- Bitcoin retreated below $87,000 after recent all-time highs near $90,000, facing increased selling pressure.

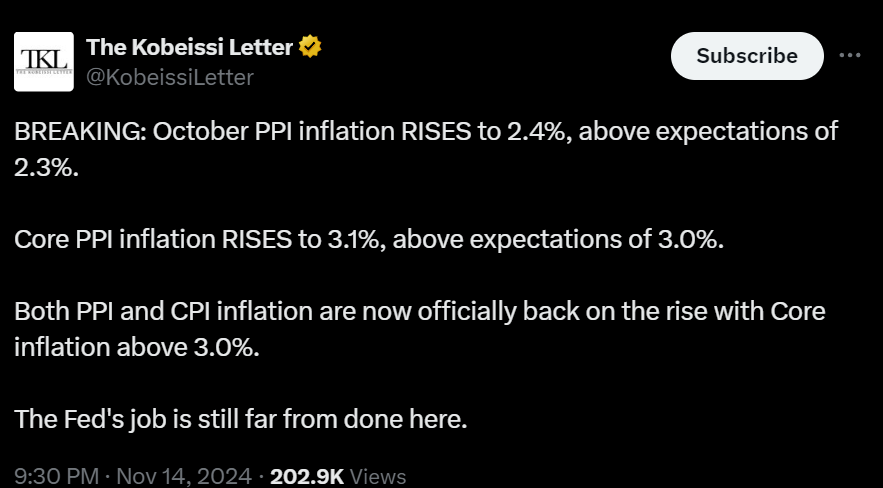

- US Producer Price Index data for October showed inflationary forces rising, affecting market sentiment and rate cut expectations.

- Analysts suggest Bitcoin could hit $100,000 by Thanksgiving if key support levels hold.

Bitcoin prices experienced a pullback on November 15, falling below $87,000 following new all-time highs earlier in the week. Market consolidation replaced the rally as the cryptocurrency navigated mixed signals from U.S. inflation data.

The October Producer Price Index (PPI) came in at 2.4%, slightly exceeding expectations, according to the Bureau of Labor Statistics. Analysts expressed concern over the potential implications for Federal Reserve policy, noting the inflationary trend could limit the likelihood of further interest rate cuts.

Source: The Kobeissi Letter

Inflation Sparks Stagflation Worries

Market observers noted a shift in rate cut expectations following the PPI data release. CME Group’s FedWatch Tool showed a decrease in the probability of a December rate cut, dropping from 82% to 58%.

Commentators, including The Kobeissi Letter, highlighted the growing risk of stagflation, a challenging economic condition marked by stagnant growth and rising inflation. Analysts warned the Federal Reserve faces a dilemma: raising rates could deepen a recession, while cutting rates risks fueling inflation further.

Key Support Levels Eyed as Market Awaits Next Move

Traders identified $87,000 as a critical support level for Bitcoin. Skew, a market analyst, noted an “aggressive seller” attempting to push prices lower, while Keith Alan of Material Indicators emphasized the importance of maintaining support near $86,000.

Alan suggested a healthy retest of support could strengthen momentum, setting the stage for Bitcoin to approach $100,000, possibly by Thanksgiving. However, he cautioned that losing support at key levels could drive prices toward the $75,000 range.

Bitcoin’s ability to hold its recent gains will likely shape market sentiment as investors balance bullish expectations with evolving macroeconomic challenges.