- Massive Expiry Incoming: $13.8B in Bitcoin options expire May 30, with bulls aiming to push BTC above $110K to maximize profits.

- Call Dominance: Most puts sit below $109K; calls heavily outweigh puts above current price levels, favoring bulls by up to $4.7B.

- ETF Support & Risks: $1.9B in ETF inflows boost bullish sentiment, but macro factors like tariff tensions could still swing momentum.

Bitcoin (BTC) is gearing up for its biggest monthly options expiry of 2025 — with total exposure climbing to $13.8 billion. And yeah, bulls are watching this one closely. After a strong 25% run over the last month, they’ve got a shot at locking in prices above $110,000.

Options Market at a Turning Point

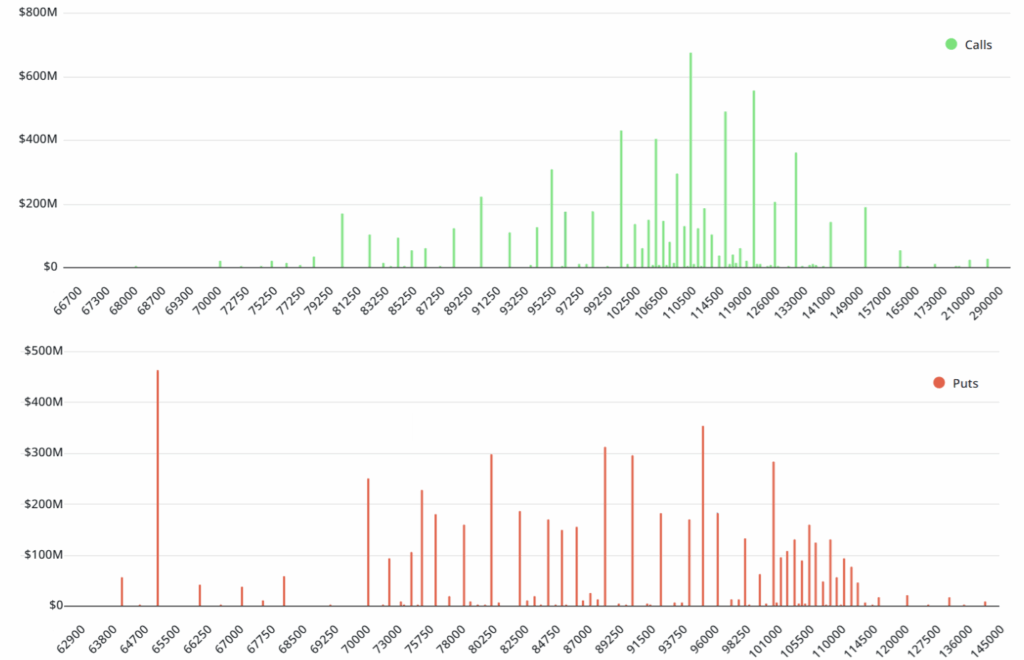

According to Laevitas, there’s about $6.5 billion in put (sell) options open — but here’s the kicker: 95% of those are below $109,000. If BTC stays where it is (or pushes higher), most of those puts will expire worthless. That leaves less than $350 million in play.

On the flip side, there’s $3.8 billion in call (buy) options up to $109,000. But not all of that is bullish. Some traders might’ve sold those calls to hedge exposure or collect premium — it’s not always a moon bet.

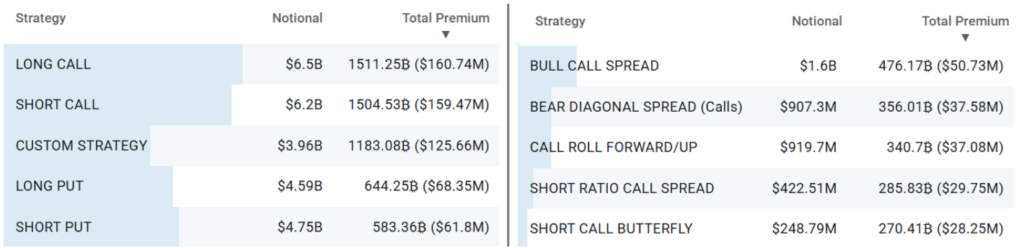

Strategy Breakdown

Some of the most active strategies recently on Deribit include “short calls” — used by folks looking to earn income if BTC stays put. Then there’s the “bull call spread,” which caps profits but also reduces downside risk. Either way, positioning’s heating up.

ETF Inflows Add More Fuel

Bulls are also getting backup from ETFs. Between May 20 and 22, U.S. spot Bitcoin ETFs saw $1.9 billion in net inflows. That’s a big confidence boost, especially with BTC trading above $105,000.

Still, bears aren’t out of the game. There’s $79 billion in open interest on Bitcoin futures, much of it tied to short positions. If BTC pops above $110k, though, those shorts could get squeezed hard.

May 30: All Eyes on $110K

Here’s a rough breakdown of potential expiry outcomes:

- $102K–$105K: $2.75B in calls vs $900M in puts → Net gain for bulls: $1.85B

- $105K–$107K: $3.3B calls vs $650M puts → Bulls ahead by $2.65B

- $107K–$110K: $3.7B calls vs $350M puts → $3.35B advantage

- $110K–$114K: $4.8B calls vs $120M puts → $4.7B in favor of bulls

Bottom line? If bulls can push BTC above $110K by May 30, they’re in for a serious payday. That could even open the door for a new all-time high. But a lot rides on macro stuff too — like the ongoing tariff drama. One headline could change the game fast.