- Bitcoin hit a new all-time high of $109,458, marking seven straight green weekly candles.

- Analysts are eyeing targets between $135K and $320K, citing bullish patterns and Elliott Wave signals.

- Experts warn of liquidation risks as BTC heatmaps show rising leverage and possible bull traps.

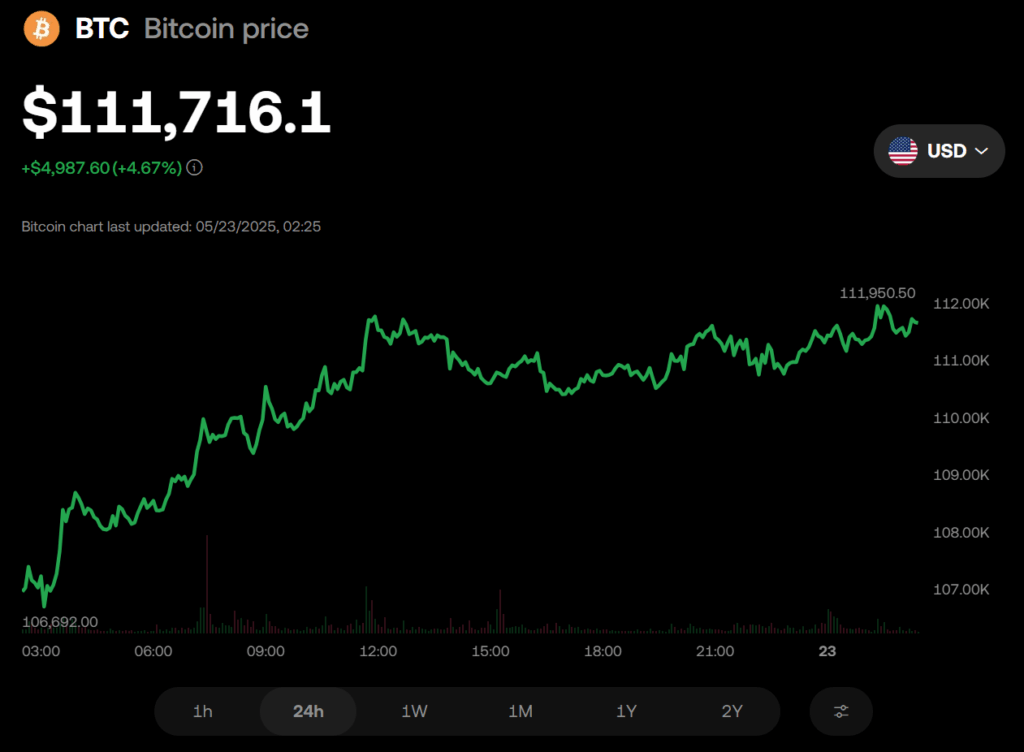

Bitcoin just did it again. On May 21, BTC smashed through another all-time high, clocking in at $109,458 on Binance. That’s now seven green weekly candles in a row, all the way from its swing low around $74,500. Pretty wild ride. If it closes this week (May 25) above $106,500? That’ll be the longest streak of weekly gains since back in October 2023.

And it’s not just price. Market cap? Blasted through $2.17 trillion. Realized cap? $911.5 billion. Glassnode flagged both as fresh record highs. Bitcoin isn’t just making headlines—it’s making history all over again.

Bullish Targets? Let’s Talk $135K (or Higher…)

With momentum heating up, analysts aren’t exactly being shy with their price targets. Titan of Crypto—yeah, that guy—says $135,000 is still very much “in play” for 2025. His chart uses the ol’ Fibonacci extension trick, and that 1.618 level is flashing a target somewhere between $135K and $140K. Could be a stretch, but hey, so was $100K once upon a time.

Veteran trader Peter Brandt chimed in, too. He shrugged off the ATH as “not technically significant” in a bull market. Fair point. “Bull markets make ATHs all the time,” he said, throwing out a more modest—but still hefty—range: $125K to $150K… maybe by end of August?

Then there’s Gert van Lagen—he’s thinking bigger. A lot bigger. Like $300K to $320K. Why? His analysis points to BTC breaking out of a 4-year bullish megaphone pattern. Those widening trendlines? They’re suggesting a massive rally ahead. According to Elliott Wave Theory, Bitcoin’s cruising into Wave 5 of an impulse cycle. That could mean another 170% to 190% surge. Yeah, it’s bold—but not impossible.

But Not So Fast… Risk Still Lurks

While all this optimism flies around, a few folks are still flashing the caution sign. João Wedson, CEO of Alphractal, says investors should cool it a bit. His concern? The market’s headed into high-leverage zones, according to BTC heatmaps. And that usually means one thing: the sharks are circling. Market makers could use this euphoric spike to flush out overconfident bulls—or even bait the bears.

Wedson put it simply: don’t get greedy. “Manage your risk,” he said. New highs are exciting, sure—but that’s when traps get set. You don’t want to be the guy celebrating at $110K, only to get wiped out by a whipsaw liquidation a day later.