• Ark Invest bought $18 million worth of Coinbase (COIN) shares during a market slump on Monday

• The firm also purchased $11.2 million worth of Robinhood (HOOD) stock

• Ark offloaded shares in Block (SQ) and Ethereum Futures ETFs during the same period

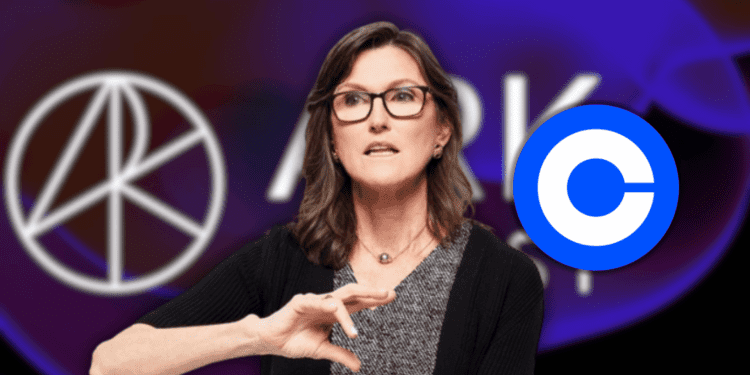

Ark Invest, the investment firm led by Cathie Wood, bought $18 million worth of Coinbase stock on Monday as prices plunged across crypto markets.

Ark Invest Buys $18 Million in Coinbase

Ark Invest purchased 93,797 Coinbase shares worth $18 million across three exchange-traded funds amid the broad market selloff.

According to the company’s latest trade filing, Ark bought 65,165 shares ($12.3 million) for its Innovation ETF (ARKK), 13,003 shares ($2.5 million) for its Next Generation Internet ETF (ARKW), and 15,629 shares ($3 million) for its Fintech Innovation ETF (ARKF).

This is the first time Ark has rebought Coinbase shares since acquiring $21 million worth in June 2023. Coinbase’s subsequent 250%+ rise led Ark to sell off its position numerous times.

Ark’s strategy involves limiting individual holdings to 10% of any ETF to maintain diversification. This means Ark will likely continue rebalancing if Coinbase rises or falls significantly.

Monday saw Ark take advantage of volatility around recession fears and geopolitics. Coinbase fell 7.3% to $18.97, its lowest since February, reducing year-to-date gains from over 75% to just 9.5%.

Purchases of Robinhood, Sales of Block and Ethereum ETFs

Ark also bought 681,885 shares in Robinhood worth $11.2 million as the stock fell 8.2%. However, Ark sold Block shares worth $2.6 million and $34 million worth of ProShares’ Ethereum ETF as crypto prices retreated.

Bitcoin dropped below $50,000 briefly while ether lost all 2022 gains, falling below $2,200. Both have recovered slightly, with Bitcoin at $55,156 and Ether at $2,460. The GMCI 30 rose 8.7% over 24 hours to 10,584.