- Aptos is partnering with Trump-linked WLFI to launch the USD1 stablecoin on Oct. 6, with immediate DeFi and exchange support.

- The network is targeting Ethereum and Tron’s stablecoin dominance, already processing $60B in monthly volume.

- New products like “Decibel” DEX and “Shelby” storage aim to strengthen Aptos’ position in the coming years.

Layer-1 blockchain Aptos has stepped into the spotlight again, this time announcing a partnership with the Trump family–linked World Liberty Financial (WLFI) to roll out its USD1 stablecoin.

Aptos co-founder and CEO Avery Ching revealed that discussions with WLFI had been ongoing for some time, noting that the project “sees us as some of the best tech partners they could work with.” Speaking at the TOKEN 2049 conference in Singapore, Ching explained that WLFI is building products not just for retail but also banking and broader financial use cases. The first milestone, he said, is launching a stablecoin where yield flows back to users.

USD1 is scheduled to go live on Aptos Network on October 6, complete with ecosystem-wide support. Liquidity pools, rewards, and incentives will be integrated across key Aptos DeFi platforms such as Thala, Hyperion, Echelon, and Tapp. Major wallets and exchanges including Backpack, OKX, Petra, Bitget Wallet, Nightly, OneKey, and Gate Wallet are also lined up to support the launch.

Ching highlighted Aptos’ efficiency as the deciding factor, calling it “incredibly cheap” at less than a hundredth of a cent per transaction and “way faster than any blockchain out there” with sub–half-second processing times.

Targeting Tron’s Stablecoin Dominance

Aptos’ strategy is clear: chip away at the dominance of Ethereum and Tron in the stablecoin game. Earlier this year, Tether (USDT) launched on Aptos and quickly saw “tremendous growth,” according to Ching. Currently, Aptos hosts $1.3 billion in Tether, though that’s still tiny compared to Tron’s $78.6 billion and Ethereum’s $94.8 billion in circulation.

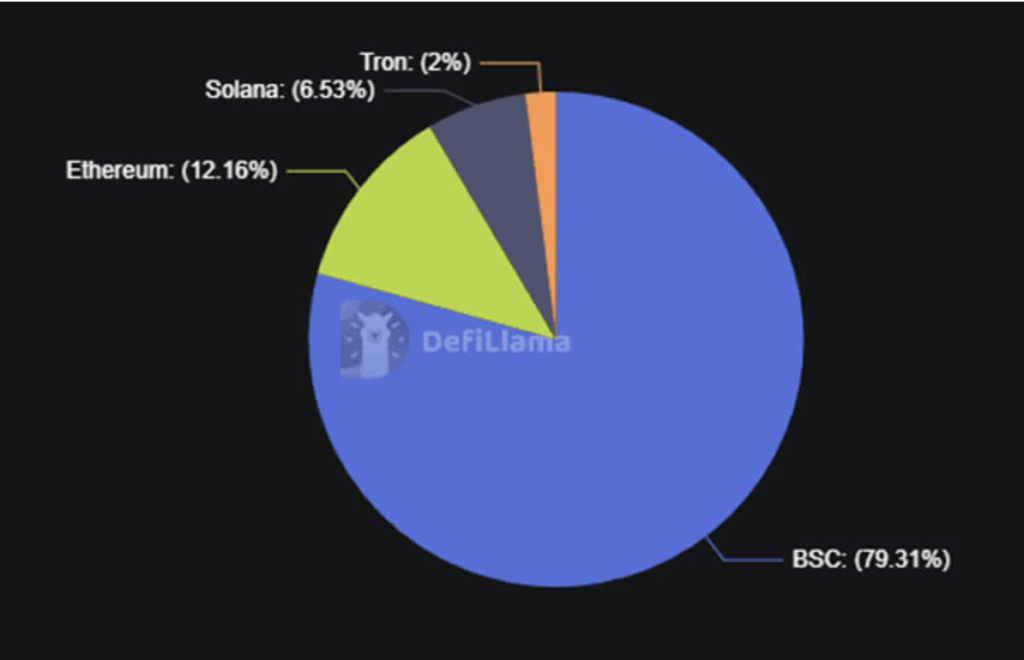

For context, USD1’s market cap sits at $2.68 billion, with most of that still on BNB Chain, per DefiLlama. Aptos hopes this new partnership will help draw more liquidity onto its own chain.

Growing Market Share, New Ambitions

Despite only holding about 0.35% of the overall stablecoin market share (RWA.xyz data), Aptos has quietly been building momentum. Alongside USDT and USD1, Aptos already runs other stablecoins like USDC, Ethena USD (USDE), and PayPal’s PYUSD, processing over $60 billion in monthly volume.

Ethereum remains king with around 59% of the stablecoin pie — or nearly 70% if you include L2s and other EVM-compatible chains. Still, Aptos is betting that efficiency and speed will carve out a niche, especially for institutional use cases.

Aptos’ New Projects on the Horizon

Beyond stablecoins, Aptos is cooking up more products. Ching introduced “Decibel,” a decentralized exchange focused on stablecoins, spot trading, and perpetuals, with testnet expected this month and a full mainnet release before year’s end.

He also teased “Shelby,” a decentralized storage system being built with Jump Crypto, aimed at handling real-time social apps and AI training data. Shelby is slated for launch in 2026.

It’s worth noting that Ching was previously the head of Meta’s Diem crypto project. Since then, Aptos has attracted heavy backing from major names like Andreessen Horowitz, Apollo, Franklin Templeton, Circle Ventures — and even FTX Ventures before its collapse.