49 million in net inflows. BlackRock’s ETHA led the charge with $40.03 million. Grayscale’s ETH ETF brought in $18.28 million, while Bitwise, 21Shares, and VanEck tossed in $5.06M, $4.14M, and $2.58M, respectively.

Only one outflow happened—Grayscale’s ETHE lost $6.6 million. But overall, trading volume for ether ETFs came in at $300.99 million, and total assets are still holding around $5.92 billion.

So yeah—between the big bitcoin inflows and ether ETF bounce-back, it’s lookin’ like accumulation mode is back in full swing.