- Bitcoin’s bounce above $90K faded as sentiment normalized from fear to neutral.

- Santiment data suggests the move was driven by short covering, not strong buying.

- Price structure for BTC and ETH points to consolidation rather than a confirmed recovery.

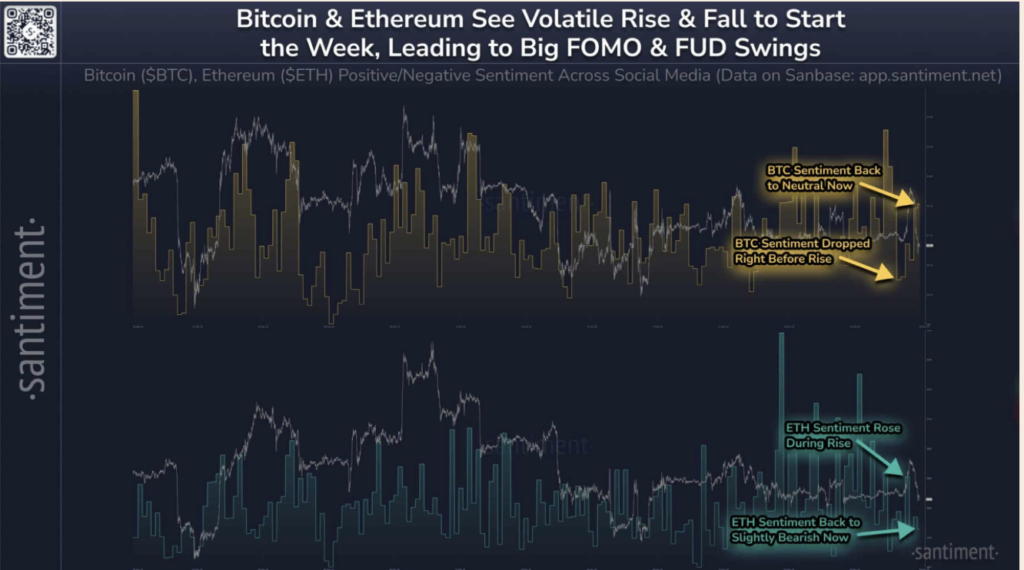

Bitcoin’s push back above $90,000 after the Christmas weekend didn’t last long. Price has since slipped under $87,000, right as market mood shifted from outright fear to something closer to cautious neutrality. The timing isn’t random. Data from Santiment shows that the bounce lined up almost perfectly with a spike in negative social sentiment, a setup that often sparks short-term, contrarian moves.

This time, though, the follow-through never showed up. As fear cooled and sentiment normalized, buying interest didn’t expand. Instead of building momentum, the rally stalled, and price drifted into consolidation. It felt more like a reflex than a real turn.

Sentiment Moved First, Price Didn’t Follow

Santiment’s data highlights a pattern traders have seen before. Bitcoin rallied while fear, uncertainty, and doubt dominated social channels, then lost steam once sentiment stabilized. That suggests the move was driven more by short covering and tactical positioning than by fresh conviction buying.

Crucially, sentiment never flipped bullish. It simply flattened out. Traders didn’t pile in, they stepped back. That hesitation has left Bitcoin without a clear catalyst to push higher. Ethereum followed a similar path, just with a slight delay. ETH sentiment improved during the bounce and briefly outperformed Bitcoin, but that optimism has since faded as price failed to reclaim key resistance levels.

Charts Point to Compression, Not a Comeback

The 12-hour Bitcoin chart reinforces what sentiment is already hinting at. Price remains locked inside a broader downtrend, defined by lower highs and repeated rejections at descending resistance. Recent action has compressed into a tightening range around the mid-$80,000 area, a classic sign of indecision.

Every attempt to break higher has run into sellers. Supply is still active, even if downside momentum has slowed. Ethereum’s structure looks much the same. ETH has stabilized above recent lows near $2,930, but recovery attempts continue to stall beneath declining resistance. There’s no clean trend shift, just sideways pressure.

From Reflex Rally to Waiting Game

What stands out most in this setup is the lack of escalation. Fear spiked, price bounced, but volume and sentiment never expanded enough to support continuation. Instead, the market seems to be shifting from reactive positioning into a wait-and-see phase.

Historically, sustained recoveries tend to form when improving sentiment is backed by clear structural breakouts. That alignment isn’t here yet. At the same time, the absence of renewed panic selling suggests the market isn’t sliding into capitulation either. Bitcoin and Ethereum are stuck in that uncomfortable middle zone, supported enough to avoid sharp drops, but capped by overhead supply and hesitant participation.

What This Setup Suggests Next

With sentiment neutral and price compressed, the market likely needs an external catalyst or a fresh wave of positioning to break the range. Until then, short-term volatility may continue without a clear direction, chopping up both sides.

For now, the post-holiday move serves as a reminder. Fear can spark quick bounces, but without conviction, those moves tend to fade into consolidation, not turn into trends.