- Andrew Tate claims he cashed out $500,000 in Bitcoin to invest in GameStop and other meme stocks to spite hedge funds

- Tate says he is “taking down Wall Street” and that a hedge fund manager will lose $1.3 billion if GameStop stock continues rising

- The GameStop stock price has more than doubled in the last 24 hours, causing trading halts and $1.4 billion in losses for investors betting against it

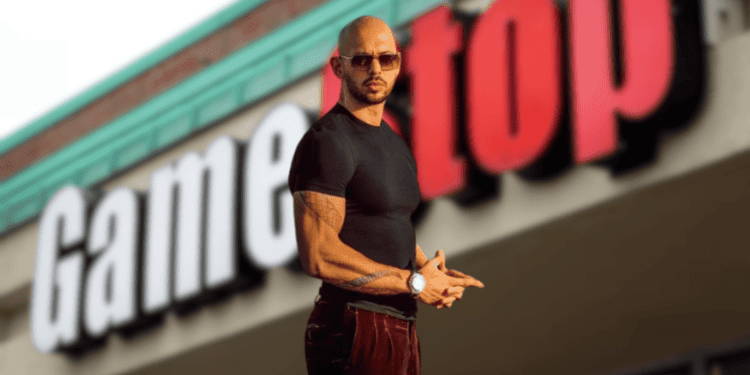

Controversial influencer Andrew Tate claims he has cashed out $500,000 in Bitcoin to invest in GameStop and other meme stocks. His goal is to spite hedge funds and “take down Wall Street” after the recent meme stock rally caused short sellers to lose billions.

Tate’s Plan

Tate says he is going “all-in with maximum leverage” on GameStop and other meme stocks. He claims he doesn’t care if he loses it all, as his main motivation is causing losses for a hedge fund manager who Tate says will lose $13 billion if GameStop’s price opens high the next day.

Meme Stock Mania Returns

The flurry of activity around GameStop has more than doubled its value recently, prompting exchanges to halt trading multiple times. An unofficial Solana meme coin named after GameStop has posted even more astronomical gains. The return of influential Reddit user Roaring Kitty, who helped fuel the original 2021 meme stock rally, hints that another rally may be underway.

Tate’s Ongoing Legal Issues

Tate’s enthusiasm for meme stocks comes amid his ongoing trial for alleged human trafficking and rape. A court recently said the trial can go ahead after months of delay. Tate is currently prevented from leaving Romania for 60 more days as he awaits a trial date.

Conclusion

It remains to be seen whether meme mania will return full force, but Tate is clearly trying to capitalize on the hype. His legal issues continue to unfold in the background as he embraces his role as a meme stock provocateur.