- AVAX has broken above the $20 mark, gaining 15% in the past month, but faces strong resistance between $25.46 and $32.68 where over 1.3 million addresses are holding at a loss.

- On-chain data and technicals show mixed signals: while AVAX broke out of a falling channel and above the Ichimoku Cloud (a bullish sign), the Awesome Oscillator is flashing red bars, hinting at fading momentum.

- Price outlook is uncertain: If momentum stalls, AVAX could fall back to $14.68; if bulls regain strength, a move toward $30.42 is possible. Key zone to watch: $25–$33.

Avalanche (AVAX) has finally cracked back above the $20 mark — after several failed attempts earlier this month. It’s up roughly 15% over the past 30 days, which, yeah, sounds promising. But before you strap in for a moon mission, it’s worth asking: can it really hold the line?

There’s a bit of mixed sentiment swirling around, and some on-chain clues suggest AVAX might be gearing up for a struggle at higher levels.

A Sell Wall Is Lurking Overhead

At the time of writing, AVAX is hovering around $22. Not bad, right? But according to IntoTheBlock’s Global In/Out of Money (GIOM) data, things get a little sticky once we approach $25 and above.

Basically, the GIOM shows how many holders are in profit, breaking even, or underwater. And right now, there’s a sizable chunk of addresses — like, 1.3 million of ‘em — sitting on AVAX bags bought between $25.46 and $32.68. That’s about 20.65 million AVAX waiting to dump the moment they break even.

So, what’s that mean? Well, unless a fresh wave of buyers floods in, AVAX could hit a serious resistance wall between $25 and $33. This crowd is just waiting for a chance to exit break-even, which could keep the lid on any major rally — at least for now.

Price Forecast: Caution Ahead?

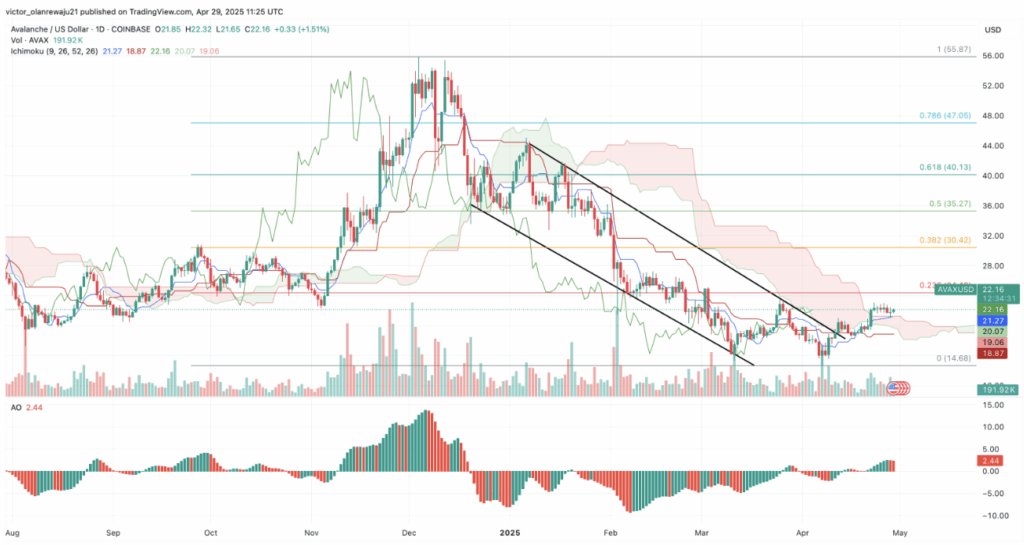

Technically speaking, AVAX just broke out of a falling channel — which is great, no doubt. It also jumped above the Ichimoku Cloud, another decent bullish signal. But, and it’s a big but, the Awesome Oscillator (AO) is starting to throw out red flags.

The AO is still positive, which says there’s some bullish energy left. But the red bars creeping in? Not a great sign. It hints that momentum’s cooling off a bit.

If this fading trend keeps up, AVAX could dip back below $20 — and in a worst-case (or super bearish) scenario, it might slide down to around $14.68. Yeah… not ideal.

That said, if momentum does return — and let’s face it, crypto likes to surprise — the bulls could take another shot. A full-on surge might push AVAX toward $30.42, which lines up with the 0.382 Fibonacci level. It’s ambitious, sure, but not out of reach.

Final Thoughts

AVAX has broken the $20 ceiling, which is a solid move, but now it’s got to prove it can stay there. With a looming sell wall up ahead and mixed momentum signals, traders should tread carefully. Watch that $25–$32 range closely — it could be the battlefield where bulls and bears really go at it.

Still, if the volume kicks up and sentiment shifts, we could see AVAX claw its way back to the $30 zone. Just… don’t bet the farm on it — yet.