- Bitwise updated its Avalanche ETF filing with staking features and industry-low 0.34% fees, aiming for a Q1 2026 launch.

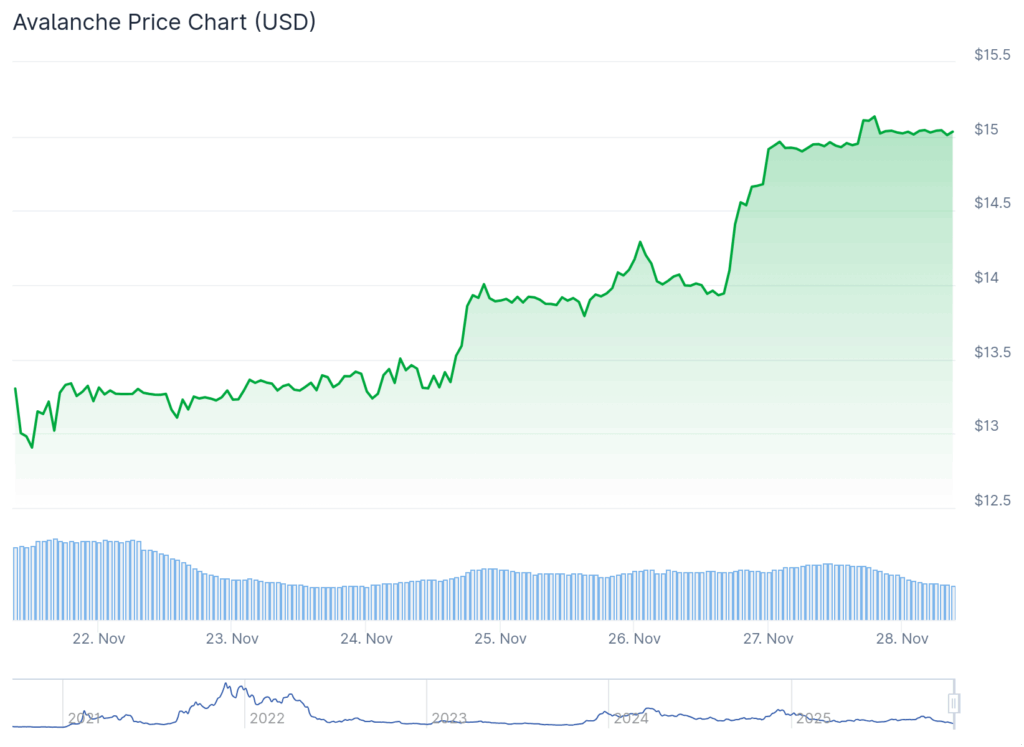

- AVAX jumped nearly 7% to $15 after the filing, though it still sits below major resistance at $18.

- The proposed BAVA ETF would be the first in the U.S. to stake up to 70% of its AVAX holdings, giving it a major edge over VanEck and Grayscale.

Bitwise stirred the market once again after updating its Avalanche ETF filing, a move that instantly sent AVAX climbing almost 7% toward the $15 range. The revised submission, delivered to the SEC on November 27, lays out a structure that feels unusually aggressive for a U.S. crypto ETF — mainly because it leans directly into staking, something competitors have avoided despite growing interest from institutions. While these changes don’t guarantee approval, the update makes it clear Bitwise wants to be first in line when regulators finally green-light a staking-enabled ETF.

Bitwise’s BAVA ETF Introduces Staking and Under-Cuts Competitors

The ETF will trade under the ticker BAVA on NYSE Arca if approved, and Bitwise is making sure the economics look tempting from the start. Its management fee lands at 0.34%, noticeably cheaper than VanEck’s 0.40% and Grayscale’s heavier 0.50%. Beneath the surface, though, the real disruption is the fund’s ability to stake up to 70% of its AVAX holdings — something no other proposed U.S. ETF has attempted. Recent IRS guidance helped clear the fog around yield-generating assets, and Bitwise seems eager to take advantage before anyone else steps in.

The fund keeps 12% of staking rewards as part of its operating expenses, letting the rest pass directly to shareholders. VanEck and Grayscale don’t offer staking in their filings, meaning Bitwise is betting that yield will pull interest during the early phase of competition. Notably, Bitwise plans to seed the ETF with 100,000 shares at $25 each, worth $2.5 million, essentially putting its own capital on the line to reinforce confidence.

Custody, Fees, and New Safeguards Ahead of Launch

To get the foundation right, Coinbase Custody Trust Company will secure the AVAX holdings, while BNY Mellon takes care of the cash side. The updated filing also comes with heavier disclosures, including references to quantum-computing risks, exchange vulnerabilities, and an expanded liquidity reserve aimed at avoiding disruptions in volatile markets. As an incentive, Bitwise will waive all fees for the first month or until the ETF hits $500 million in assets — a strategy that mirrors its earlier launches tied to XRP and Dogecoin.

Market Reaction: AVAX Pops but Still Faces Technical Obstacles

The market didn’t hesitate to respond. AVAX jumped around 7% the moment the filing hit the wire, lifting the token toward $15 with a market cap now hovering around $6.41 billion. Even with the move, AVAX still sits below its 50-day moving average near $18 — a level traders see as a crucial momentum trigger. A clean break above that zone could open targets near $22, and possibly even $28 if volume kicks in. If sellers regain control, however, the $14 support area becomes important; a breakdown there could drag the token back to the $12 range.

Regulatory Path: Q1 2026 Shaping Up as Avalanche’s Big Moment

Bitwise isn’t alone in this race. VanEck and Grayscale are both pushing for their own Avalanche ETFs, with NASDAQ lined up as their preferred listing venue. All three issuers appear to be aiming for Q1 2026 approvals, although nothing is guaranteed given current regulatory pacing. The updated Bitwise filing relies on the CME CF Avalanche-Dollar Reference Rate as its benchmark, which should give investors a clean and transparent read on AVAX’s underlying price throughout the ETF’s lifecycle.