- APT fell 2.4% while the broader crypto market moved higher.

- Heavy volume rejection confirmed strong resistance near $1.75.

- Price is consolidating near $1.69 with bearish technical signals intact.

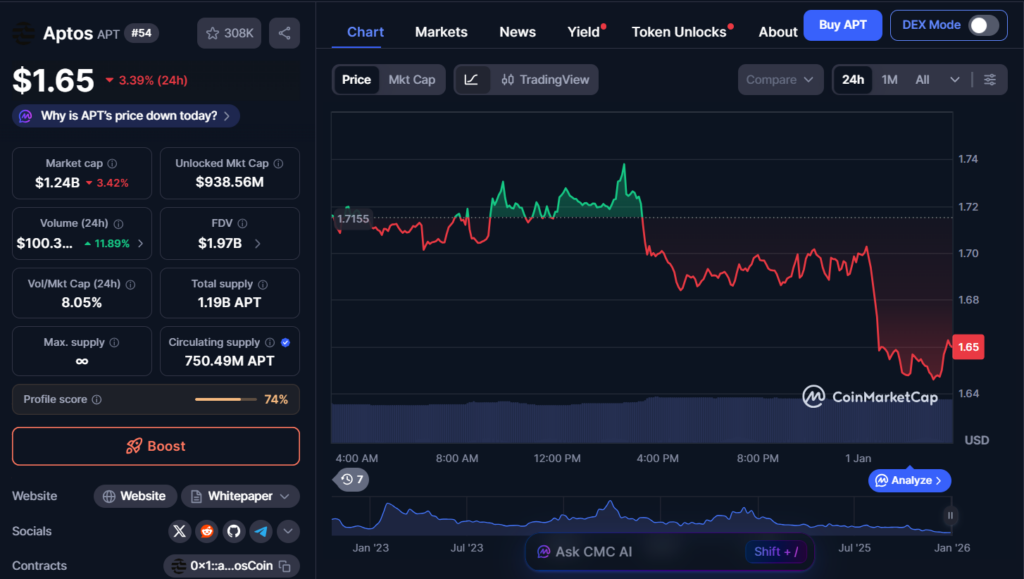

Aptos (APT) moved against the broader crypto market on Tuesday, slipping 2.4% to trade near $1.69 while major assets pushed higher. The CoinDesk 20 index was up roughly 0.5% at the time of writing, making APT’s underperformance stand out. Trading activity remained muted, pointing to selective caution rather than broad risk-off behavior.

Weak Relative Performance Signals Investor Hesitation

According to CoinDesk Research’s technical analysis model, APT declined from $1.73 to $1.69 over the last 24 hours, forming a volatile but contained range. While overall market sentiment leaned positive, capital flow into APT appeared restrained. This divergence suggests investors may be rotating elsewhere rather than adding exposure to Aptos at current levels.

Volume data reinforced that view. Although 24-hour trading volume was about 31% above the seven-day average, it failed to reach levels typically associated with strong accumulation or panic selling.

Heavy Volume Rejection Confirms Key Resistance

The most notable activity occurred earlier in the session, when APT saw a sudden spike of 12.2 million tokens traded, more than double its 24-hour moving average. That burst of volume coincided with a sharp rejection near $1.75, firmly establishing the zone as major resistance.

Following the rejection, price action compressed into a tight consolidation channel. Momentum slowed as volume normalized, signaling that neither buyers nor sellers were willing to aggressively push the next move.

Key Levels to Watch Going Forward

Short-term support has formed around the $1.68–$1.69 psychological zone, which has held through multiple tests. On the upside, immediate resistance sits near $1.70–$1.705, while the broader range high at $1.75 remains the major hurdle. A sustained break above that level would require renewed volume and a shift in sentiment.

For now, technical indicators continue flashing bearish signals across multiple timeframes. Until stronger demand appears, APT may remain range-bound while traders look for clearer direction.