- Rising demand for store-of-value assets and currency concerns fuel Bitcoin’s long-term value debate

- Bitwise’s Matt Hougan suggests Bitcoin could reach $200,000, spurred by fiat devaluation

- Geopolitical tensions and economic uncertainty contribute to increased interest in Bitcoin and gold

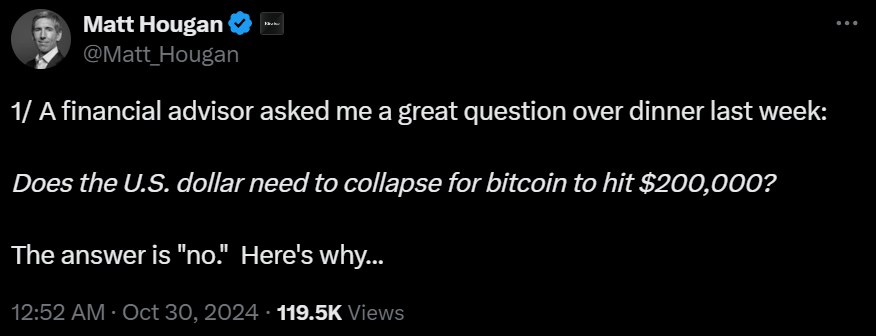

Increasing interest in alternative store-of-value assets, like Bitcoin, may drive a significant price rise, according to Matt Hougan, chief investment officer at Bitwise Asset Management. Hougan recently noted that while a dollar collapse is unnecessary, ongoing devaluation of fiat currencies may encourage investors to seek assets that hold or grow in value over time, with Bitcoin being a primary candidate.

Source: Matt Hougan on X

On October 29, Hougan addressed the possibility of Bitcoin reaching $200,000, emphasizing that investors betting on Bitcoin are making two concurrent assumptions. The first is Bitcoin’s potential to solidify its status as a store of value. The second is that government control over fiat currency could lead to continued depreciation of those currencies, resulting in more demand for hard assets like Bitcoin.

Bitcoin’s Value Growth Potential

Currently, Bitcoin’s market cap stands at around $1.4 trillion, representing 7-8% of gold’s $18 trillion market capitalization. Hougan suggested that Bitcoin could mature to capture a larger portion of the value attributed to gold, with a potential valuation for a single Bitcoin nearing $400,000 if it captures about half of gold’s market.

Should Bitcoin maintain its 7% share relative to gold but see a tripling in demand, each Bitcoin could be valued at $200,000. This projection assumes that Bitcoin’s acceptance as a store of value continues to grow alongside economic shifts.

Economic Uncertainty and Market Sentiment

The discussion comes amid escalating economic concerns and geopolitical tensions, including rising gold prices, which hit a new peak of $2,778 per ounce on October 29. A report by Financial Sense suggested that the United States may integrate dollar devaluation into its industrial strategy to stay competitive globally, particularly against economies like China’s.

Economists have argued for a US industrial policy that supports new technologies and shields industries from subsidized competition, which could also indirectly influence the dollar’s value. Such shifts, coupled with investor sentiment, have contributed to the belief that Bitcoin could achieve unprecedented highs in the coming years.