- AVAX leads all chains with $32.92M in 24-hour net inflows, signaling rising investor demand as it nears a critical technical breakout zone.

- Price is testing the $18.60–$19 resistance range, with analysts watching for confirmation of a move toward the $25–$30 level.

- ETF speculation for 2025 is building, potentially setting the stage for major institutional adoption and long-term price growth.

Avalanche (AVAX) is making serious noise in a cautious crypto market, logging the highest net inflows across all chains over the past 24 hours. With $32.92 million flowing into its ecosystem, Avalanche is showing clear signs of renewed interest—just as it approaches a key technical resistance zone. While many tokens remain flat or declining, AVAX is quietly building momentum that could set it up for a major breakout.

On-Chain Data Shows Strong Accumulation

The $32.92M in net inflows isn’t just a statistical bump—it places AVAX at the top of the leaderboard among all tracked chains. That level of activity, especially in a low-volatility market, hints that investors are positioning early for a potential move. Historically, AVAX has seen similar surges during market uncertainty, but the scale and timing of this round suggest something bigger may be in play.

Price Action Targets $19 Breakout

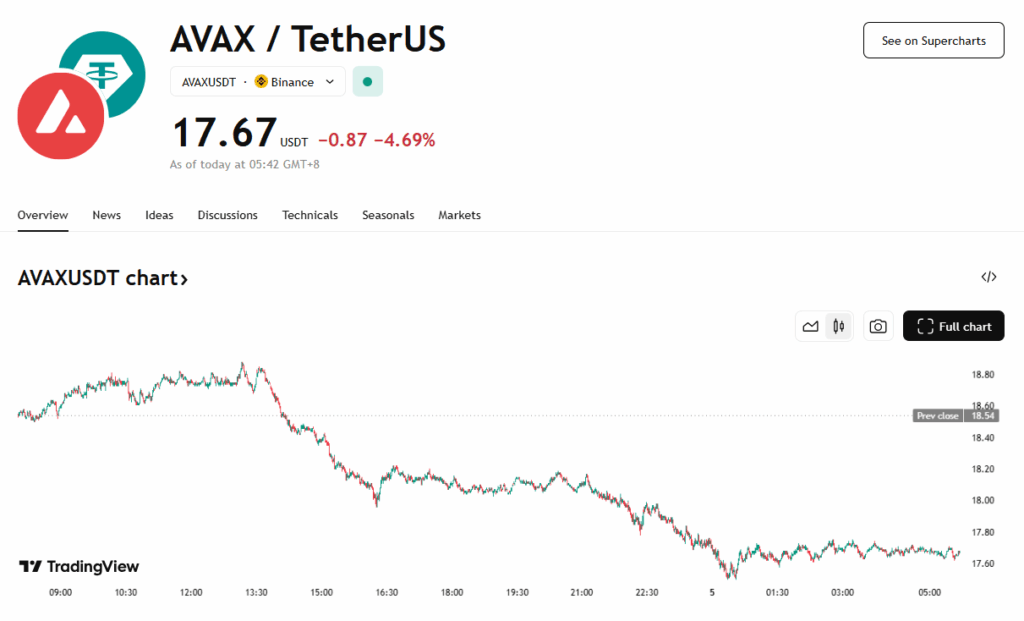

Technically, AVAX is still trading within a falling channel, with a major resistance band between $18.60 and $19. This zone has rejected price multiple times over the past few weeks, making it the key level to flip. Analysts point to a short-term double-bottom forming near $17 and rising trading volume—both indicators of bullish strength. If AVAX clears the $19 mark, it could break out of the current downtrend and head toward $25 or even $30.

AVAX ETF Speculation Builds Steam

Fueling even more buzz is speculation around a potential spot AVAX ETF. While unconfirmed, crypto commentators like Steven9000 suggest that a 2025 launch isn’t out of the question. The impact of a spot ETF would be huge: legitimizing AVAX for institutional investors and reducing price volatility through more structured capital flows. As seen with Bitcoin and Ethereum, ETF inclusion tends to be a major catalyst for sustained price appreciation.

Final Thoughts

Avalanche is showing all the early ingredients of a major bullish setup—top inflows, a solid technical base, and a narrative that’s heating up fast. If AVAX clears the $19 resistance, it won’t just be a chart move—it could be the beginning of a larger shift fueled by ETF speculation and real capital inflows. The pieces are aligning; now it’s a matter of execution.

Ask ChatGPT