- Bitcoin is on track to close May above $102,400, which would mark its highest monthly close ever.

- A golden cross and strong compression patterns hint at a possible breakout past the $110K all-time high.

- Over $3 billion in short liquidations could be triggered if BTC rallies further, adding fuel to the bullish momentum.

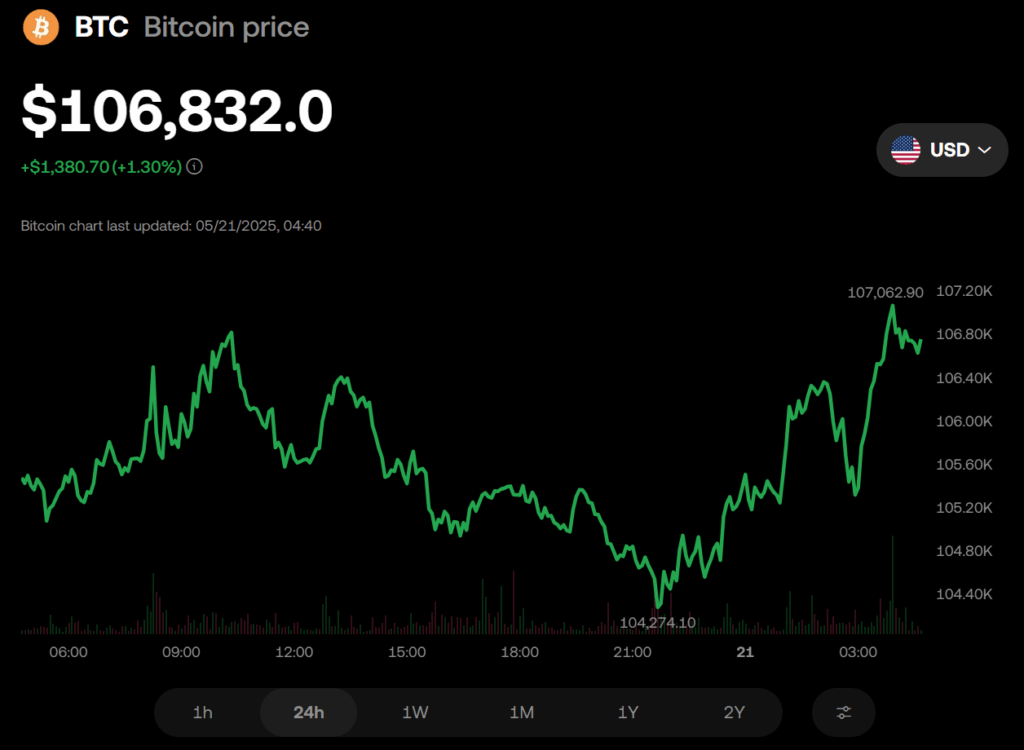

Bitcoin’s bullish run isn’t slowing down just yet. With the price sitting around $106,595 and just 11 days left in May, the asset is inching closer to what could be its highest monthly candle close ever. The current record to beat? $102,400. If BTC holds its momentum, this could be a big moment—possibly a signal that the market is ready to step into full-blown price discovery mode.

Price Discovery and the Golden Cross

Crypto trader Jelle pointed out that Bitcoin is hovering just beneath its all-time high of $110,000. If it breaks through that ceiling, BTC would enter price discovery—basically a fancy way of saying “we’ve never been here before.” In such a phase, buyers and sellers find new footing in a range where no historical data exists. At the same time, analysts are eyeing a golden cross forming on Bitcoin’s daily chart, a pattern that usually precedes strong gains—historically anywhere from 45% to 60%.

Strongest May Since 2019?

If Bitcoin manages to close the month near $110,000, that’s a 15% to 17% gain in May alone. Not too shabby, especially considering the average return for May hovers around 8%. A move like this would make May 2025 Bitcoin’s strongest May since 2019, giving bulls even more to celebrate and potentially attracting more FOMO-driven retail money.

Compression Signals and Liquidation Pressure

Analysts like Axel Adler Jr. have flagged a familiar compression pattern forming—basically a tightening price range that often precedes breakouts. This mirrors what we saw back in 2017, right before BTC rocketed from $1,000 to $20,000. Adding to the tension, if Bitcoin climbs just a few thousand dollars higher to $110,000, it could trigger $3 billion in short liquidations. That kind of pressure could create a sharp rally. By contrast, to liquidate the same amount of longs, BTC would need to fall below $94,612—a much steeper climb down.

Momentum Feels Upward… For Now

All signs seem to point to upward momentum. The compression, golden cross, institutional interest, and looming liquidation wall on the short side all combine to paint a pretty bullish picture. That said, in crypto, nothing’s ever certain. But if May closes out with Bitcoin near or above $110K, we could be witnessing the opening act of a new leg up in the bull cycle.