- Smart contract deployments and DEX volume are rising while price stays flat—classic stealth accumulation signs.

- $92M flowed into Aptos DeFi in under a week, lifting TVL to $1.365B.

- User activity is back, with MAU and transactions both hitting multi-month highs—setting the stage for a potential breakout.

Aptos (APT) hasn’t exactly been exciting to watch lately. Price action’s been dragging—slow, sideways, and unable to break past the $0.48 wall. It’s the kind of chart that makes you shrug and scroll on. But hold up—there might be more going on here than meets the eye.

Some behind-the-scenes indicators suggest a shift might be coming. More devs are building. Liquidity’s flowing in. And APT? It’s quietly getting busier.

Devs Are Back—Smart Contracts Hit 30-Day High

According to Nansen, smart contract activity on Aptos just spiked hard. In the past 24 hours alone, over 1,200 contracts were deployed—that’s the highest one-day total in a whole month. Not bad for a chain people said was quiet.

Why does this matter? Because when devs start shipping code again, it usually means something’s coming. New tools, fresh apps, whatever—it often leads to more usage. And more usage can mean, yep, more demand for the token.

On-chain data backs this up. There’s been a visible bump in activity and—maybe more importantly—buying. People are scooping up APT again.

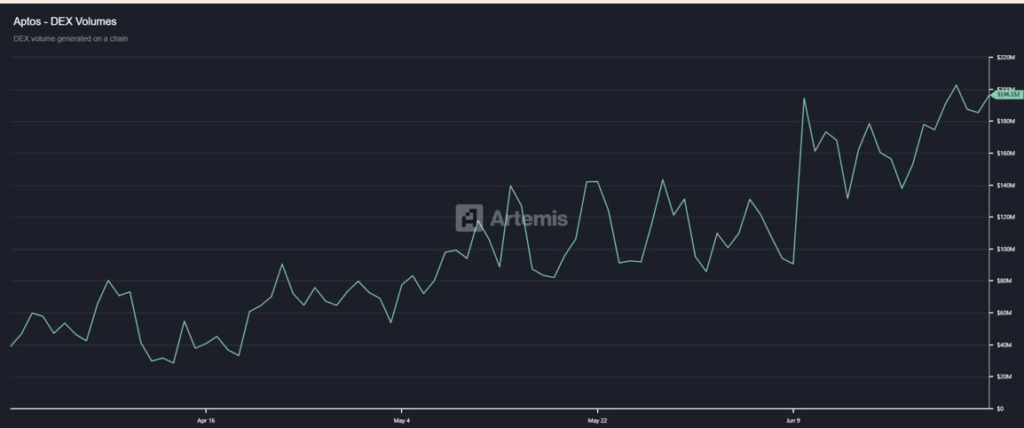

DEX Volume Just Missed $200M

Over on the trading side, things are heating up too. Artemis reports that Decentralized Exchange (DEX) volume for APT surged to $196.1 million, just shy of its June 24 peak of $202.6 million. That kind of move in a slow market? Definitely not normal.

And get this—it’s happening while price is flat. That’s often what smart folks call “stealth accumulation.” Basically: traders aren’t selling. They’re loading up while it’s quiet.

AMBCrypto pointed out similar signals. Rising liquidity and climbing TVL usually suggest that interest is returning, even if price hasn’t caught up yet.

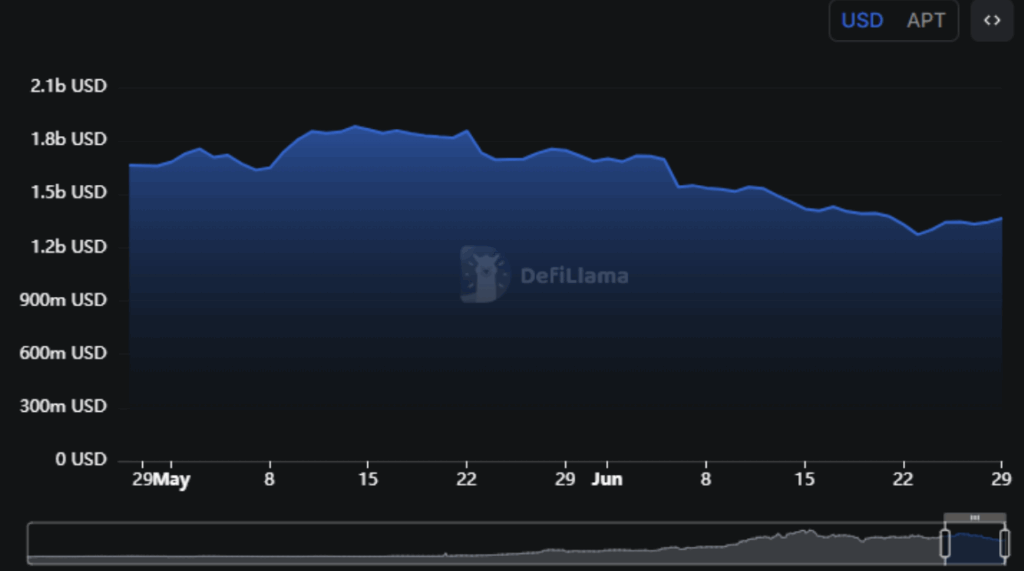

Liquidity’s Flowing Back Into Aptos

Data from DeFiLlama shows Total Value Locked (TVL) on Aptos protocols jumped from $1.273B on June 23 to $1.365B by June 28. That’s a $92 million rise in less than a week. Not massive—but definitely notable.

If that kind of liquidity keeps coming in—and DEX volume holds up—it’s not crazy to think APT could be gearing up for a breakout.

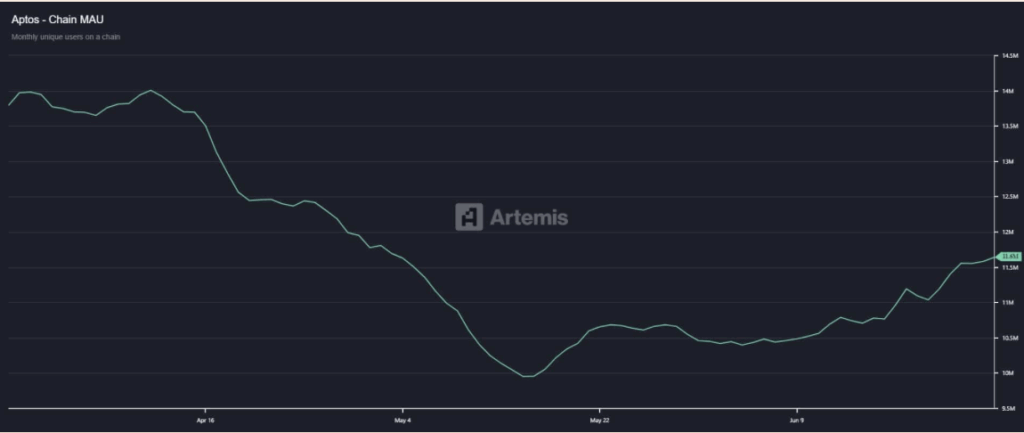

User Growth Is Back, Too

It’s not just devs and whales. Regular users are trickling back in. Artemis data showed Monthly Active Users (MAU) hit 11.6 million—up from last month’s dip, and the highest we’ve seen in a while.

Meanwhile, Transaction Count jumped to 5.3 million, the most since February. That’s not just HODLing—that’s people using the chain.

Put it all together—more users, more trades, more building—and you’ve got a network that’s quietly humming again. If the trend sticks, APT might not stay stuck for long.