Bitcoin’s (BTC) price movement remained drab as it tanked below the $19,500 mark on September 7 for the first time since mid-July. The macroeconomic conditions do little to help the situation as most European countries fight off a recession. As if its invasion of Ukraine has not done enough damage to world economies, Russia has now cut off natural gas supplies plunging Europe into a possible energy crisis.

What impact do these have on risk-on assets like Bitcoin and other digital assets? Let’s dig in.

The Macro Lens

It is most likely that major world economies are heading into a Recession. Since Bitcoin is a risk-on asset, it may not perform well in such macroeconomic conditions. Several things have happened in the past to occasion this.

Quantitative Tightening (QT) has begun and is still slowly jacking up, adversely affecting cryptocurrencies as risk assets. In addition, the U.S. confirmed that its GDP had dropped in two consecutive quarters, an indicator previously used to define a recession, with others arguing that the definition is inadequate. Moreover, inflation predictions have been unreliable, and the housing sector appears worrying.

Furthermore, the Ethereum Merge, set to take place in mid-September, could result in significant price volatility in the crypto market.

As for recent events, there is not much to celebrate from the macro front. The dollar continues to strengthen, with the U.S. dollar index (DXY) reaching a new record high of 110.786 on September 7. Employment indicators are lagging, with the full-time employment index being negative for three months, according to EPB Macro Research. Across the Atlantic, Europe is fighting to contain an energy crisis that could result in blackouts, closed factories, and a devastating recession. This is because Russia has cut off natural gas supplies that the continent has depended on for years.

In East Asia, China has been experiencing a significant economic crisis over the past few months, occasioned by its collapsing real estate sector. In addition, the populous country has imposed strict Covid-19 lockdown rules in many regions. China’s manufacturing hub, Chengdu city, is among the areas under strict lockdown rules.

As such, there is a lot of uncertainty on the macro front as recessions seem to be slowly creeping in along with other geopolitical turmoils and tensions. This is creating a domino effect on the crypto market.

Bitcoin Price Still Locked In A Downtrend

The global crypto market capitalization is up 4.3% in the past 24 hours to stand at $978.5 billion. Bitcoin is up by 2.81%, surpassing its $19,000 support level.

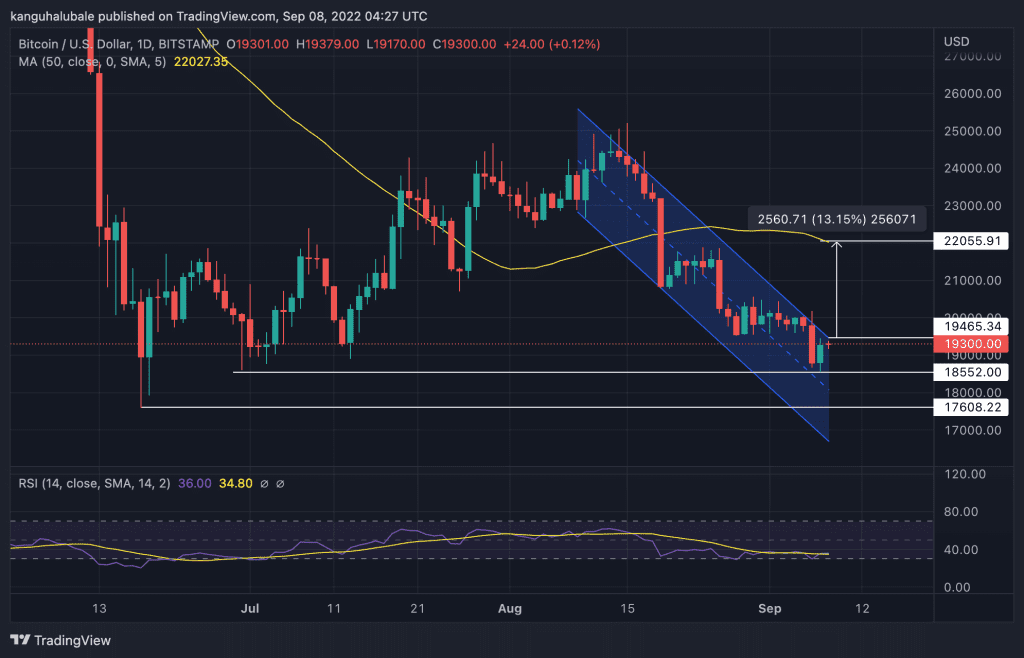

However, the big crypto is still trading within the confines of a descending parallel channel which started appearing on the daily chart when the $25,000 resistance level rejected BTC on August 14. The 50-day simple moving average (SMA) is facing down, and the relative strength index (RSI) is positioned in the negative region, suggesting that the price action favors the downside. The price strength at 36 indicates that the bears are more substantial than the bulls and are determined to lower the price.

If BTC turns away from the current level, it may drop to seek solace from the $18,500 support level. Further down, the price of the pioneer cryptocurrency may settle to seek relief from the middle boundary of the falling channel at $18,000 or later toward the lower limit of the descending channel at $16,704.

On the upside, data shows that the global trust in cryptocurrencies is still strong despite the market downturn. As such, increased demand from the current levels may push BTC’s price above the channel’s upper boundary at $19,465. If this happens, it will signal strength amongst buyers who could propel Bitcoin’s price higher to tag the 50-day SMA at $22,027. This would represent a 13.5% rise from the current price.

The key takeaway here is that markets work in cycles. There are bear and bull cycles. At the moment, Bitcoin is in a bear cycle, and crypto enthusiasts are confident that this will soon pass and that the market will come out stronger.