- Arizona Governor Katie Hobbs blocked a bill to ban taxes on crypto mining activities and blockchain node operations

- The vetoed bill’s definition of blockchain technology was considered too broad

- Governor Hobbs remains open to finding innovative solutions to support the state’s economy

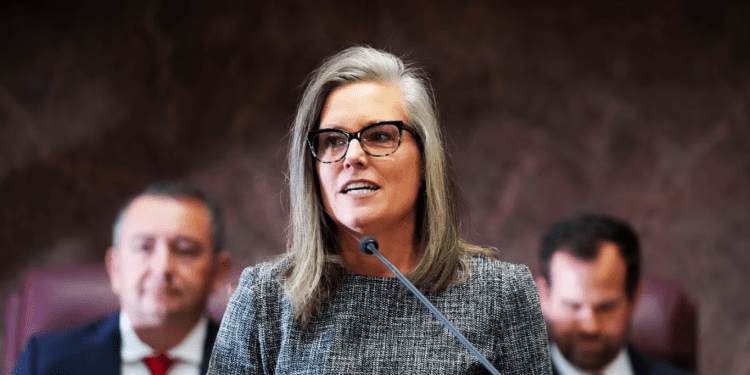

Arizona Governor Katie Hobbs has blocked a bill to ban taxes on crypto mining activities and blockchain node operations. This bill, SB 1236, also aimed to prevent local governments from imposing restrictions or prohibitions on running a blockchain node for crypto mining activities.

The Governor vetoed the bill because she felt its definition of blockchain technology was too broad and could hinder policymaking in this “energy-intensive economic activity.” Despite this, Governor Hobbs expressed openness to collaborating with the Legislature to find innovative solutions that support the state’s flourishing economy while engaging with the local stakeholders to develop such solutions.

Last January, Senate members Wendy Rogers, Sonny Borrelli, and Justine Wadsack introduced a bill, SB 1240, that proposes the introduction of property tax exemptions for crypto. The Senate has approved this bill, and it is now under review by the House.

Best and Worst States for Crypto

Recent studies have analyzed which US states are friendliest to the crypto industry and which are more taxing.

Currently, the crypto-friendly ones include Wyoming, Texas, Colorado, and Arizona.

Wyoming, in particular, has emerged as an attractive destination for crypto investors and businesses because it exempted them from money transmission licenses.

Additionally, the state has launched a Financial Technology Sandbox and introduced crypto banks for servicing the crypto sector. Moreover, Wyoming has no state income tax. Other US states that have put forward similar friendly crypto policies include Florida and Texas, with zero state income tax.

Colorado recently launched a program to accept state tax payments via cryptocurrency. However, this state does have a state income tax, while capital gains are not taxed.

Arizona currently has tax-free airdrops, while miners receive 10-year tax discounts and sales tax credits in Texas.

Meanwhile, according to studies, the most authoritarian states for crypto businesses include Hawaii, New York, and California. In particular, New York, with some of the highest state taxes in the USA, mandates that crypto businesses operating in the state register for a costly BitLicense with strict privacy policies. Hawaii also requires companies dealing in virtual assets to have fiat reserves backing the value of all digital assets. In contrast, Hawaii and California have some of the highest state taxes in the US.

Despite a lack of uniform regulation and taxation for the crypto industry within the US, multiple states are stepping up and spearheading policies favorable to the burgeoning sector in the US.