- Bitwise just filed for an Avalanche ETF, joining VanEck and Grayscale, sparking bullish sentiment.

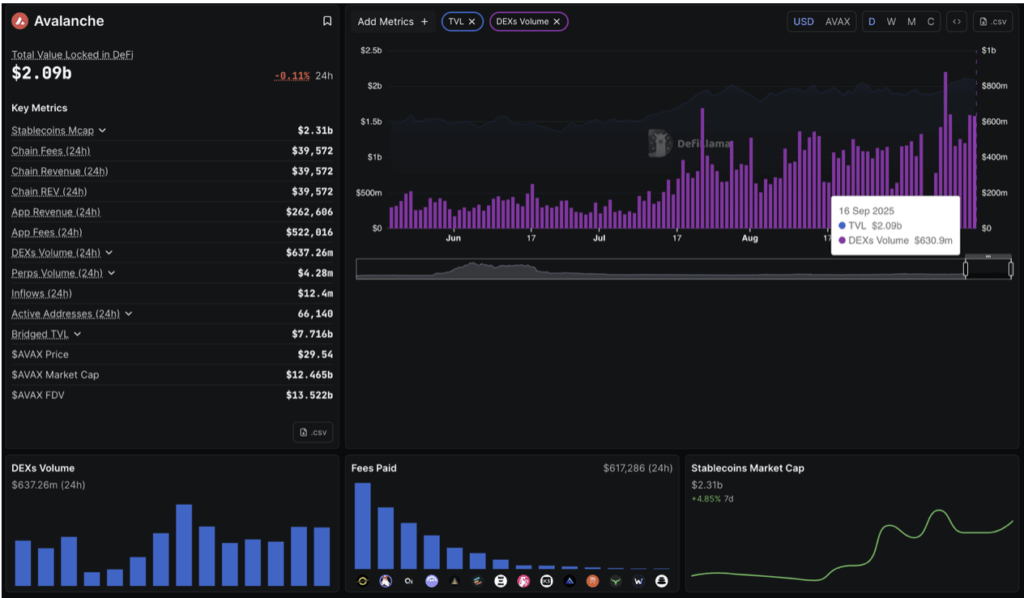

- Avalanche network activity is climbing, with TVL at $2.09B and stablecoin market cap up nearly 5%.

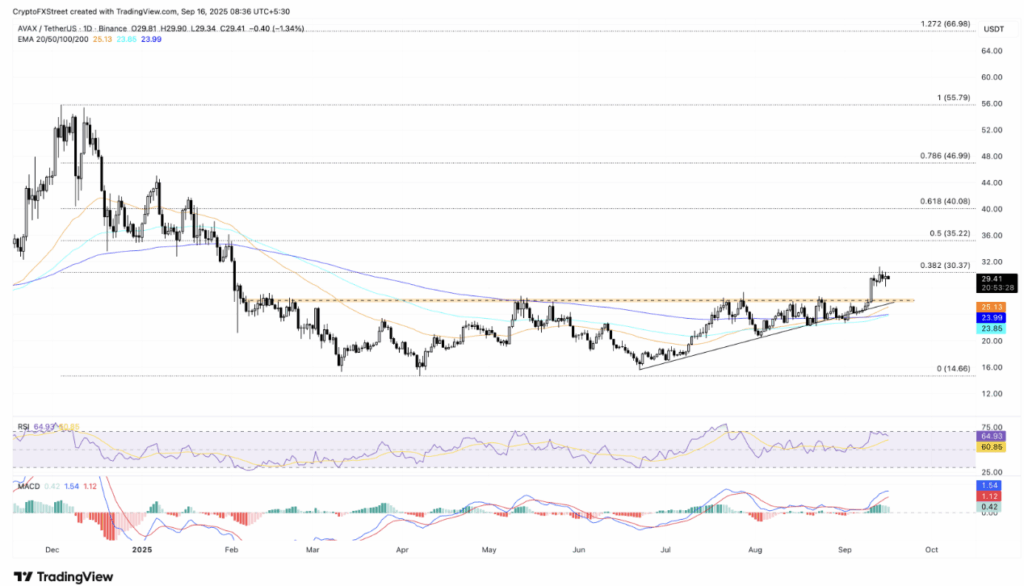

- AVAX must close above $30.37 to confirm a breakout, with $35.22 as the next upside target.

Avalanche (AVAX) has been hovering just under the $30 line, slipping about 1% on Tuesday. Price action looks indecisive, but the mood in the market is shifting thanks to a new ETF filing. Bitwise officially submitted its S-1 form with the U.S. SEC, aiming to launch an Avalanche ETF—an announcement that’s already got traders buzzing about a potential breakout. On-chain activity and technical charts are both flashing signs of optimism, giving bulls something to hold onto.

Avalanche ETF News: Bitwise Joins the Race for Approval

Bitwise is expanding its crypto ETF portfolio, and now Avalanche is in the mix. With this S-1 filing, Bitwise steps into the same ring as VanEck, 21Shares, and Grayscale—big names already positioning themselves for an AVAX-backed product. The reasoning is simple: U.S. investors have been piling into Bitcoin and Ethereum ETFs, so demand for an Avalanche fund could follow that same path. If approved, it might provide the spark that AVAX needs to sustain a breakout above stubborn resistance levels.

Avalanche Network Growth: TVL, DEX Volume, and Stablecoin Demand

Behind the charts, Avalanche’s ecosystem is alive and well. Data from DeFiLlama shows its Total Value Locked (TVL) climbed to $2.09 billion, up from $1.92 billion just a week earlier. Liquidity is moving back into the chain, and that’s not the only metric turning higher.

DEX volumes have now stayed above $2 billion for eight straight weeks, pointing to sticky trading activity across Avalanche protocols. Meanwhile, stablecoin market cap on the network has risen nearly 5% to $2.31 billion. More liquidity and more active users usually translate into one thing—stronger demand for AVAX tokens over time.

AVAX Price Prediction: Can Avalanche Break the $30 Resistance?

For now, the key level sits around $30.37, which happens to line up with the 38.2% Fibonacci retracement level from December’s $55.79 high down to April’s $14.66 low. AVAX has knocked on this door a few times but hasn’t closed above it, leaving traders cautious. If it finally does, technical projections point toward the $35.22 level as the next upside checkpoint.

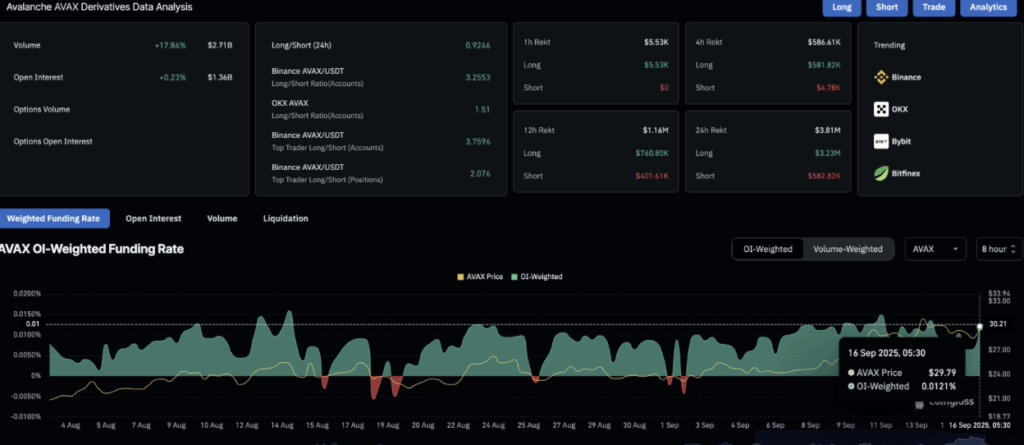

Open Interest data adds to the case for strength. CoinGlass shows OI has edged up to $1.36 billion, reflecting more capital moving into futures markets. The funding rate has also doubled, jumping to 0.0121% from 0.0064% just a day ago, meaning bulls are paying a premium to keep long positions open.

Momentum indicators lean bullish as well, but not without caveats. The daily RSI has cooled off to 64, out of the overbought zone but still firmly above neutral. The MACD is also above its signal line, keeping the trend tilted to the upside.

Avalanche Price Outlook: Support and Risk Levels to Watch

Of course, pullbacks are always possible in this type of setup. If AVAX can’t hold above $30, then eyes will shift lower toward the 50-day EMA around $25.13. That area could act as a safety net before bulls regroup.

For now, the picture is mixed but leaning positive: strong ecosystem growth, institutional ETF interest, and bullish technicals all working in Avalanche’s favor. The only missing piece? A clean breakout above $30 to prove the move has legs.